Despite recent crypto market turmoil caused by economic concerns, geopolitical tensions and shifting investor sentiment, the crypto market is showing signs of stabilizing. Major coins like Dogecoin (DOGE); Ripple’s XRP and Solana (SOL) are holding strong; suggesting a potential bottom even as Bitcoin faces its own challenges.

- Bitcoin’s Recent Drop: Context and Reactions

- Signs of a Floor: DOGE, XRP and SOL Hold Steady

- Geopolitics, Tariffs and Tech Wars: A Volatile Mix

- Staking and DeFi: The Silver Lining

- Conclusion: What’s Next for Crypto?

- FAQ

- Why are DOGE, XRP, and SOL stabilizing?

- How do geopolitical tensions affect the market for cryptos?

- How does institutional involvement help in stabilizing markets?

- What does SEC’s stance on staking mean for the crypto market?

- Glossary

Bitcoin’s Recent Drop: Context and Reactions

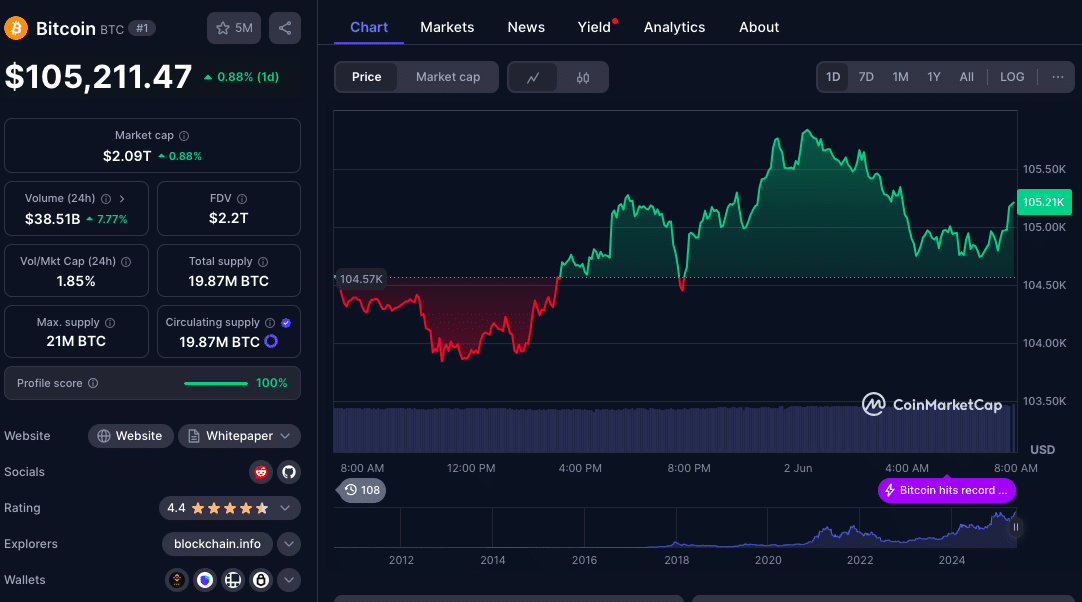

Over the past week, Bitcoin, has dropped 5% and is currently trading at $105,211 at press time. While this might look bearish short term, seasoned traders are unfazed. Price action in the last 24 hours has been seemingly flat, indicating a cautious but steady sentiment. The underlying reasons are familiar: inflation, US-China tariff tensions and broader economic uncertainty.

This cooling off isn’t limited to Bitcoin. Global markets are still jittery due to trade tensions and geopolitical risks. US restrictions on AI chip exports and sales of advanced chip-design software have pulled capital away from risk assets like cryptocurrencies.

Signs of a Floor: DOGE, XRP and SOL Hold Steady

In all of these, DOGE, XRP and SOL are holding strong, with price action suggesting a bottom. This is a surprise to many as the market is so volatile. Traders are interpreting this as a stabilization phase where major altcoins may be about to bounce.

DOGE is holding support, buoyed by its strong community and speculative interest. XRP is stabilizing, especially given the ongoing legal battles with regulators. SOL is performing well, with sustained developer and institutional interest and growing ecosystem.

Despite the macro headwinds, institutional interest in crypto is also strong. Analysts are seeing continuous inflow of capital from big financial institutions into Bitcoin and altcoins like XRP and SOL. While retail is spooked by short term volatility, market reports say long term players are using the dip to get in.

The market is also getting a boost from staking and DeFi adoption. Real world asset tokens are gaining traction and the US SEC is easing staking regulations for institutions. DeFi is looking good. These are all signs the crypto market isn’t just surviving but evolving and preparing for the next growth phase.

Geopolitics, Tariffs and Tech Wars: A Volatile Mix

The market is a volatile mix of staking and DeFi. Current market conditions can’t be understood without considering the geopolitical and economic backdrop. US-China tensions are heating up again with new restrictions on AI chip exports and halted software sales.

These geopolitical frictions are spilling over into risk asset markets, including crypto. But DOGE, XRP, and SOL are showing some resilience to these headwinds, so maybe they are decoupling from traditional market reactions or at least absorbing the shocks better.

Bitcoin’s price action is getting more in line with traditional risk assets like high growth tech stocks. This is due to trade policy uncertainty and economic crosswinds. The market reports that savvy investors are diversifying into assets with growth potential like XRP and SOL and holding onto Bitcoin as a hedge against fiat volatility.

Staking and DeFi: The Silver Lining

While price action in major coins gets all the headlines, staking and DeFi have become the quiet pillars of crypto market stability. With the SEC’s recent exemption of certain staking activities from strict scrutiny, institutional players are going deeper into DeFi protocols. Real world asset tokens, linking blockchain to real world assets like real estate and commodities are also gaining traction.

This convergence of DeFi with institutional finance and the stability of DOGE, XRP and SOL is a cautiously optimistic sign. It means the market might be on the cusp of a sustained rebound driven by innovation and strategic investment.

Conclusion: What’s Next for Crypto?

The near term for crypto markets depends on several factors: escalation of global trade disputes, US and China inflation data, central bank policy amongst others.

Investors and traders should be on high alert. While DOGE, XRP and SOL are looking like a bottom, macro and geopolitical risks can trigger new waves of volatility. But the growing institutional presence in crypto, regulatory clarity, and technological innovation mean the sector is preparing for the long term.

FAQ

Why are DOGE, XRP, and SOL stabilizing?

These tokens have this support because of strong community bases; consideration of institutional interests; and, lastly, technological innovation in their respective ecosystems.

How do geopolitical tensions affect the market for cryptos?

Global trade disputes; tariffs and restrictions…they reduce risk appetite and increase volatility in assets like cryptos. However, the recent resiliency of altcoins signals a certain degree of maturity in the market.

How does institutional involvement help in stabilizing markets?

With their huge cash infusions and holding legitimacy in the crypto market, institutions counter retail-induced volatility for a longer-run development.

What does SEC’s stance on staking mean for the crypto market?

The SEC’s staking exemptions are furthering institutional participation in DeFi; which in turn promotes innovation and adoption that supports market stability.

Glossary

DeFi (Decentralized Finance): Financial services based on blockchain, which take out the traditional middlemen.

ETFs (Exchange-Traded Funds): Essentially put, investment funds traded on an exchange, providing exposure to assets such as stocks.

Quantitative Easing (QE): Central bank policy to stimulate the economy by increasing the money supply.

Altcoins: Cryptos other than BTC.

Sources

Disclaimer: This post is for informational purposes only; it does not constitute financial advice. Do your own research before making investment decisions.