This article was first published on Deythere.

- Bitcoin Under $75,000: Liquidity and Liquidations

- Altcoins Slide with Bitcoin

- Macro Forces and Risk Assets

- Analyst Views and Market Sentiment

- Conclusion

- Glossary

- Frequently Asked Questions About Crypto Market Crash Today

- Why did the crypto market crash today?

- How much was liquidated during the sell-off?

- Were there macroeconomic forces at play?

- Are altcoins affected too?

- Is this crash unique?

- References

The crypto market crash today has seen Bitcoin dipping under $75,000 and drag the entire market into even deeper bearish territory. Traders across exchanges watched as leveraged positions got wiped out, liquidations surged and market sentiment flipped to fear.

This sell-off is pushed by thinner liquidity, macroeconomic stress, geopolitical doubts ,and structural market factors not just pure price weakness.

The result is a downturn in the prices of both Bitcoin and most of the major Altcoins

Bitcoin Under $75,000: Liquidity and Liquidations

Bitcoin briefly fell below the $75,000 mar,k hitting lows that haven’t seen since April 202,5 during early trading today. This happened as liquidations in the crypto futures market saw a sharp increase.

More than $2.5 billion of leveraged positions were liquidated in the last 24 hours, according to liquidators and market trackers, with the overwhelming majority of about $2.42 billion coming from “long” bets, where traders had been hoping prices would rise.

Liquidation cascades happen when automatic margin calls force positions to close as prices go the wrong way against traders. This adds selling pressure that can drive prices lower, even without new selling from ordinary investors.

Traders and analysts pointed to thin liquidity as a main cause. When there are few buy orders, even modest sell pressure can drive prices sharply lower, widening price gaps and triggering cascaded liquidations.

In a social media post on the last day of January, researchers at The Kobeissi Letter put the break of key levels down to “entirely a liquidity situation,” meaning waves of forced exits in an illiquid market. This is one of the factors believed to have driven the speed and ferocity of the crash.

Altcoins Slide with Bitcoin

The more general cryptocurrency crash today led altcoins to decline sharply alongside Bitcoin. Tokens like XRP, Chainlink, Monero, and Ethereum all saw sharp drops. XRP, for instance, followed Bitcoin’s drawdown lower, while Chainlink shed over 5% in the same session.

At press time, Ethereum is down 7.15% to $2,225; XRP is down 4.4% to $1.58, Chainlink 5.05% to $9.37, and Monero 8.89% to $396.

According to CoinGlass data, liquidations over the past 24 hours saw -69% to $799 million, while open interest climbed 4% to $108 billion.

Altcoins dropping is to be expected during heavy Bitcoin sells, as capital moves out of the less liquid markets for safer assets or fiat. The digital asset space is so interconnected that when Bitcoin falls, many other tokens follow suit as traders rebalance or reduce exposure.

This is shown in the overall market cap’s recent shrinkage, where a total of over $100 billion has been wiped from its value in the past few sessions.

Macro Forces and Risk Assets

The crypto market crash today did not happen alone. The entire financial markets were also under stress. Global equities and precious metals saw violent moves and this in turn would have affected trader behaviour in crypto.

According latest reports, silver fell over 14% and gold lost 7.5%, as stock indexes in Asia also slumped to emphasize the risk-off environment. Investors fled for safer assets, including equities and digital tokens.

Major stock futures in the United States fell as markets braced for macroeconomic uncertainty, which could include possible changes in the leadership and direction of Federal Reserve policy.

Analysts said risk assets including cryptocurrencies that benefited in earlier periods while monetary conditions eased fell victim to tighter liquidity and growing interest-rate expectations.

This change was emphasized by Sam North, a market analyst at eToro, who told The National that Bitcoin had become less of a speculative “political trade” and more of a high-liquidity risk asset reacting to macro signals such as the prospect for tighter monetary conditions and stronger dollar liquidity.

This has rendered risk assets such as Bitcoin more vulnerable to shifts in liquidity and sentiment aside from crypto space.

Analyst Views and Market Sentiment

Analysts are attributing the crypto market crash today to technicals and macrofactors. In addition to leverage and liquidity concerns, traders have cited the break of important technical levels as well as a flipping of trader positioning.

Data from options markets indicated that put options around the $75,000 level were being accumulated, which is an indication that market makers and traders have been hedging against more downside. Technical analysts view this as a sign of increasing bearishness in the market, with confidence fading.

At the same time, global tensions including in the Middle East have reinforced risk-off sentiment. Spikes in geopolitical stress influence global liquidity preferences, with some capital fleeing from risky bets into traditional havens, though even gold and silver have not been holding up especially well as of late.

In addition, long-standing support levels such as the “true market mean” which is a composite measure of active Bitcoin cost basis, were also breached, and market analysts have described this as intensifying selling pressure and opening the door to deeper technical corrections.

Conclusion

The crypto market today is rooted in a combination of technical failures, unwinding of leverages, and macroeconomic uncertainty as well as liquidity constraints.

Bitcoin’s fall below $75,000 has triggered one of the largest reported liquidation waves in recent crypto history as altcoins dipped alongside.

Analysts have said this is not a one-factor event, but instead a “perfect storm” of high leverage, shallow market depth, geopolitical frictions and changing perceptions over monetary policy.

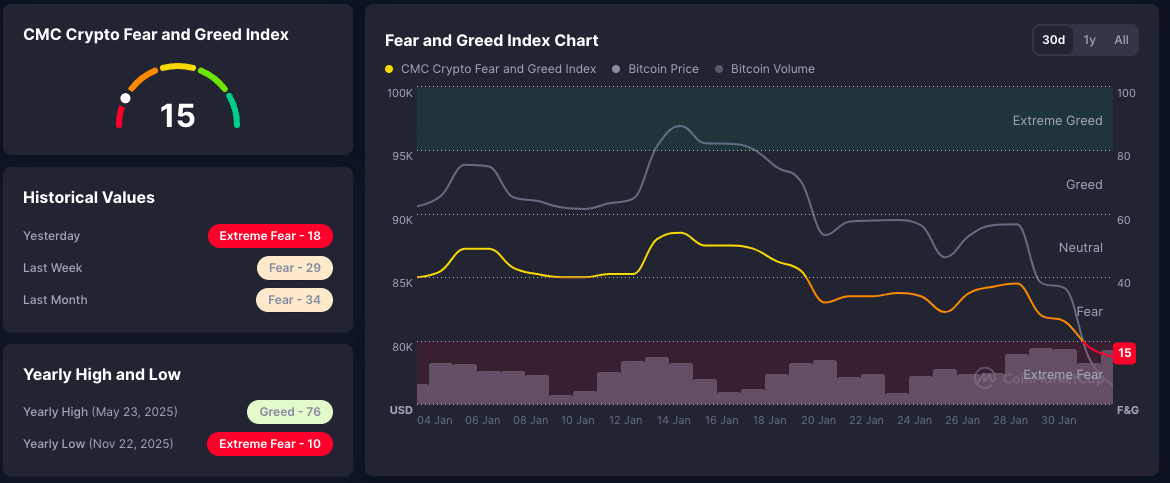

The result is a market extremely pushed towards risk avoidance, as sentiment indicators indicate “Extreme Fear,”and traders turn over positions with the hope that they avoid the fate of others.

Glossary

Liquidations: forced shutdowns of leveraged positions when the market moves against traders, typically adding to downward pressure.

Liquidity: the amount of buy and sell orders in a market, and thin liquidity can cause bigger price swings.

Risk-off: a market sentiment in which investors exit from riskier assets and move into safer ones because of a high degree of uncertainty or fear.

Put options: financial contracts that traders may use to hedge or try to profit on a drop in prices.

Frequently Asked Questions About Crypto Market Crash Today

Why did the crypto market crash today?

The crash was pushed by a lack of liquidity in the market and a wave of forced liquidations from leveraged positions that brought Bitcoin under key technical levels.

How much was liquidated during the sell-off?

According to market data, over $2.5 billion of leveraged positions were liquidated in the past 24 hours across crypto markets alone.

Were there macroeconomic forces at play?

Yes. Wider market concerns, such as geopolitical stress and potential of tighter monetary policy, helped to drive risk-off sentiment that kept digital assets under pressure.

Are altcoins affected too?

Yes. Large altcoins, including XRP, Chainlink and Ethereum also declined with Bitcoin in the crash.

Is this crash unique?

Large wholesale forced liquidations in sharp downturns have occurred in the past, but this is extreme due to the linkage of macro stress and liquidity tightening.

References

Bitget

FastBull

The National

CoinReporter

LatestLY