The cryptocurrency market has never been for the faint of heart, but September 2025 was a month that reminded even seasoned investors of just how unforgiving it can be.

Over ten days, the digital asset market saw $300 billion in value erased, leaving both retail traders and institutions scrambling. The crypto crash not only highlighted the dangers of leverage but also underscored the urgent need for stronger risk management as the sector prepares for Q4.

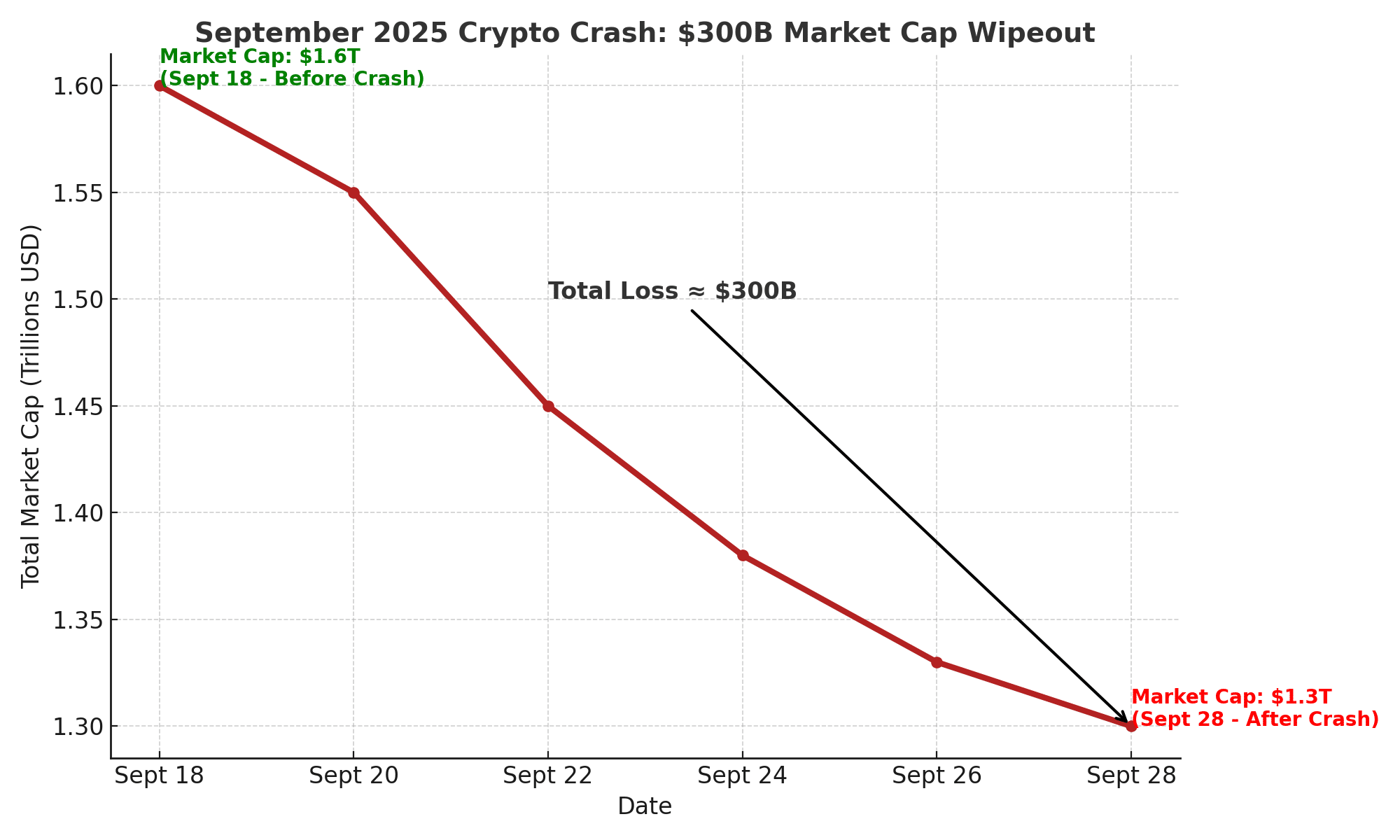

A Sudden $300 Billion Wipeout

The numbers were staggering. Between September 18 and September 28, crypto’s total market capitalization dropped from around $1.6 trillion to nearly $1.3 trillion.

What made this crypto crash particularly brutal was not just the scale of the loss but the speed at which it unfolded. Forced liquidations alone exceeded $7 billion, with Ethereum and Bitcoin leading the bloodletting as long positions collapsed.

Traders on X described the selloff as “the kind of capitulation that reshapes narratives,” pointing to order books so thin that prices sliced through major support zones without resistance. For investors, it felt like the dominoes fell all at once, pulling down altcoins from XRP to Solana.

The Perfect Storm: Why It Happened

While speculation often points to single causes, this crypto crash was triggered by a cocktail of pressures. Rising U.S. bond yields sparked global risk aversion, pushing capital away from speculative assets. Meanwhile, leveraged positions had piled up to dangerous levels, and once prices tilted downward, margin calls spread like wildfire.

An institutional strategist explained it bluntly: “The crash wasn’t about Bitcoin or Ethereum failing. It was about the system cracking under its own weight of leverage.” This perspective underscores how much structural fragility remains in digital markets despite their growing institutional adoption.

Investors Eye a Q4 Rebound

Not everything is doom and gloom. Historically, crashes often pave the way for rebounds, and many analysts believe Q4 could offer just that. Anticipated rate cuts, pending ETF approvals, and regulatory developments may inject fresh optimism.

Already, signs of quiet accumulation are visible as larger players buy into Bitcoin and Ethereum at lower levels, betting that September marked the cycle’s low point.

One market analyst wrote on X, “If liquidity returns and macro pressures ease, Q4 could flip the script. September’s crash might end up being the shakeout before the surge.” For traders still reeling, this cautious optimism is welcome news.

Lessons for the Long Term

The lasting impact of the crypto crash may be its role in reshaping how exchanges, funds, and retail traders approach risk. Calls are growing for exchanges to tighten liquidation protocols and improve transparency in derivatives markets. Regulators, too, are likely to seize on September’s chaos as evidence for stricter oversight, particularly on leveraged products.

This focus on stability mirrors patterns seen in traditional finance, where every crash historically prompted reforms — from Wall Street regulations after the 1929 stock collapse to new risk frameworks following 2008. Crypto may now be facing its own moment of reckoning.

Conclusion

September’s crypto crash was one of the largest market shocks since the early pandemic years, stripping away $300 billion in value and shaking investor confidence. Yet it also left behind vital lessons.

Overreliance on leverage and fragile liquidity remain the industry’s Achilles heel, but with reform and renewed discipline, recovery is possible. As Q4 unfolds, investors will discover whether September was the end of a dangerous chapter or the beginning of a stronger one.

FAQs about the September crypto crash

Q1: How much was lost in September’s crypto crash?

Roughly $300 billion in market value vanished, with more than $7 billion in leveraged liquidations.

Q2: What triggered the crash?

A combination of rising bond yields, heavy leverage, and thin liquidity created cascading sell pressure.

Q3: Could the market rebound in Q4?

Yes. Potential catalysts include ETF approvals, central bank easing, and fresh institutional inflows.

Q4: What are the long-term lessons?

Stronger risk management, reduced reliance on leverage, and improved regulatory frameworks are key takeaways.

Glossary of Key Terms

Crypto Crash: A sudden and steep decline in the value of the cryptocurrency market.

Leverage: Using borrowed funds to increase trading exposure, magnifying both gains and losses.

Liquidation: The forced closure of leveraged positions when collateral falls below thresholds.

Market Capitalization: The total value of a cryptocurrency or the entire market, calculated as price times supply.

ETF (Exchange-Traded Fund): A tradable investment vehicle tracking assets like stocks or cryptocurrencies.

Liquidity: The ease of buying or selling an asset without causing drastic price changes.