This article was first published on Deythere.

- When Wallet Activity Slows, Market Confidence Often Follows

- Crypto Market Slowdown Shows Why Price Can Be Deceptive

- Retail Investors Step Back as Volatility Fatigue Sets In

- What This Phase Means for Analysts and Long-Term Observers

- A Market Pause That May Define the Next Move

- Conclusion

- Glossary of Key Terms

- FAQs About Crypto Market Slowdown

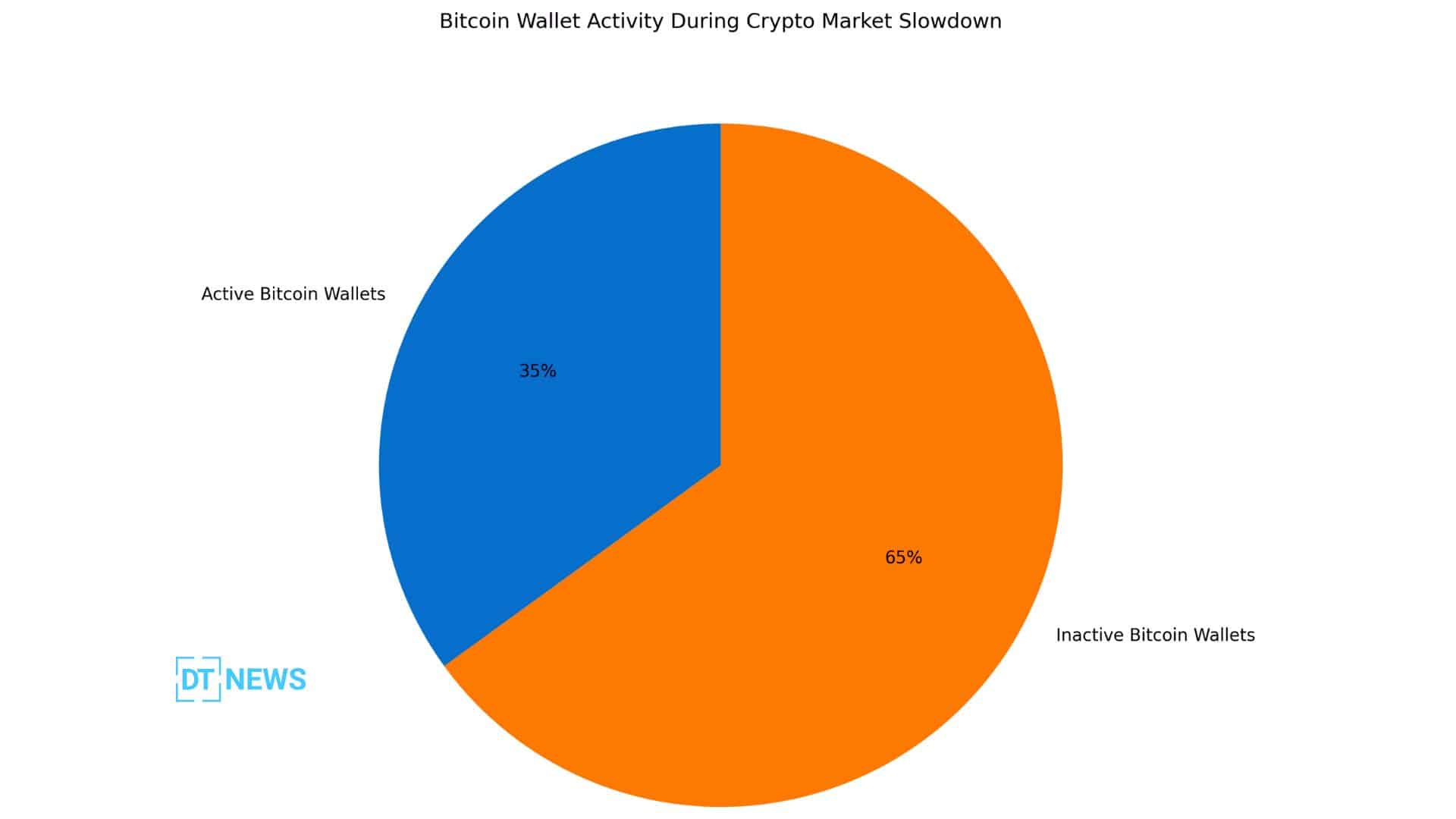

The crypto market slowdown is becoming harder to ignore, not because of dramatic price crashes, but due to a quiet retreat in real network use. While charts still flash green and red, the deeper signal lies beneath the surface. Fewer Bitcoin wallets are active today than at any point in the past year, and that change speaks louder than short-term price swings.

According to the source, recent blockchain data shows a steady decline in wallet activity even as Bitcoin price continues to fluctuate. This divergence suggests that traders may be watching rather than acting. In crypto, momentum is not built on charts alone. It is built on participation.

When Wallet Activity Slows, Market Confidence Often Follows

On-chain data has long acted as a reality check during uncertain cycles. Active wallets track the number of unique participants using the network. When that number drops, hesitation often follows. Current data indicates that daily active Bitcoin wallets have slipped to a 12-month low, despite Bitcoin’s price holding near $87,000, according to the latest CoinMarketCap figures.

This pattern is not new. Historical data shows that strong rallies usually align with rising wallet counts. When prices move without that support, rallies tend to lose strength. Analysts studying blockchain metrics have pointed out that declining activity often signals reduced retail interest, a trend discussed in recent network analysis.

Crypto Market Slowdown Shows Why Price Can Be Deceptive

The crypto market slowdown highlights a common mistake among new investors. Price action alone rarely tells the whole story. A rising Bitcoin price can still occur when fewer wallets are active, especially if large holders dominate trading. In such cases, price movements reflect concentration, not broad confidence.

Recent on-chain charts shared across analyst forums show flat wallet growth during sharp intraday price moves. That imbalance suggests caution rather than conviction. One widely referenced market study notes that sustainable development depends on expanding participation, not shrinking it. Similar trends have been observed in past consolidation phases, which are explored in detail.

Retail Investors Step Back as Volatility Fatigue Sets In

Retail participation has historically fueled crypto surges. Its absence now is telling. The crypto market slowdown appears tied to exhaustion after months of rapid moves. Many smaller traders have paused activity, waiting for a clearer direction.

CoinMarketCap data shows that while Bitcoin price remains elevated, spot trading volumes have softened. Fewer small wallets are sending or receiving funds. Analysts describe this phase as a cooling period in which speculation fades, and patience takes over. A well-known market saying fits the moment. Markets reward discipline, not noise.

What This Phase Means for Analysts and Long-Term Observers

For financial students and analysts, the current crypto market slowdown offers an important lesson. On-chain data often leads price trends. Developers and network observers also view slower periods as constructive. Reduced congestion allows time for protocol improvements and testing.

At present, Bitcoin price stability suggests support remains strong. However, without renewed wallet growth, upside may stay capped in the short term. Past cycles show that accumulation often begins quietly, long before enthusiasm returns.

A Market Pause That May Define the Next Move

The crypto market slowdown does not signal failure. It signals transition. Markets pause, recalibrate, and move again. With Bitcoin’s price holding steady and wallet activity subdued, the market is growing patient. Those watching the data now may recognize the early outlines of the next cycle before it becomes obvious.

Conclusion

The crypto market slowdown is not being driven by fear, but by silence. Declining Bitcoin wallet activity is an indication that less users are getting involved with the network, even though the price goes up and down. The difference that has formed between price and participation is a sign that needs to be noticed. The past indicates that the market is always reluctant to decide which way to go and thus the price is likely to be stable for some time.

For the investor, the analyst, and the developer, the period brings no confusion but rather enlightenment. Following on-chain data now could be more beneficial than engaging in the hunt for short-term profits. When the user activity comes back, it usually does not come back in a silent manner.

Glossary of Key Terms

Active Wallets: Bitcoin addresses that send or receive funds during a set period.

On-Chain Data: Information recorded directly on the blockchain.

Retail Investors: Individual, non-institutional market participants.

Market Consolidation: A phase where prices move sideways after volatility.

FAQs About Crypto Market Slowdown

Why are active Bitcoin wallets declining?

Lower risk appetite and market fatigue have reduced transaction activity.

Does a decline in wallet activity affect Bitcoin’s price?

Yes. Weak participation can limit price momentum over time.

Is a crypto market slowdown bearish?

Not always. It often precedes consolidation or accumulation phases.

Should long-term investors worry?

Historically, such phases favor patient, data-driven strategies.