A wave of cryptocurrency companies is racing to go public in 2025 as regulatory tailwinds and surging crypto markets fuel a crypto IPO boom. Crypto prices are surging to all time high and new laws have made the industry attractive to investors. From Trump’s policies to market breakthroughs, what are the drivers behind the crypto IPO mania and the risks of this trend?

- Regulatory Tailwinds for Crypto IPOs

- Record Crypto Market Momentum

- Major Crypto IPOs and Pacesetters

- Institutional Demand and Market Dynamics

- Expert Analysis and Outlook

- Crypto IPO Boom at a Glance

- Long-Term Implications for Crypto and Capital Markets

- Conclusion

- FAQs

- What’s behind the crypto IPO surge?

- Which crypto companies have gone or are going public?

- Are crypto IPOs a good investment?

- What role do SPACs play in crypto companies going public?

- Glossary

Regulatory Tailwinds for Crypto IPOs

US crypto companies are finally coming off the sidelines to access Wall Street. A pro-crypto regulatory environment under President Trump is a big part of that. According to reports, President Trump recently signed the bipartisan “GENIUS Act” to create the first federal framework for US dollar-pegged stablecoins.

That law along with an earlier executive order expanding alternative assets (including crypto) in 401(k) plans, told Washington to get on board with digital assets. Market observers say those moves “picked up exactly what they wanted,” as crypto friendly regulations and corporate treasuries embracing Bitcoin have boosted investor confidence.

BlackRock which lobbied for the 401(k) order praised the expansion of asset options. Reports claim that even crypto skeptics admit that having clear rules “brings in a much broader audience” to crypto.

Record Crypto Market Momentum

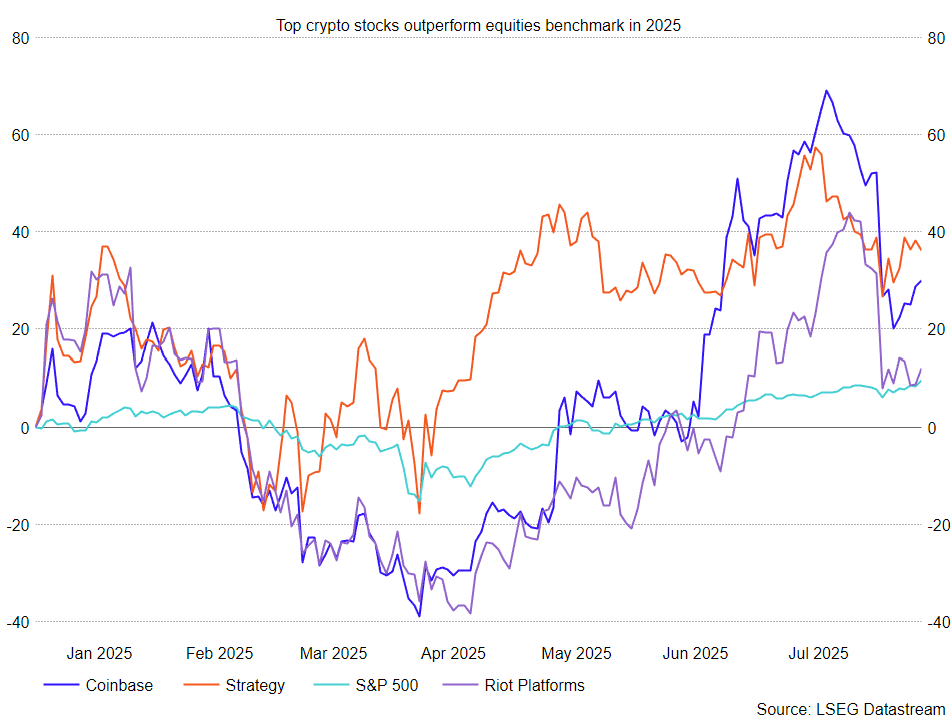

Bitcoin and other cryptos are currently snagging all time highs. Bitcoin just recently broke $124,000 and Ether $4,700 amid Fed rate cuts and regulatory reforms. Overall, crypto market cap is over $4 trillion, up from $2.5 trillion a year ago. These all time highs have made crypto companies more valuable and bankable.

As Reuters notes, “a string of regulatory wins… corporate treasury adoption and ETF inflows” have brought investors into crypto and sent Bitcoin to new highs. Big companies now hold digital assets on their balance sheets.

For example, MicroStrategy and other “crypto holding companies” use corporate treasury funds to buy Bitcoin (a strategy popularized via SPAC mergers). ETF inflows from BlackRock and Fidelity Bitcoin ETFs have also poured more capital into the space.

As a result, analysts have acclaimed that this is the perfect environment for companies to go public.

Major Crypto IPOs and Pacesetters

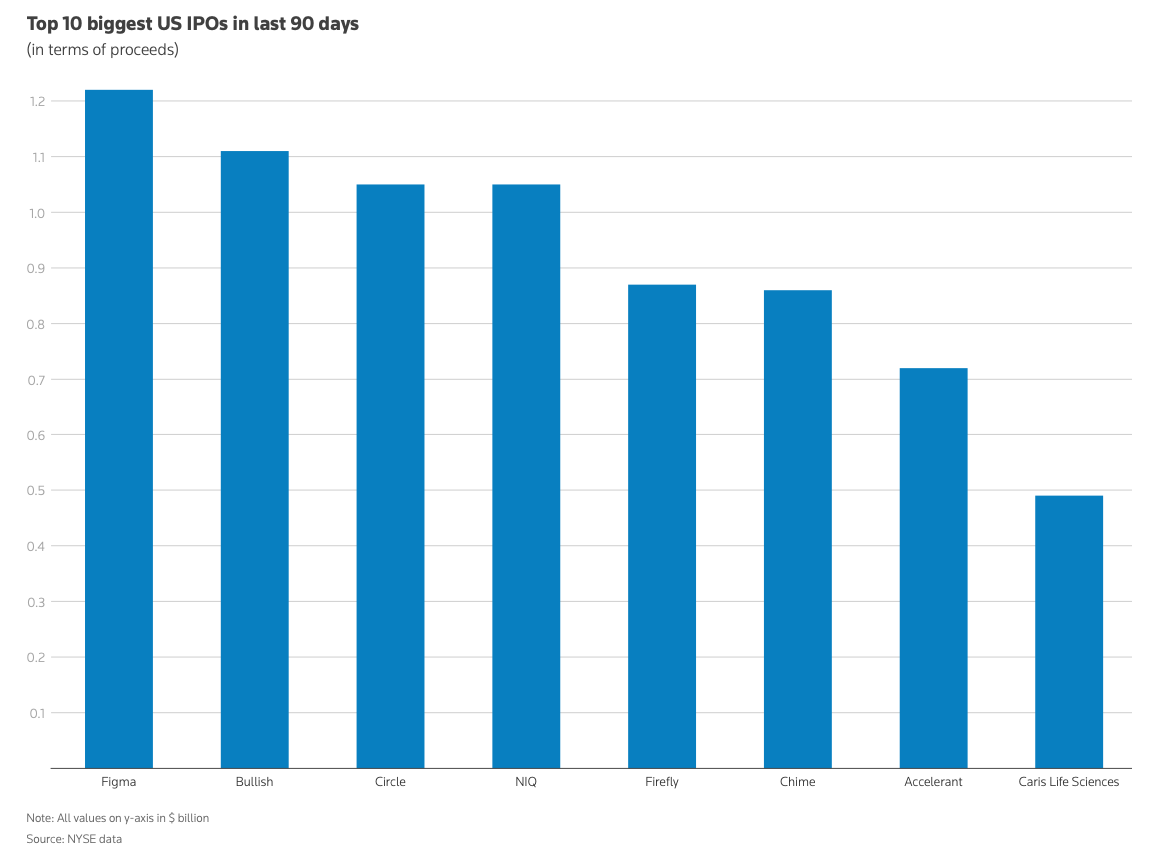

Several big crypto companies have already gone public. Circle Internet Financial; the issuer of the USDC stablecoin, led the way with a June 2025 IPO on the NYSE. Circle reportedly raised $1.05 billion and more than doubled on day one, currently valuing it at $35 billion.

Analysts called Circle’s offering a “bellwether” for crypto IPOs. NYSE President Lynn Martin even said the strong debut is good for the IPO market overall. Circle’s founder, Jeremy Allaire, says the company’s success is because public markets have been “starved of new issues” in crypto and fintech.

Then Bullish, backed by Peter Thiel, has also made headlines. Bullish raised about $1.11 billion in its August 2025 IPO and opened above $100 (vs $37 IPO price). After its first day, Bullish was reportedly worth around $13.2 billion. Its CEO said the success of the exchange’s first listing, will “give people more options” to access crypto.

Bitget research notes that Bullish’s IPO;

“reflects growing institutional confidence…driven by a favorable regulatory environment under the Trump administration and Bitcoin’s surge”.

Reports say the company will convert a large portion of IPO proceeds into stablecoins, betting on the newly cleared stablecoin market.

Other crypto companies are also following. Exchanges like Gemini and Kraken have reportedly filed confidentially for IPOs. Asset managers Grayscale and others have signaled listing plans.

Even though Coinbase went public in 2021, no major crypto company had followed. Now the stream of crypto listings, both IPOs and SPAC deals, is flowing. Smaller crypto startups are merging with blank-check SPACs to list faster and with less SEC scrutiny.

These SPAC mergers are a way for crypto companies to become public “crypto holding companies” like MicroStrategy, by holding tokens on their balance sheets.

Institutional Demand and Market Dynamics

Sources report that Institutional investors are part of the driving forces behind this crypto IPO mania. Wall Street giants like BlackRock and Ark Invest showed interest in crypto IPOs; Bullish’s share sale was upsized due to demand from these firms.

In fact, Bullish processed over $1.25 trillion in trading since 2021, showing Wall Street’s appetite for regulated platforms. As one industry observer says, retail investors drove crypto’s early bull runs, but “the institutional wave has begun”.

Institutional crypto strategies bolster SPAC listings because new crypto holding companies are positioning themselves as vehicles for investors looking for broad crypto exposure via regulated stocks.

Meanwhile, the overall IPO market is recovering. According to reports, there were 216 U.S. IPOs by summer 2025 (most since 2021) raising nearly $40 billion. High-profile fintech and tech IPOs (like Chime and Figma) are also giving momentum.

However, Institutional investors say the market is “highly sensitive to sentiment”. Crypto companies going public still face volatility, one bad quarter or regulatory glitch and interest could dry up.

Expert Analysis and Outlook

Industry experts are observing this crypto IPO boom. Mizuho’s Dan Dolev calls Circle’s IPO a “bellwether” for public markets’ pent up demand for crypto and fintech. Jacob Zuller of Third Bridge says “public markets have accepted that crypto is not going away”.

Renaissance Capital’s Matt Kennedy notes that positive trading of Circle’s stock gave “the green light for the industry”. On the policy side, IPOX’s Kat Liu points out that the crypto sector’s $4+ trillion market cap has “boosted public market sentiment” for deals.

However, experts warn of risks. Some say crypto assets are still highly correlated with equities, reducing their value as a hedge. Bell Curve’s Bill Strazzullo says crypto’s 90% correlation with the S&P 500 means:

“when you buy crypto, you are basically just increasing exposure to the stock market”.

Others note that crypto still has uncertainty. Even as stablecoins and ETFs get approved, a price swing or regulatory setback could flip investor sentiment. As B. Riley’s Joe Nardini puts it, as long as crypto assets trade at premiums, companies will raise funds; but a change in conditions could shut off that market.

Overall, most analysts think the crypto IPO boom means broader acceptance of digital assets. If crypto companies have strong fundamentals (custody standards, revenue growth) and regulators are supportive, this wave of crypto IPOs could continue. But given crypto’s volatility, investors and retirees are advised to heed to the warnings.

Crypto IPO Boom at a Glance

| Details | |

|---|---|

| Why the Boom | Trump’s pro-crypto policies, BTC and ETH rallies to ATH, $4T+ market cap |

| Big IPOs | Circle ($1.05B, $35B value), Bullish ($1.11B, $13.2B value) |

| Next in Line | Gemini, Kraken, BitGo, Grayscale |

| Investor Demand | BlackRock, Ark Invest buying big |

| Risks | High volatility, equity correlation, and regulatory shifts |

| Impact | Crypto going mainstream, attracting pensions & institutions |

Long-Term Implications for Crypto and Capital Markets

The recent crypto IPOs boom is a structural change in the relationship between digital assets and traditional finance. When companies like Circle and Bullish go public, they don’t just raise capital; they validate the entire industry for institutional investors.

Public companies are subject to rigorous reporting requirements, corporate governance standards and oversight that private crypto companies have avoided. This transparency attracts pension funds, sovereign wealth funds and conservative asset managers who were previously hesitant to touch the crypto space.

Going public gives early-stage backers, venture capitalists, and private equity firms an exit, and encourages fresh investment into the next generation of blockchain companies. This influx of capital doesn’t just benefit the companies going public; it trickles down to the rest of the crypto ecosystem, funding DeFi projects to infrastructure providers.

The rise of “crypto holding companies,” publicly traded firms that hold significant amounts of Bitcoin and Ethereum, gives traditional investors exposure to crypto assets without having to manage wallets, exchanges, or private keys. This hybrid model is like the gold holding companies of old, potentially creating a new class of crypto blue chips.

While the IPO surge is good news, it’s not immune to macro and political risks. At present, the market’s optimism seems to be tied to the Trump administration’s pro-crypto stance. A change in leadership or a sudden tightening of regulations could reverse sentiment in an instant.

Conclusion

Based on the latest research, the Crypto IPO boom is transforming capital markets with record listings and valuations. Regulatory clarity and momentum is bringing crypto companies into public markets faster than ever.

But experts say crypto assets are still highly volatile and correlated, and as such; investors are advised to proceed with caution. While the IPO wave is the mainstream adoption of digital assets, its long-term success will hinge on regulatory support and market stability.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

A wave of crypto IPOs is hitting US markets, driven by Trump era pro-crypto policies ) and surging crypto prices. Circle and Bullish raised billions and attracted institutional investors. Analysts see this as evidence of growing mainstream crypto acceptance, but warn of risks.

FAQs

What’s behind the crypto IPO surge?

The crypto IPO boom is driven by a bullish market and pro-crypto US policies. New laws like the GENIUS Act for stablecoins and an executive order for 401(k) crypto access; and regulatory support gave confidence.

Which crypto companies have gone or are going public?

Circle (stablecoin issuer) and Bullish (crypto exchange) both raised billions in 2025. BitGo, Grayscale, Gemini and potentially Kraken are also filing to go public.

Are crypto IPOs a good investment?

Crypto IPOs give exposure to the digital asset space but come with high risk. While initial trading has been strong (often doubling debut prices as in Circle and Bullish), crypto stocks are volatile and subject to regulatory changes.

What role do SPACs play in crypto companies going public?

Special Purpose Acquisition Companies (SPACs) allow crypto startups to merge into a public shell company often with less scrutiny than a traditional IPO. This has been popular for crypto firms and allows them to go public faster.

Glossary

IPO (Initial Public Offering): The first sale of a company’s shares to the public on a stock exchange.

Stablecoin: A type of cryptocurrency designed to maintain a fixed value by pegging it to a reserve asset (usually the US dollar). E.g. Circle’s USDC or Tether’s USDT.

SPAC (Special Purpose Acquisition Company): A publicly traded shell company; that raises capital in an IPO and later merges with a private company (often in crypto or biotech) to take it public.

ETF (Exchange-Traded Fund): A tradable security that tracks an underlying asset or index.

Institutional Investor: Asset managers; hedge funds, banks or corporations that invest big.