This Article Was First Published on Deythere.

Cryptocurrency markets got a much-needed boost after US President Donald Trump confirmed that he’ll be meeting Chinese President Xi Jinping on October 31st at the APEC summit in South Korea.

Sources reported that this announcement helped lift the crypto market sentiment as traders took the proposed meeting as a sign that maybe US-China trade tensions might be easing up.

This news comes after a gloomy few weeks where the market had been spooked by Trump’s tariff threats, leading to an ugly liquidation event in the crypto derivatives market.

Trump-Xi Confirmation and The Immediate Crypto Reaction

Speaking with news sources, President Trump told Fox News’ Maria Bartiromo;

“We’re going to meet in a couple of weeks. We’re going to meet in South Korea, with President Xi and other people, too.”

He added, “He is a very strong leader, a very amazing man… It is going to be fair.”

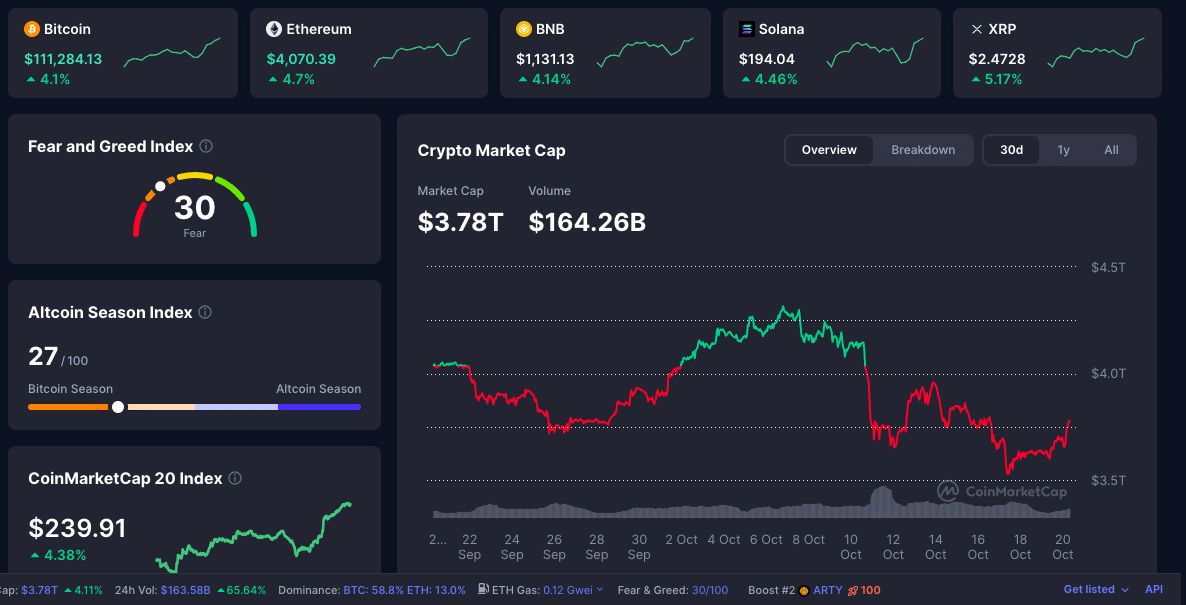

Almost straight away, the markets reacted: Bitcoin jumped up about 2%, while Ethereum and BNB each jumped about 4% and Solana was up by nearly 4%. Analysts are saying this all came down to the fact that the markets are getting a bit more hopeful that trade tensions are going to ease up, making it easier for risk assets, including cryptocurrencies, to recover.

Background: Trade Tensions and the Derivatives Wipeout

Earlier in October, the crypto market had endured one of its most severe liquidation events, with over $19 billion in leveraged positions wiped out in a single 24-hour span. This all followed President Trump’s threats of 100% tariffs on Chinese imports, and China responded by slapping export controls on rare earth metals.

Both of those moves sent Bitcoin and other tokens crashing, and snowballed into a big sell-off. The Crypto Fear & Greed Index dropped all the way down to 22. Basically, investors became uncertain about what was going to happen next.

But against all these, news like the summit between President Trump and President Xi coming up, really stands out. Market watchers are hopeful that this will fully turn the crypto market sentiment around.

What to Watch

Right now, there are a few indicators that market watchers can keep an eye on to see if this rally is going to stick. One of the main ones is how open interest in crypto derivatives is looking. If it moves higher, it is a good sign that investors are getting back in and are feeling more confident.

Another one to watch is the funding rate for perpetual futures. If it goes up, it could mean that investors are also getting more optimistic and are willing to bet on the price of a particular cryptocurrency moving up.

Also important is the movement of large wallet flows and whale activity: for example, a reported $255 million of new long positions in Bitcoin and Ethereum emerged shortly after the announcement.

Finally, the ratio of altcoin vs Bitcoin performance can indicate risk appetite returning; the recent gains by Solana and BNB suggest this may be occurring.

Conclusion

The news that President Trump and President Xi are going to be meeting up on the 31st of October has given the crypto market a boost. Markets responded quickly with major cryptocurrencies making gains, a clear sign that traders are feeling more optimistic.

The question now is whether this shift in crypto market sentiment is actually going to translate into a real influx of money and an improvement in derivative metrics.

Glossary

Open interest: Total number of open futures or options contracts.

Funding rate: Regular payments between long and short positions in perpetual futures to balance demand.

Derivatives liquidation event: Forced closure of leveraged positions when collateral thresholds are breached.

Risk-on asset: An Asset that generally goes up when investors are willing to take more risk.

Margin market: Trading with borrowed funds to amplify price moves.

Frequently Asked Questions About Trump and Xi Meeting

Why does a Trump and Xi meeting affect cryptocurrencies?

Because cryptocurrencies are sensitive to macro-geopolitical risk, when major trade tensions ease, risk-on assets, including crypto, tend to go up, and crypto market sentiment improves.

What is the evidence of the crypto reaction to this news?

After Trump’s announcement, Bitcoin went up 2%, $ETH and $BNB 3.5%, and $SOL 4% .

Does improved sentiment mean a crypto rally?

Not necessarily. Sentiment is only one part of the equation. Sustained rallies also require capital flows, improving derivatives metrics, and a stable macro.

What can reverse the sentiment?

A breakdown in the Trump-Xi talks, renewed trade or tariff escalation or another large derivatives liquidation event can quickly reverse sentiment and bring weakness back into the market.