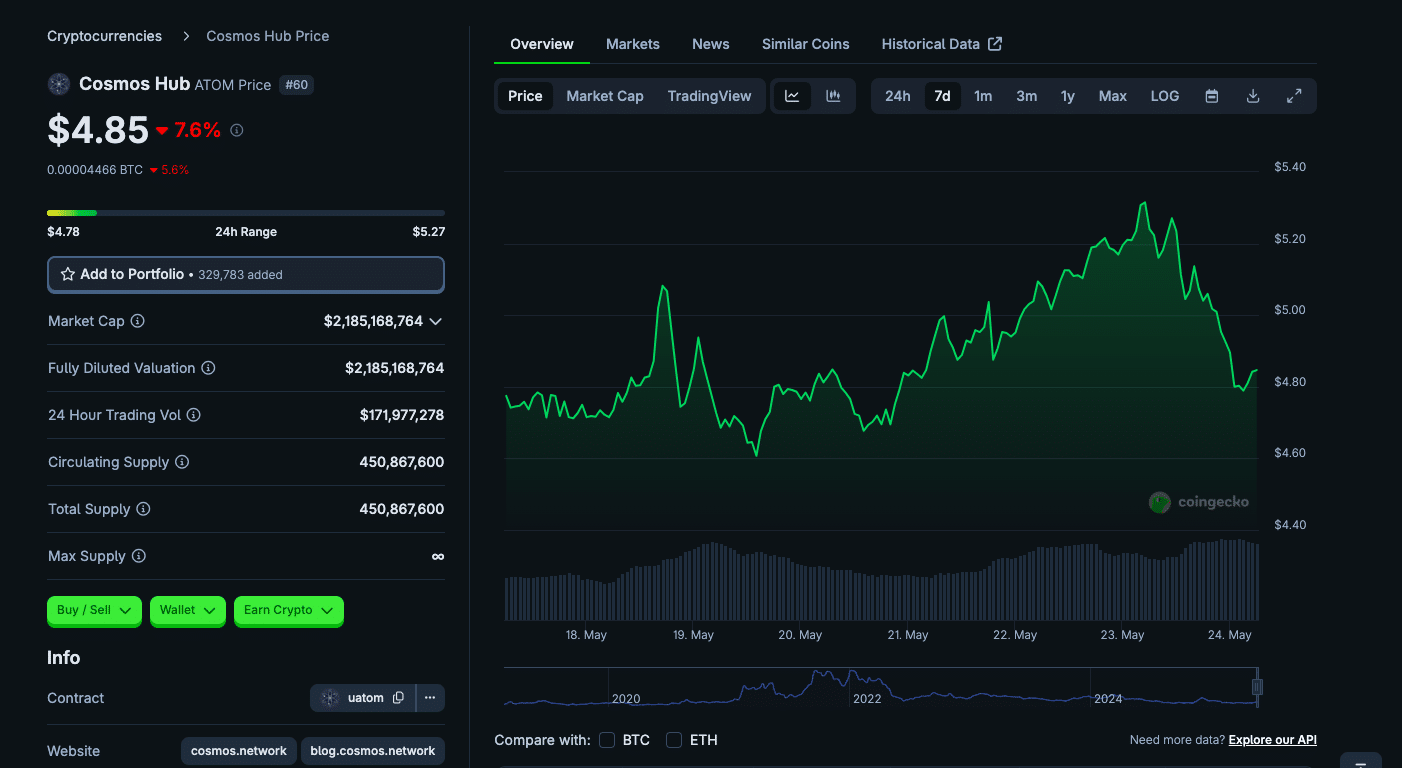

Cosmos (ATOM) price prediction for 2025 and 2026 requires looking at both the blockchain’s fundamentals and market trends. As of May 2025, ATOM is trading at $4.85 with a market cap of $2.1 billion.

- What Is Cosmos and the ATOM Token?

- Recent Updates and Ecosystem News

- Current Market Data (May 2025)

- Short-Term Technical Analysis

- 2025–2026 Cosmos Price Forecasts

- Experts’ Cosmos Price Forecasts

- ATOM Price Factors

- Conclusion

- FAQs

- What is Cosmos (ATOM) and why is it important?

- What is the current price and market cap of ATOM?

- What are the expert predictions for Cosmos (ATOM) in 2025 and 2026?

- Should I invest in ATOM based on these price predictions?

- Glossary

ATOM bounced back strongly in late 2023, up 87% from its 2023 low by December and has been consolidating in 2024 and 2025. In this balanced Cosmos price prediction, we review ATOM’s background, recent ecosystem updates, technical sentiment, and expert forecasts to get a range of possible 2025-2026 price outcomes.

What Is Cosmos and the ATOM Token?

Cosmos is a network of blockchains that enables interoperability via the Inter-Blockchain Communication (IBC) protocol. The Cosmos Hub was launched in 2019; by the Interchain Foundation and Tendermint (now Ignite) teams. ATOM is the native PoS token of the Cosmos Hub; used for staking (securing the network) and governance.

Cosmos pioneered modular blockchain development: its Cosmos SDK and Tendermint consensus allow projects to launch independent zones that can “talk” through IBC. As Messari notes,

“Cosmos Hub (ATOM) is a sovereign Proof-of-Stake blockchain with no native smart contracts, pioneering IBC for cross-chain interoperability.”

Key aspects of Cosmos tokenomics are staking and inflation control. Validators stake ATOM to earn rewards; until late 2023, ATOM’s annual inflation was up to 20%. But a governance proposal (Proposal 848) in Q4 2023 reduced inflation from 20% to 10% and implemented a disinflation schedule. Post-upgrade, inflation has stabilized around 12%, boosting staking yields and capital efficiency. Over 63% of ATOM’s 450 million supply is currently staked.

This high staking rate provides security rewards but also reduces the circulating supply, which is good for the price. Cosmos has no supply cap but the recently reduced and stabilizing inflation is a key factor in our Cosmos price prediction.

The ecosystem now has over 100 independent blockchains (zones), including smart-contract networks (e.g. Neutron, Juno), DeFi hubs (Osmosis, Gravity DEX), and many more. This broad Interchain footprint and growing IBC usage (including new bridges like Ethereum) is the foundation of ATOM’s long-term value.

Recent Updates and Ecosystem News

A big part of forecasting ATOM is understanding recent developments. Cosmos governance has been active. In March 2025, the community passed Gaia v23 (IBC Eureka), which upgraded IBC to v2 and enabled the Eureka bridge to Ethereum. This allows Cosmos Hub to connect directly to Ethereum, opening up cross-chain use cases and potentially increasing ATOM utility. Cosmos engineers plan to extend Eureka to Solana, Arbitrum and Base next.

Also in early 2025 Neutron (a Cosmos smart-contract chain) “graduated” from sharing Cosmos Hub security via its Mercury upgrade and became fully sovereign. These upgrades reflect an evolving security model (from interchain security to chain-specific security) that could impact hub inflation and staking demand.

Governance reforms have also improved technical stability. The 2024-2025 Cosmos roadmap emphasizes continuous upgrades: the Informal Systems team and others implemented new fee mechanisms, ICS 2.0 and Partial Set Security (PSS) proposals, and regular code revisions.

For example, Proposal 848’s inflation cut (mentioned above) has already taken effect by mid-2024. Additionally, Cosmos has invested in ecosystem projects (a $500k stake in Elys Network, and onboarding DAODAO for governance tooling). These developments strengthen Cosmos’s fundamentals and often precede price increases.

On the DeFi side, the Cosmos ecosystem has grown rapidly. According to KuCoin research, Cosmos DeFi TVL grew 300% in 2023 and surpassed $1 billion. Osmosis has been a liquidity hub and new protocols (Frax on Cosmos, Sifchain bridging to Binance Smart Chain, etc.) are emerging. Higher TVL and ecosystem usage tends to correlate with Cosmos price increases.

Current Market Data (May 2025)

As of late May 2025, market data for ATOM is: price ($4.85), circulating supply (450 million), market cap ($2.1 billion), and 24h trading volume ($171 million). Note that the CoinMarketCap rank is around 53. Year-to-date (2025), Cosmos price has ranged from $3.42 to $7.73. The CoinLore “Yearly Price History” shows an average price of $4.96 in 2025 and a YTD close of $5.21.

This range of $3.4 (early 2025 low) to $7.7 (post-March high) is the context for our forecast ranges. In addition to price data, we consider on-chain metrics of over 60% of the supply is staked, earning real staking rewards above inflation. Transaction volume on the Hub has been steady since the Ethereum inscription peak. Cosmos has relatively low fees per tx (especially after a fee market upgrade).

There are no direct crypto-specific legal pressures on Cosmos, though broad regulatory trends (SEC, MiCA in EU) affect all PoS projects. Overall, the current market sentiment on ATOM is cautious-to-neutral; it’s down almost 8% over 24h but up slightly after recent consolidation.

Short-Term Technical Analysis

In the short term, technical indicators are mixed. Investing.com’s May 23, 2025 technical summary rates ATOM as a “Strong Sell” overall. Most moving averages (MA) on daily charts are down: the 5-100 day SMAs are below price and tagged “Sell”. The 200-day MA has just started to turn up (supporting a medium-term uptrend).

On the 14-day RSI, ATOM is at 36 (below 50), marked as “Sell” in the Investing.com analysis. The MACD is slightly negative and several oscillators (Stochastic, CCI) are oversold. This means recent downward momentum and no strong bullish divergence.

Key levels from technical analysis are: support around $4.17–$4.43. Cosmos price and resistance is near $4.36–$4.58 in the very short term. In practice, ATOM has recently held support near $4.40 and stalled near the $4.50–4.60 zone.

A break above $4.60 could open the next zone near $5.00, whereas a break below $4.40 could go to $4.30 or lower support.

In summary, short-term sentiment is cautious. The RSI and MAs suggest Cosmos price is neither strongly overbought nor showing a clear bullish reversal. If the crypto bull market (e.g. BTC rally) strengthens, ATOM may test resistance $4.98–5.05 next. Conversely, macro headwinds or Bitcoin weakness could break support towards $4.17–4.30. The current consolidation implies volatility may pick up in coming weeks; a key factor in near-term price prediction.

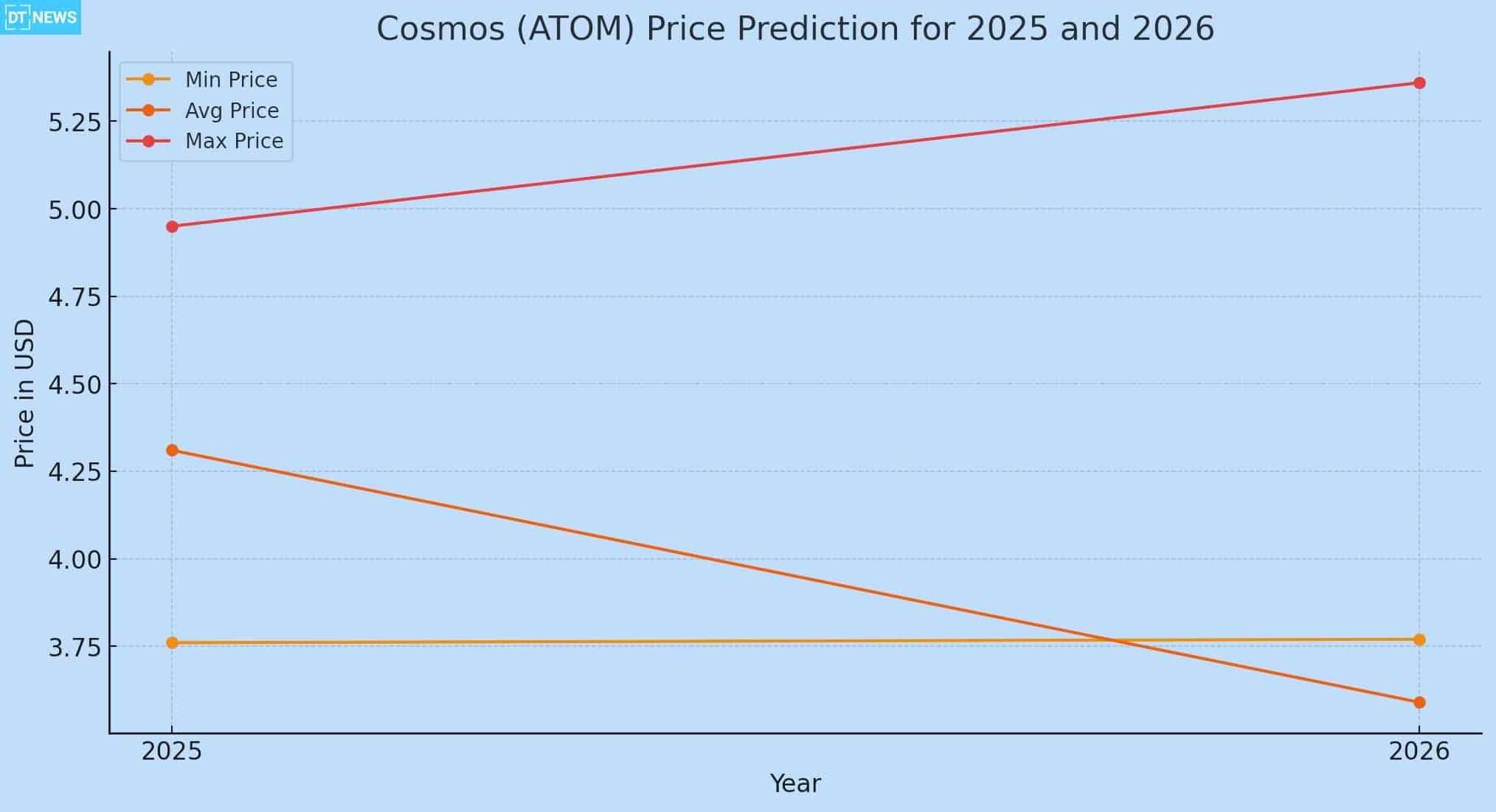

2025–2026 Cosmos Price Forecasts

Cosmos (ATOM) price prediction for 2025 is around $3.7 to $5.0. For 2026, the forecasts are a bit more scattered. Many analysts see Cosmos price mostly between $3.0 and $5.5 in 2026. There are extremely bullish projections, where crypto sources have Cosmos price at $15–$22 by 2026, but those are based on very optimistic bull-market assumptions.

For clarity, we summarize the representative predictions below:

| Year | Min Price | Avg Price | Max Price |

| 2025 | $3.76 | $4.31 | $4.95 |

| 2026 | $3.77 | $3.59 | $5.36 |

These are mid-range Cosmos price analyst expectations; actual price may vary. A successful launch of the IBC Eureka bridge or a broader crypto rally could push Cosmos price to the high end of these ranges, while a prolonged market downturn could hold it to the lows.

Experts’ Cosmos Price Forecasts

DigitalCoinPrice: Predicts Cosmos price will range from $3.68 to $9.00, with an average of $8.46 in 2025. For 2026, Projects growth with a range between $8.82 and $10.30, and an average of $9.61.

CoinSurges: Bullish with a minimum of $15.20, average of $22.78, and high of $30.35 for 2025. For 2026, Bullish with the same range as 2025: $15.20 to $30.35.

Switchere: Moderate growth for 2025, low of $13.11, average of $15.56, high of $18.50. Uptrend from $17.39 to $24.53, average Cosmos price of $20.63 for 2026

BeInCrypto: $22.10 to $46.20 Cosmos price by 2025 end. Strong rally, $30.42 to $49.06 for 2026

Investing.com: Conservative top at $17.44, minimum of $3.86 for 2025. Cosmos price High of $20.00 for 2026

ATOM Price Factors

Several factors will influence Cosmos (ATOM) price in 2025-2026:

IBC Adoption – As IBC deployments (like the Ethereum bridge) roll out, demand for ATOM could increase as more projects and users join the Cosmos network. More interoperability (e.g., connecting Ethereum DeFi to Cosmos) means higher Hub fees and staking revenue.

Network Upgrades – Successful major upgrades (like Mercury and future Hub enhancements) will improve network security and appeal, supporting price. Failed or delayed upgrades will hurt confidence.

Staking Incentives – With inflation controlled at 10–12%, ATOM’s staking yield (currently in mid-teens %) is competitive. High real yields will attract capital into ATOM, supporting price. If future governance further cuts inflation, ATOM could trade even higher as an “inflation-hedged” asset.

Market Trends – Like all crypto, ATOM follows broader sentiment. A Bitcoin bull market (driven by ETF inflows, macro policy, etc.) will lift altcoins, including Cosmos. For example, if BTC sustainably breaks new highs, ATOM will at least test the upper end of forecasts ($5+). If interest rates rise or regulation cracks down, speculation will reduce and ATOM will cap or drop.

Defi Activity – Cosmos DeFi ecosystem health (Osmosis volume, new chain launches) directly impacts ATOM usage. The $1B+ TVL shows strong on-chain activity, which is good. Any loss of DeFi momentum (e.g. competition from Ethereum rollups or Polkadot) will slow ATOM’s growth.

Competition and Alternatives – Other interoperability blockchains (Polkadot, Avalanche’s subnets, Layer-2s) compete with Cosmos. If Cosmos’s technology or adoption lags peers, ATOM could underperform. Finally, Regulatory Risk – Cosmos’s decentralized governance and staking could face scrutiny (e.g. whether ATOM is a security). Adverse regulations could add downward pressure.

In summary, positive developments (IBC bridges, staking demand, bull crypto cycle) would favour a bullish Cosmos price prediction, while negative macro or tech setbacks would justify a bearish outlook.

Conclusion

Our Cosmos price prediction for 2025–2026 is cautiously optimistic. Based on on-chain data and expert forecasts, ATOM is likely to trade in the $3–$5 range, with upside toward the high end if key catalysts materialize. The average consensus (~$4–$5) reflects gradual growth driven by IBC adoption and staking rewards. However, we also note risks: ATOM’s performance depends on broader crypto market conditions and Cosmos-specific execution.

In short, future Cosmos price will hinge on technical adoption (IBC, SDK projects), tokenomics (staking/inflation), and macro sentiment. Should Cosmos continue to execute its roadmap and crypto markets improve; ATOM could modestly appreciate. But investors should remain aware of volatility and regulatory factors. A balanced approach considering both bullish forecasts (e.g. strong 2026 growth) and bearish scenarios (market pullbacks); is prudent.

FAQs

What is Cosmos (ATOM) and why is it important?

Cosmos is a blockchain ecosystem focused on interoperability among independent networks. Its native token, ATOM, secures the Cosmos Hub via proof-of-stake and powers cross-chain transactions (via IBC). ATOM holders can stake tokens to earn rewards and vote on network governance.

What is the current price and market cap of ATOM?

As of May 2025; ATOM is trading around $4.85 with a market cap of $2.1 billion. Circulating supply is about 450 million. These numbers update in real time; check a reliable price tracker (CoinMarketCap or Binance) for the latest.

What are the expert predictions for Cosmos (ATOM) in 2025 and 2026?

Analysts predict ATOM to average around $4–$4.5 in 2025 ;and $3.5–$4 in 2026; with ranges of $3.7–$5.0 for 2025 and $3.8–$5.4 for 2026.

Should I invest in ATOM based on these price predictions?

Price predictions are not guarantees; they are educated estimates based on current data and analyst models. ATOM’s medium-term outlook is good given Cosmos’s growing ecosystem but it’s a speculative asset. Investors should consider their risk tolerance; do their own research and maybe look at staking or usage (via DeFi) rather than short-term price alone.

Glossary

ATOM: native cryptocurrency of the Cosmos Hub blockchain, used for staking and governance.

IBC (Inter-Blockchain Communication): protocol that enables data and token transfers between independent blockchains in the Cosmos ecosystem (and beyond).

Proof-of-Stake (PoS): a consensus mechanism where validators lock up (stake) tokens to participate in block validation. PoS is more energy efficient than Proof-of-Work.

Staking: Locking up ATOM tokens in a validator node to secure the network.

TVL (Total Value Locked): total value of assets (e.g. crypto tokens) locked in DeFi protocols.

Tokenomics: economic model of a cryptocurrency, including supply, inflation rate, and distribution rules.

RSI (Relative Strength Index): technical indicator (0–100); used to gauge if an asset is overbought (>70) or oversold

Support/Resistance: Price levels where an asset historically tends to stop falling (support) or rising (resistance).