This article was first published on Deythere.

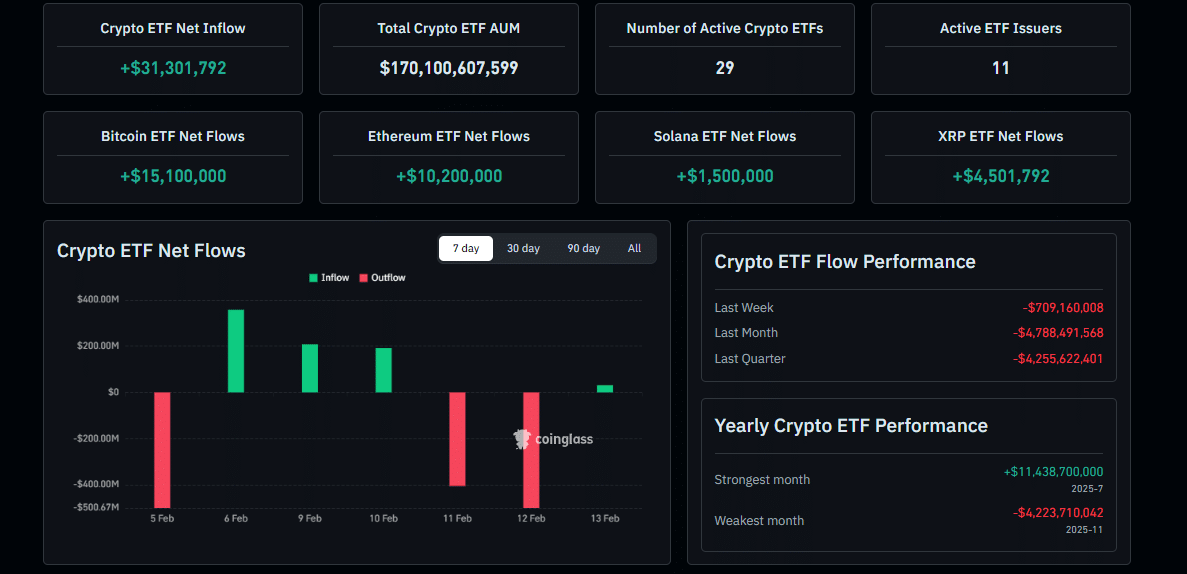

Crypto ETF flows are signaling a meaningful change in institutional behavior across digital asset markets. The latest weekly data shows sharp withdrawals from dominant funds alongside targeted gains in select alternatives. The pattern suggests repositioning rather than retreat, but the scale of movement adds urgency for investors watching market direction.

According to the source, spot Bitcoin exchange-traded funds recorded net outflows of $359.91 million, while Ethereum spot ETFs lost $161.15 million during the same period.

Analysts describe this combined decline as one of the more significant weekly pullbacks in recent months, reinforcing the importance of current crypto ETF flows for short-term sentiment analysis.

Bitcoin and Ethereum See Clear Capital Exit

The synchronized withdrawals from the two largest digital assets rarely occur without broader context. Market observers often connect such crypto ETF flows to profit-taking after price rallies, macroeconomic uncertainty, or institutional portfolio rebalancing designed to manage exposure during volatile periods.

Historical fund behavior across global exchange-traded products shows that large exits from leading assets typically signal caution rather than collapse.

Capital often remains inside the broader asset class, waiting for clearer economic signals or stronger growth narratives before returning to core holdings. This interpretation aligns with recent institutional research tracking ETF allocation shifts across risk cycles.

SOL and XRP Spot ETFs Record Fresh Inflows

While major assets faced pressure, altcoin ETF inflows moved in the opposite direction. Solana-linked funds attracted approximately $13.17 million, and XRP-based ETFs added about $7.65 million in new capital. Though smaller in absolute scale, these gains carry strong directional meaning within evolving crypto ETF flows.

Investors appear to be rotating capital into select altcoins rather than exiting the crypto sector entirely. Solana continues to draw attention because of fast transaction speeds and expanding developer activity.

XRP remains closely watched for its role in cross-border payment infrastructure, an area still explored by global financial institutions. Public fund-flow and market data supporting these trends can be reviewed through transparent ETF tracking dashboards available online.

The steady rise in altcoin ETF inflows highlights selective institutional confidence. Instead of broad speculation, capital is targeting networks linked to practical use cases and measurable ecosystem growth.

What Changing Crypto ETF Flows Mean for the Market

The contrast between withdrawals in dominant assets and rising altcoin ETF inflows suggests a short-term rotation within crypto ETF flows, not a structural decline in the sector. Investors frequently adjust allocations based on risk appetite, regulatory expectations, and macroeconomic outlook, especially during consolidation phases.

If altcoin ETF inflows continue, fund issuers may accelerate efforts to expand altcoin-focused investment products, increasing diversification opportunities for institutions. At the same time, sustained outflows from Bitcoin and Ethereum ETFs could create temporary price pressure, even if long-term adoption trends remain intact.

For now, the evidence shows capital moving within crypto rather than leaving it. This internal redistribution reflects a market growing more strategic, measured, and responsive to changing narratives.

Conclusion

Recent crypto ETF flows confirm a decisive but nuanced shift in institutional positioning. Bitcoin and Ethereum experienced one of the largest weekly pullbacks in months, while consistent altcoin ETF inflows toward Solana and XRP reveal targeted confidence instead of market retreat.

Understanding these evolving crypto ETF flows offers critical insight into where liquidity, innovation, and long-term opportunity may emerge next in the digital asset economy.

Glossary of Key Terms

Crypto ETF flows: Movement of institutional money entering or leaving digital-asset exchange-traded funds.

Altcoin ETF inflows: New investment directed toward ETFs tracking cryptocurrencies beyond Bitcoin and Ethereum.

Spot ETF: A fund that directly holds the underlying cryptocurrency rather than derivatives.

Capital rotation: Strategic shifting of investment between assets to manage risk and capture growth.

FAQs About Crypto ETF Flows

Why are crypto ETF flows closely monitored?

They reveal institutional sentiment and often signal trend changes before price movements become visible.

Do altcoin ETF inflows indicate stronger future performance?

They suggest rising interest but do not guarantee sustained price growth.

Can Bitcoin and Ethereum recover after ETF outflows?

Previous cycles show withdrawals are often temporary when sentiment improves.

Will more altcoin ETFs appear soon?

Continued demand and regulatory clarity could support additional product approvals.