The crypto market Christmas outlook is being shaped by lighter holiday trading and cautious sentiment, with Bitcoin, Ethereum, and XRP staying within certain price zones as the holiday period approaches. Traders are paying close attention to key levels because even a quiet market can experience sudden changes when liquidity is low.

- What Does the Crypto Market Christmas Outlook Represent?

- How Is Bitcoin Navigating the Holiday Period?

- Why Is Ethereum Still Under Pressure?

- What Is Limiting XRP’s Short-Term Upside?

- What Should Traders Expect in the Coming Days?

- Conclusion

- Glossary

- Frequently Asked Questions About Crypto Market Christmas Outlook

The crypto market Christmas outlook reflects careful analysis rather than hype, as investors track chart patterns and resistance points. It also focuses on how strong support levels may prevent deeper declines during this slower trading period.

What Does the Crypto Market Christmas Outlook Represent?

The crypto market Christmas outlook describes how digital assets behave during the holiday season, when trading becomes lighter and both institutional investors and everyday traders are less active.

It helps investors judge possible risks and chances for gains at a time when many people are away from screens and market volume is reduced. The market at present is seen as slightly weak, with several major coins slipping after an earlier rally.

Even so, analysts say that important price changes can still happen if a key support or resistance level is triggered, meaning the market is not fully settled. Because of this, traders are staying cautious, focusing on charts, and avoiding early assumptions about the next direction.

How Is Bitcoin Navigating the Holiday Period?

Bitcoin plays a main role in the crypto market Christmas outlook because its price direction influences confidence across the wider market. $BTC is sitting close to $87,000 and has tried several times to move above $90,000 but has not been able to do so.

This struggle to break that level shows that interest from big investors and long-term holders has slowed down for now. If pressure continues, Bitcoin could fall toward $85,500, which traders see as an important support level that helps keep market sentiment steady.

There is still a possible positive outcome, because if Bitcoin manages to close strongly above $90,000, it could change momentum and lift prices toward $93,000–$94,000. This mix of resistance on one side and potential gains on the other is why traders remain alert and closely watch every move.

Why Is Ethereum Still Under Pressure?

Ethereum also plays an important part in the crypto market Christmas outlook, showing the hesitation many investors feel at this stage. $ETH is trading around $2,940.87, showing a 0.25% lift over the past 24 hours and a 0.75% rise over the past month, keeping it just under the important $3,000 mark that traders are watching.

Recent figures point to continued net outflows, meaning many holders are still choosing to pull funds out during this lighter trading period. If the price does not move above the $3,000–$3,200 range, it could slip further and possibly head toward $2,600, the next major level of support.

Even with this pressure, Ethereum is not viewed as having no chance to rise. Instead, it sits in a wait-and-react position, where stronger buying interest is expected only after a clear price signal encourages confidence again.

What Is Limiting XRP’s Short-Term Upside?

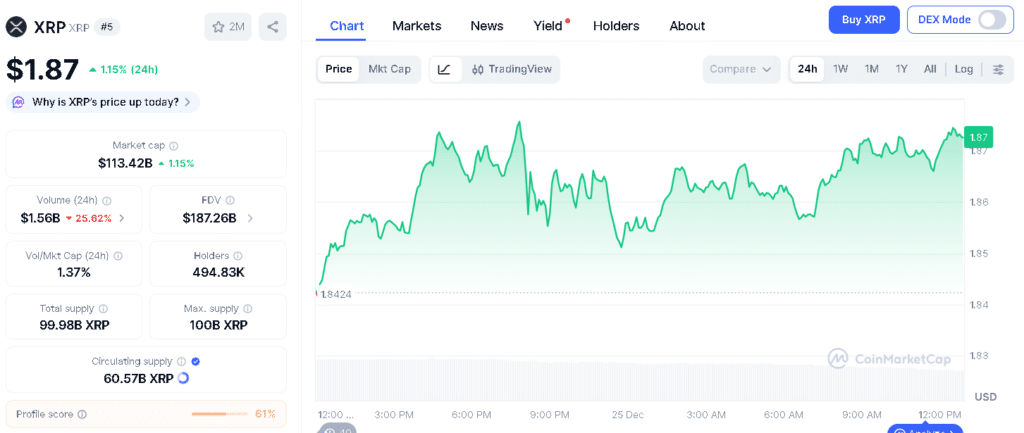

XRP is trading around $1.87, with a 1.14% lift in the past 24 hours, although it remains 16.2% lower across the past month, reflecting the wider uncertainty seen in the market. The crypto market Christmas outlook explains that momentum has slowed, yet XRP stays close to several support areas that could help prevent deeper declines.

If the price weakens, it could slide toward $1.77, a level many traders are watching as the next important support. However, if overall sentiment improves, XRP still has room to move higher and may look toward $1.96.

In this situation, XRP stands in a neutral position. It does not appear ready for a major breakout, but it is also not set for a confirmed decline. Instead, it waits for clearer signals before choosing a direction.

What Should Traders Expect in the Coming Days?

The market is not giving a clear sign of strong optimism, but it is also not ruling out sudden shifts. Institutional demand is slowing, retail traders are less active, and many investors are waiting to see what happens once the holiday period passes.

The crypto market Christmas outlook suggests that sideways movement or small declines may continue unless a major price signal appears and pushes momentum in a new direction. For now, traders are expected to remain cautious and make measured decisions until stronger market signals return.

Conclusion

The crypto market Christmas outlook offers a measured view at a time when traders can be pulled between festive optimism and the fear of missing out. Bitcoin sits beneath a major resistance zone, Ethereum is hovering just below a key psychological threshold, and XRP is moving within a narrow band marked by nearby supports which reinforces a message rooted in discipline.

Market behavior remains cautious, where levels carry more weight than narratives, and movement depends on confirmation rather than assumption. As the holiday period approaches, those who take time to understand this outlook with its restrained momentum, its pressure points, and its emphasis on patience may be better positioned than those who lean on seasonal expectations.

Glossary

Price Zone: The range where a cryptocurrency’s price stays stable.

Liquidity: How easily a crypto can be bought or sold.

Resistance Level: A price point that stops the crypto from rising.

Support Level: A price point that stops the crypto from falling.

Sideways Market: When prices stay in a narrow range with little change.

Frequently Asked Questions About Crypto Market Christmas Outlook

Why is trading lighter during Christmas?

Trading is lighter because many investors and traders take a break during the holidays, which lowers market activity and liquidity.

How is Bitcoin performing during the holiday period?

Bitcoin is trading near $87,000 and has struggled to break $90,000, showing that investors are cautious.

Why is Ethereum under pressure?

Ethereum is below $3,000 because many holders are withdrawing funds, which slows its momentum.

What limits XRP’s short-term gains?

XRP is near support at $1.77, and its slow momentum prevents it from making large upward moves.

Can XRP still rise in the short term?

Yes, if market sentiment improves, XRP could move higher toward $1.96.