This article was first published on Deythere.

- Bitcoin Encounters ETF Outflows and Profit-Taking

- Ethereum Falls with ETF Action Unclear

- First XRP ETF Outflows since Launch

- Driving Forces: Rate Expectations and Market Sentiment

- Market Metrics and Signals

- Conclusion

- Glossary

- FAQs About January Crypto Market Retreat

- What caused the crypto market retreat in January 2026?

- Did Bitcoin lose eits arly-year surge?

- Do investors still support Ethereum and XRP?

- Is the dip a long-term trend?

- References

The crypto market saw a strong start in early January but even so BTC, Ethereum and XRP prices seem to have retreated. This crypto market retreat is believed to be fueled by blended ETF flows, profit-taking and macro views on U.S. Federal Reserve policy.

Bitcoin Encounters ETF Outflows and Profit-Taking

2026 started positively for Bitcoin, see it edge towards $95,000 on January 6 after healthy ETF inflows proved institution had a fresh interest. However, according to SoSoValue data, on January 5, U.S.-based spot Bitcoin ETFs added $697 million in net inflows, the most seen on a single day since October 2025, with BlackRock’s IBIT and Fidelity’s FBTC funds leading the way.

Despite that start, the rally had lost steam as the week wound down. Bitcoin ETFs sharply reversed to trade deep into negative territories on January 7 and 8, with around $486 million leaving the funds. This is recorded as one of the biggest outflows in recent weeks as institutional investors took profits.

The equivalent price action resulted in Bitcoin dropping from about $94,000 to around $90,500. This fall is attributed to profit-taking and loss of appetite for risk across other markets, such as U.S. stock futures, in particular the tech-heavy Nasdaq 100.

Ethereum Falls with ETF Action Unclear

Ethereum joined the broader market in adopting the changing tone. ETH prices hovered in the low $3,000-mid range before pulling back a bit, after recording meaningful early year gains.

According to SoSoValue and ETF flow data, Ethereum ETFs saw net outflows at around $98 million in the mid-week reversal, turning back gains earlier this week.

This ETF flow divergence occurred while ETH printed a price drop from the range of around $3,200-$3,300 to lower levels, grinding out short-term cooling after an optimistic start in January.

Additional pressure came from larger moves in risk sentiment tied to the anticipation of upcoming macroeconomic data and expectations around the U.S. Federal Reserve.

First XRP ETF Outflows since Launch

XRP’s tumble followed the wider decline, with the token sliding after a notable early January rally, falling by about 14% from $2.4 to around $2.

Spot XRP ETFs saw the first net daily outflows since inception on 7 January, with around $40.8M exiting the products.

This ended a strong run of inflows, which had supported XRP’s performance since November 2025.

And though outflows have been recorded, total ETF assets under management are still high, suggesting this is a pause rather than a definitive change in enthusiasm.

XRP had experienced a fall in tandem with Bitcoin and Ethereum, suggesting the interconnected sell-off across top cryptocurrencies.

Driving Forces: Rate Expectations and Market Sentiment

In addition to ETF factors, wider macroeconomic forces helped drive crypto prices. The U.S. Federal Reserve’s interest rate outlook was also a n important focus for traders.

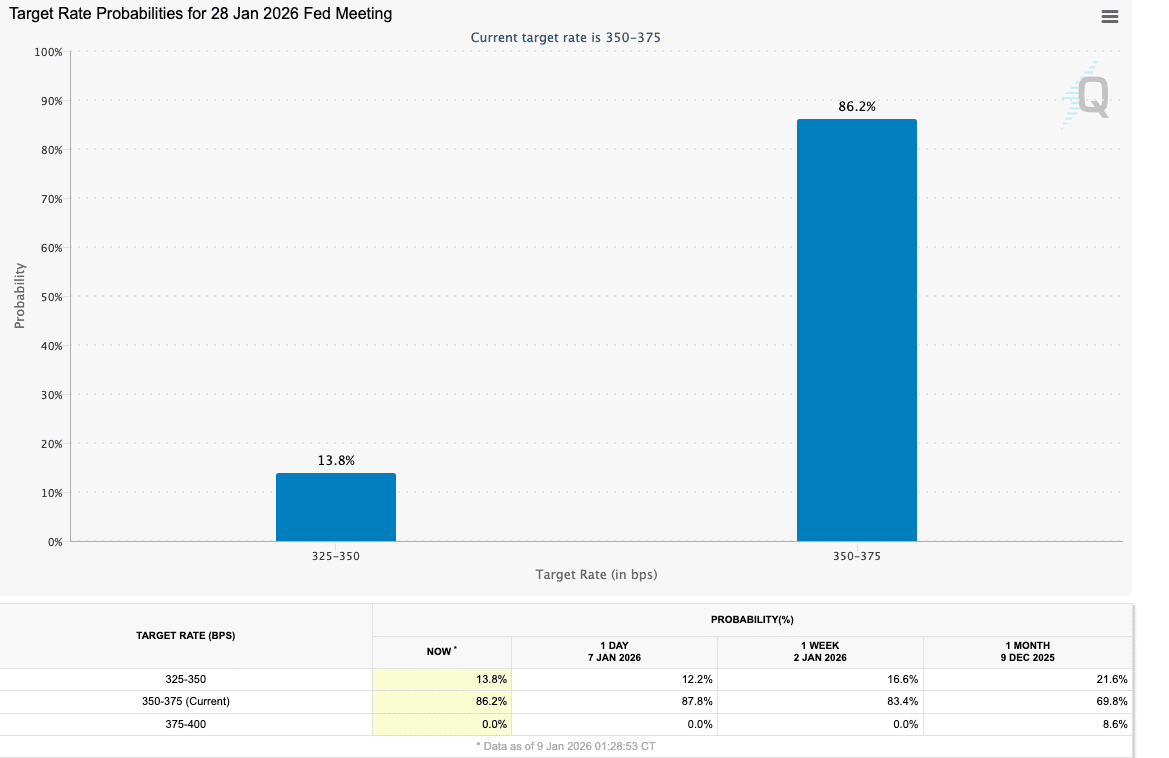

The possibility of a Fed pause in late January were priced in at more than 80 percent, with investors looking to new data on jobs and inflation for clues on the scale of future US rate cuts.

The Jobs report and inflation data, due 9 and 14 January respectively could have a greater impact on the rate cut expectations and drive the market sentiment in risk assets.

However, the current rate outlook at 3.50%-3.75% extended the crypto’s losses more.

It is important to mention that while BTC dropped 5%, most of the leading alts dumped even further during the mid-week pull-back..

Market Metrics and Signals

In addition to price movements, broader market indicators offered context to the retracement. Data collated suggested that Spot Bitcoin and Ethereum turned negative in the mid-week, while smaller crypto ETFs, mostly Solana products, registered modest inflows.

Investor sentiment measures, including the Crypto Fear & Greed Index, continued to hover in recovery territory, signaling that traders were not fleeing risk completely but adjusting their bet statements.

This mix of technical and sentiment indicators suggests a market in transition. A momentum push from early January was met with some profit-taking and more cautious repositioning ahead of big macroeconomic catalysts.

Conclusion

The crypto market retreat in January 2026 is a brief interruption in the new year surge for Bitcoin, Ethereum and XRP.

ETF flows turned from strong net inflows to large outflows mid-week, dragging risk assets along with it.

Macro catalysts, such as the outlook on U.S. Federal Reserve policy and imminent economic data releases, also added to investors’ sense of caution.

Although the sell-off showed shortsighted profit-taking and trading activities, interest in crypto ETFs and market participation continue to be present.

Glossary

Spot ETF: An ETF which directly holds the underlying asset (such as Bitcoin).

Net Flows: The amount of money that enters and exits a fund over a particular period.

Profit-Taking: Selling a position to realize gains after the price of an asset has risen.

Federal Reserve Policy: Actions taken by the U.S. central bank that impact interest rates and liquidity.

FAQs About January Crypto Market Retreat

What caused the crypto market retreat in January 2026?

The pullback was due to a change in the direction of ETF flows from inflows to outflows, as well as profit-taking and risk aversion prior to U.S. economic data releases.

Did Bitcoin lose eits arly-year surge?

Bitcoin retreated from around $95,000 to below $90,500 as funds flowed out from large spot ETFs.

Do investors still support Ethereum and XRP?

Yes. Even as there are short-term outflows and price pullbacks, both assets have continued to garner institutional and retail interest.

Is the dip a long-term trend?

Existing data indicates the trend is for short term and long-term are evidenced by ETF allocation, broader market participation.