According to the latest industry reports, crypto fund flows have taken a turn. While investors pulled $912 million from Ethereum-linked products, XRP and Solana continued to see weekly inflows. This is captured in new data from CoinShares amid changing regulatory environments.

Ethereum’s Outflows: A Warning Sign

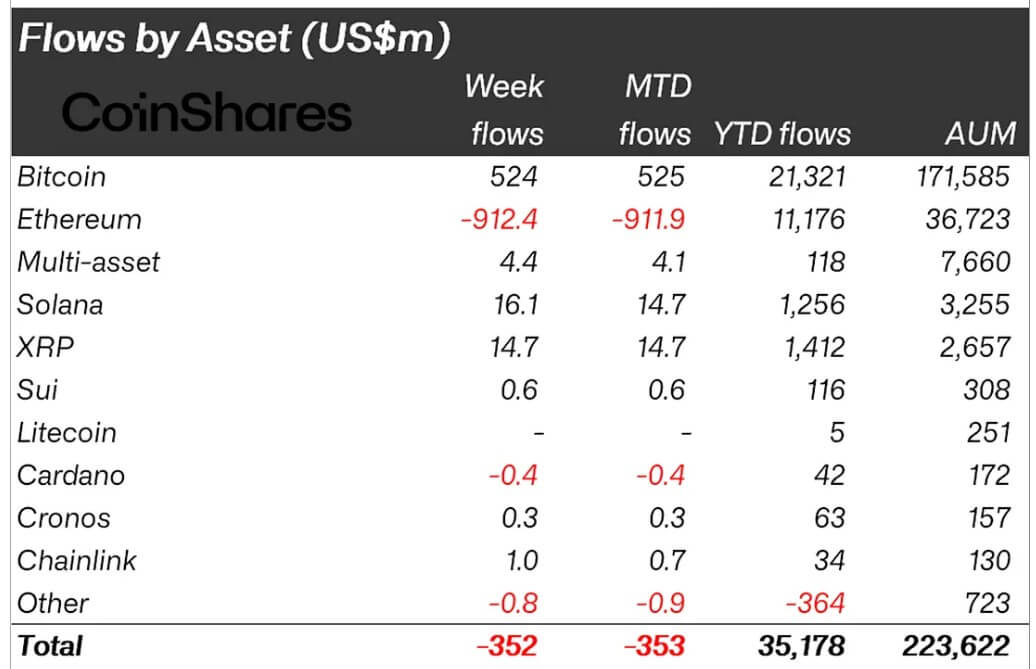

Ethereum-linked investment products saw seven consecutive days of outflows, culminating in $912 million of outflows for the week ending September 6. Despite $11.2 billion of inflows year to date, investors are reportedly rotating out of $ETH as trading volumes are soft and sentiment is cautious.

CoinShares’ head of research, James Butterfill, noted that this de-risking happened despite strong US employment numbers which usually support risk assets. Instead, a 27% drop in weekly trading volumes killed the momentum.

Also read: Ethereum’s Revenue Decline Fuels Debate Over Solana and Bitcoin Competition

XRP and Solana Holding Strong

XRP and Solana were the clear winners. $XRP funds saw $14.7 million of inflows last week, bringing total 2025 inflows to $1.22 billion. Solana saw $16.1 million of inflows for the 21st straight week, with total 2025 inflows of $1.16 billion.

This is due to growing anticipation of spot ETF approvals for both tokens. Bloomberg analysts assigned more than 90% probability to this happening.

Macro Context & Regional Disparities

The bigger picture is a global redistribution of capital. The US saw the most outflows, $440 million, while Germany and Hong Kong saw $85.1 million and $8.1 million of inflows, respectively. Canada, Brazil, and Australia saw smaller but notable inflows.

Interestingly, despite Ethereum outflows, Bitcoin products saw $524 million of inflows, so investors still see fundamental value in a digital store of assets despite the rotation.

The State of 2025: Crypto Sentiment Beyond Weekly Fluctuations

While the market watches the short term, the annual numbers tell a different story. As of early September, total YTD inflows are $35.2 billion, up 4.2% on 2024’s full year total of $48.5 billion. As a result, despite the current caution, overall market confidence is still there.

Also read: New Grayscale ETCO ETF Turns Ethereum Volatility Into Regular Cash Flow

Conclusion

Based on the latest research, in crypto fund flows, Ethereum appears to be pulling back, possibly due to short term volatility and profit taking. XRP and Solana are benefiting from ETF optimism and investor appetite for high growth altcoin exposure.

With YTD inflows looking healthy, the data shows a layered market where risk is being redistributed, not abandoned.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

Recent crypto fund flows show that Ethereum sees big weekly outflows despite strong annual performance. XRP and Solana on the other hand are steady with inflows. Regional capital movement shows a nuanced global story.

Glossary

Crypto Fund Flows: Net investment into or out of digital asset investment products, such as ETFs or ETPs, sentiment.

ETP (Exchange-traded product): a way to get exposure to crypto without owning it.

Spot ETF: Exchange-traded fund that holds the actual digital asset, not derivatives.

YTD Inflows: Year-to-date total investment into crypto funds.

FAQs for Crypto Fund Flows

Why is Ethereum seeing outflows despite strong YTD performance?

Daily outflows are likely tactical re-allocations or profit taking as trading volumes are soft, not a fundamental rejection of Ethereum.

What is driving XRP and Solana’s sustained interest?

Spot ETF approvals are giving investors confidence, positioning these altcoins as high-opportunity plays.

Is the overall crypto market still healthy?

Yes. YTD inflows of $35.2 billion; more than last year’s total, indicating overall market sentiment is still positive.

What do regional fund flows say about investor behavior?

The US is reducing exposure, while Germany and Hong Kong are increasing theirs, so global views on crypto as an asset class are shifting.