This article was first published on. Deythere.

- Bitcoin in the Crypto Market Today: Prices and ETF Flows

- XRP’s Place in the Crypto Market Now: Dissimilar Demand

- Ethereum Analysis and the Crypto Market Today: Staking ETFs, RWA Appetite

- Institutional Trends Shaping the Crypto Market Today

- Conclusion

- Glossary

- Frequently Asked Questions About Crypto Market Today

- How is the crypto market situation now?

- Why is Bitcoin struggling now?

- Why is XRP attracting inflows?

- Does Ethereum still matter in the world of crypto today?

- References

The crypto market today shows continued volatility for Bitcoin, XRP and Ethereum. Prices are following major financial indicators as ETF flows change direction and institutional interest changes expectations.

Bitcoin retreated after it declined taking other assets lower, XRP exhibited more agnostic flows than the rest and Ethereum’s activity indicates increasing interest in staking, tokenized real-world asset simulation.

According to CoinShares data, ETF flows across those assets are showing divergences that would imply not all the capital is flowing out of the sector but rather rotating within the broad cryptocurrency market.

Bitcoin in the Crypto Market Today: Prices and ETF Flows

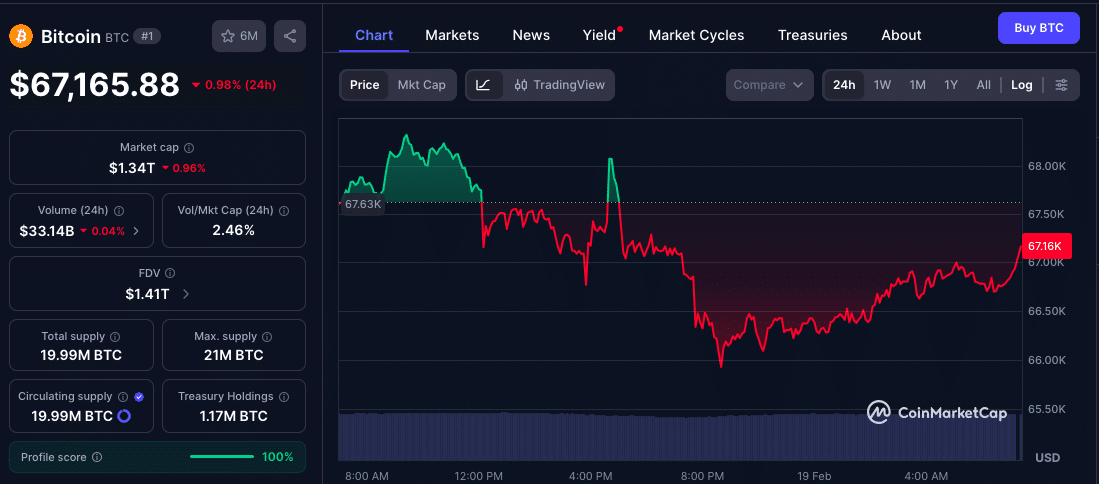

Across the crypto market, Bitcoin remains downtrodden just below crucial psychological resistance around $70,000. According to market data, Bitcoin has slid following a wide crypto ETF outflows with Bitcoin-related products seeing $133 million leave this week, which has added downward pressure on prices.

The dip in Bitcoin is still a reflection of the market, as the overall market cap is down by 2.21% to $2.3T. The CMC Fear & Greed Index remains in “Extreme Fear” at 11.

Deleveraging continues judging by the derivatives markets with total OI falling 3% in 24hrs. Bitcoin liquidations totaled $71.96M and longs paid most of the hefty price. In terms of technical analysis, the price is below the 7 day EMA, the 30 EMA and the 200 EMA which all indicate a bearish structure. The RSI is neutral at 53 and it isn’t divergent to suggest momentum’s bottom.

This decline is an illustration of how skittish investors are despite the fact that total crypto ETF assets under management (AUM) remain sizable. Analysis from Bloomberg sees Bitcoin spot ETF AUM sitting at around $170 billion, meaning that, despite hurdles, institutional money still occupies significant holdings in Bitcoin.

Bitcoin is not immune to the macroeconomic news affecting the crypto market today. Recent reports have attributed BTC drop to rising interest rate fears following leadership changes in the Federal Reserve, leading to risk-off trading across stock and crypto markets.

At press time today, BTC trades at $67,165, down by 0.98%. Any move under current price risks a test to swing low to $65,846. This means the immediate situation to watch out for is the flow trends of U.S. spot Bitcoin ETFs whose AUM has fallen from $125.04 billion a month ago to $94.01 billion.

XRP’s Place in the Crypto Market Now: Dissimilar Demand

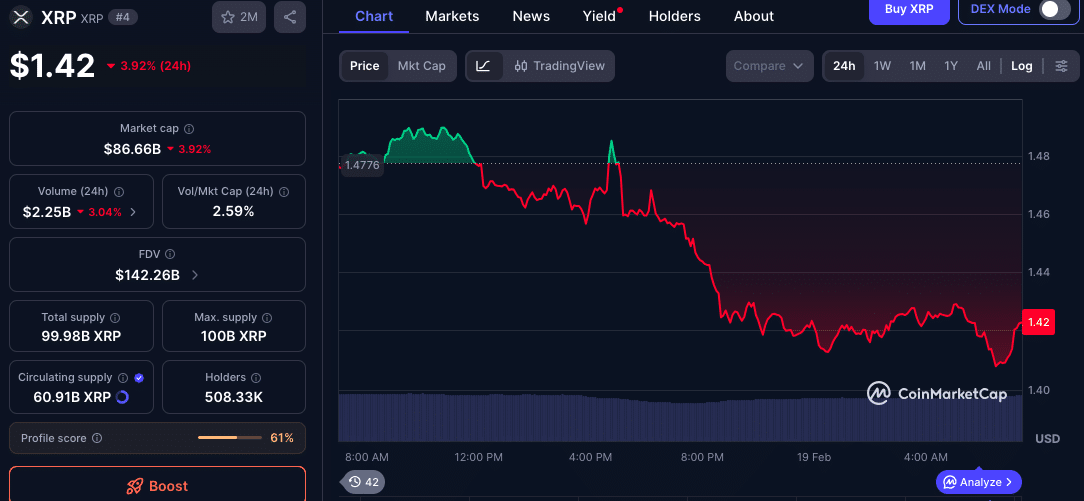

As crypto prices continue turning, XRP is among the best-performing coins in the cryptocurrency market today due to institutional inflows.

According to the most recent CoinShares weekly report, lXRP ETF products recently brought in an estimated $33.4 million while there were outflows for BTC and ETH products. This implies that some fund managing firms are still finding strategic merit in investing in XRP despite the overall market downturn.

XRP has dipped below 7-SMA at $1.45 and 30-SMA at $1.62, with its RSI (39) being oversold however no reversal yet. The technical structure maintains the bearish momentum, while long-term moving averages keep capping the upside. If selling pressure continues, the next significant support is expected to be the 78.6% Fibonacci level at $1.32.

Standard Chartered, the global bank, recently reduced its XRP price prediction for 2026 from $8 to $2.80, ascribing the overall market frailty and investor psychology in the decision. But the bank added that the token’s rival inflows show that capital is rotating within the crypto space rather than flying from risk assets altogether.

One reason institutions still took an interest in XRP was that it has a clearer regulatory status and is increasingly being used as a base currency on settlement networks, but it fell under macro pressure on pure price returns down the week. At press time today, XRP trades at $67,165, down by 3.02%.

Ethereum Analysis and the Crypto Market Today: Staking ETFs, RWA Appetite

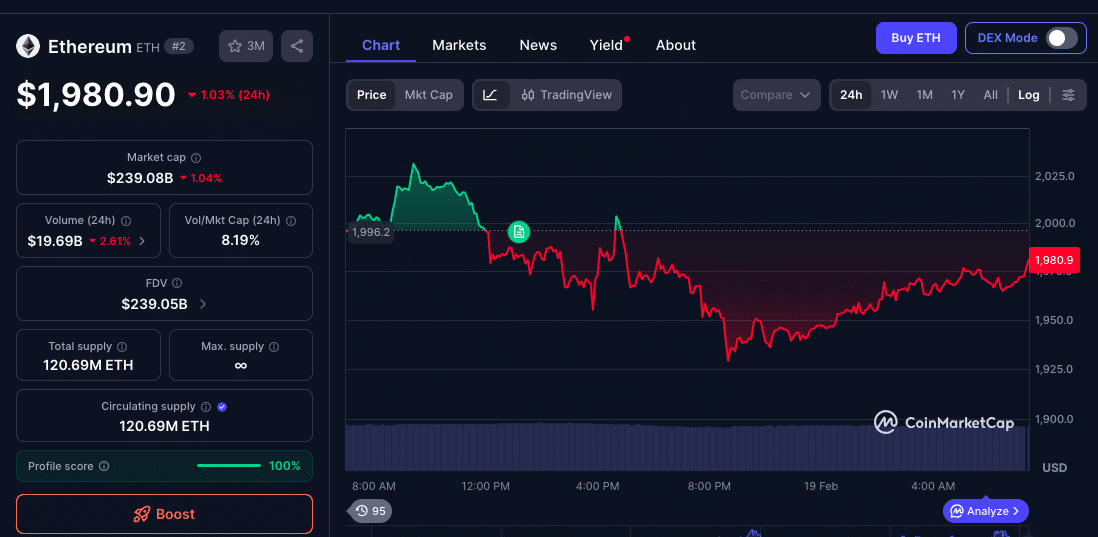

Today’s crypto market defines the changing role of Ethereum as well. Recent institutional plays include BlackRock’s Ethereum staking ETF, an indication of a new interest where regulated products offer traditional finance exposure and crypto utility.

Ethereum continues to be the number one network for RWA (Real world asset) tokenization attempts, with institutional players evaluating ETH not only to trade but also to earn yield and participate in infrastructure.

ETH is trading below its key 7-day Simple Moving Average at $1,998.8 and its RSI at around 33 reads oversold levels and shows downcast market sentiment backed by continued selling pressure.

At the same time, the average funding rate went negative to -0.001826%, which indicates a bearish sentiment from derivatives traders. The short-term bias still leans bearish below $1,999 as the market searches around to build a decent support base.

Even in the face of this softness, ETH is a DeFi backbone and smart contract workhorse; it’s very much its own thing still within crypto. Institutional interest in ETH-based products is a sign that many believe the network will continue to be useful long-term, outside of speculation. At press time today, ETH trades at $1,980.90, down by 1.03%.

Institutional Trends Shaping the Crypto Market Today

Today’s crypto market proves that institutional capital hasn’t evaporated, it has transformed. Spot crypto ETFs today have enough Bitcoin to represent roughly 6.4% of the circulating supply, demonstrating substantial long-term investment interest from wealth managers and pension funds.

That influential presence of capital has helped to keep things relatively stable, at least compared with previous cycles dominated by retail speculation. Institutions are looking for regulated exposure via ETF products, as well as infrastructure plays including staking, custody and real-world asset tokenization.

The sign is that today the crypto market looks more mature in terms of institutional infrastructures that may affect liquidity and volatility, which could be different from those we have seen before.

Conclusion

Today in the crypto market, Bitcoin is pressured through ETF outflows and macro currents, XRP demonstrates strong institutional inflows, and Ethereum receives strength from staking ETF interest and RWA demand. These dynamics imply that capital is migrating, not departing from crypto.

This rotation suggests more discriminating involvement by institutions. Regulatory uncertainty, the rise of ETFs and capital flows have taken over narratives outside of pure price speculation. Price action may be more choppy but the structural involvement of the institutions still defines much of crypto today.

Glossary

ETF: Exchange-traded funds; a regulated investment vehicle that holds assets such as cryptocurrency (like Bitcoin, XRP or Ethereum).

Institutional inflows/outflows: Capital going in or out of investment products by big financial firms.

Real-World Assets (RWA): Traditional financial assets being tokenized and placed onto a blockchain network.

Staking: Securing a blockchain, such as Ethereum, and earning rewards by locking up tokens.

Frequently Asked Questions About Crypto Market Today

How is the crypto market situation now?

There is lack of correlation across the crypto market today: BTC is losing ground from ETF outflows, while XRP and ETH show signs of institutional interest.

Why is Bitcoin struggling now?

The latest weakness in Bitcoin prices is due to outflows from EFTs combined with macroeconomic signals, such as interest rate expectations that are creating a bullish mood towards risk-off.

Why is XRP attracting inflows?

There have been inflows into XRP ETF products of late, indicating institutions are considering it a tactical allocation in the context of wider crypto rotation.

Does Ethereum still matter in the world of crypto today?

Yes. ETH will continue to be important with the staking ETF products, and increase in tokenized assets on its ledger.