According to Coinbase Institutional, new perpetual futures for $XRP and Solana are now available to U.S. traders, marking an important step in the exchange’s push to grow its regulated derivatives market.

- What Do the New Futures Contracts Offer?

- Why Is This Launch Important for U.S. Traders?

- What Impact Does the SEC’s Decision Have on Crypto Trading?

- What Do Analysts Say About Coinbase’s Strategy?

- Conclusion

- FAQs

- 1. What did Coinbase just launch?

- 2. What is the contract size for XRP and Solana futures?

- 3. Why is this launch important for U.S. traders?

- 4. How does this connect to the ETF delay?

- 5. Did Coinbase launch similar futures earlier?

- Glossary

- Sources

The move comes at a time when decisions on spot crypto ETFs remain delayed, giving traders new ways to manage risk and trade in a market that is still evolving.

What Do the New Futures Contracts Offer?

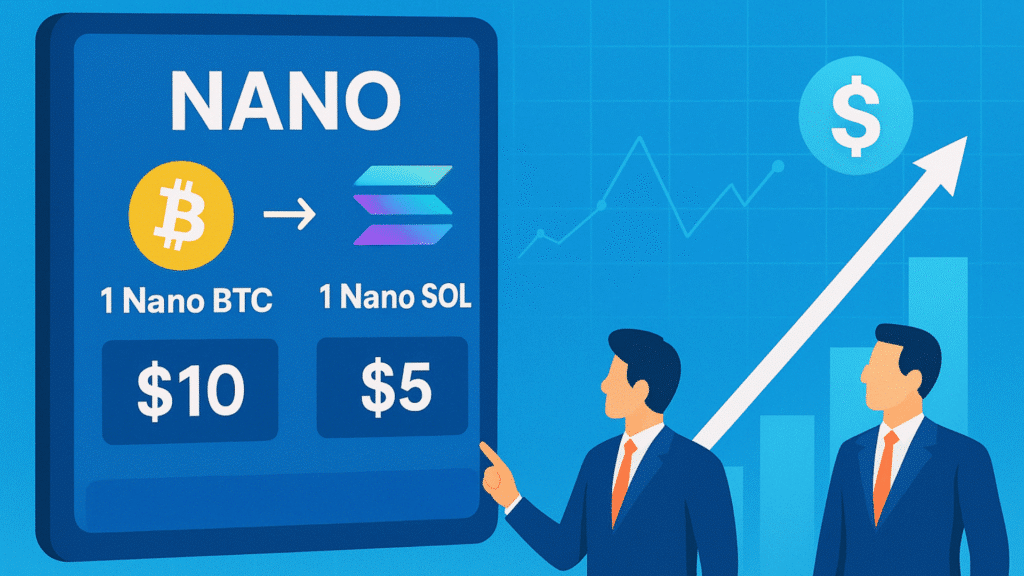

The Coinbase XRP and Solana perpetual futures come in the form of “nano” contracts, which let traders open positions without needing a large amount of money.

In these, one nano $XRP contract equals 10 $XRP, and one nano Solana contract equals 5 $SOL. Both settle in U.S. dollars and use funding rate adjustments to stay in line with spot prices.

Coinbase added these products shortly after rolling out nano Bitcoin and Ether futures at the end of July. Observers see it as another careful move to widen access to regulated trading options while continuing to operate under the oversight of the Commodity Futures Trading Commission (CFTC).

Why Is This Launch Important for U.S. Traders?

For a long time, U.S. investors had only limited ways to trade regulated crypto derivatives, since most perpetual futures were available only on overseas platforms.

The launch of Coinbase XRP and Solana perpetual futures now makes these trading options available within the U.S. under a regulated framework. Traders can now bet on the future price of $XRP and Solana or use these futures to protect their current spot holdings.

With leverage of up to 5x, Coinbase gives market participants the chance to either manage risk more effectively or increase their exposure. However, analysts caution that this also increases the chance of bigger losses.

| Feature | $XRP Perpetual Futures | Solana Perpetual Futures |

| Launch Date | August 18, 2025 | August 18, 2025 |

| Contract Type | Nano perpetual futures | Nano perpetual futures |

| Contract Size | 10 $XRP per contract | 5 $SOL per contract |

| Settlement Currency | USD | USD |

| Leverage | Up to 5x | Up to 5x |

| Regulation | CFTC Registered | CFTC Registered |

| Contract Duration | Long-dated, expires after 5y | Long-dated, expires after 5y |

| Market Access | U.S. traders | U.S. traders |

| Price Tracking | Uses funding rate | Uses funding rate |

What Impact Does the SEC’s Decision Have on Crypto Trading?

The launch of Coinbase XRP and Solana perpetual futures came at the same time the U.S. Securities and Exchange Commission (SEC) chose to delay its decision on several XRP ETF proposals from 21Shares, CoinShares, and Grayscale.

Market experts say that since ETFs are still on hold, derivatives give traders another way to get exposure to major digital assets. One derivatives strategist explained, “With the SEC still unsure about spot ETFs, futures are still the easiest regulated option for U.S. traders to take a position on price movements.”

What Do Analysts Say About Coinbase’s Strategy?

Analysts think Coinbase is taking a planned step to secure a bigger share of the perpetuals market, where offshore platforms like Hyperliquid have quickly gained ground.

By offering a regulated option, Coinbase is drawing the attention of both everyday traders and institutions that want safety and compliance.

Crypto analyst Nick Ruck said, “Coinbase is using its U.S. regulatory standing to provide something offshore exchanges cannot, which is, clear rules, proper oversight, and stronger trust for institutions. The launch of Coinbase XRP and Solana perpetual futures is a planned move to position itself as a top name in U.S. derivatives.”

Conclusion

According to the latest research, Coinbase XRP and Solana perpetual futures are set to play an important role in the next stage of U.S. crypto trading. Because the SEC is taking longer to decide on ETFs, Coinbase has chosen to move ahead on its own. It now gives traders a lawful way to keep trading through $XRP and Solana futures.

This step doesn’t just add new coins to its list, it also shows how Coinbase is pushing the direction of crypto trading in the U.S. Some believe these futures could act as a steady base for the market, mixing clear rules with fresh chances for people to take part in digital assets.

Summary

Coinbase XRP and Solana perpetual futures are now open for U.S. traders under CFTC rules. These small contracts make it easier to trade with less money and are paid in U.S. dollars.

The move comes while ETF decisions are still delayed. With up to 5x leverage, Coinbase XRP and Solana perpetual futures give traders a safer and more direct way to take part in the growing U.S. crypto market.

Stay updated on Coinbase XRP and Solana perpetual futures and get timely news on regulated U.S. crypto trading on our platform.

FAQs

1. What did Coinbase just launch?

Coinbase launched perpetual futures for XRP and Solana in the U.S.

2. What is the contract size for XRP and Solana futures?

One nano XRP contract equals 10 XRP, and one nano Solana contract equals 5 SOL.

3. Why is this launch important for U.S. traders?

It gives them regulated access to crypto derivatives previously available mainly overseas.

4. How does this connect to the ETF delay?

With spot ETF approvals delayed, these futures give traders another regulated option.

5. Did Coinbase launch similar futures earlier?

Yes, Coinbase launched nano Bitcoin and Ether futures in July.

Glossary

Perpetual Futures – Futures with no expiry, trade anytime.

Nano Contract – Tiny-sized futures for easy low-cost entry.

Funding Rate – Adjustment to match spot prices.

Hedging – Balancing spot risks with futures.

Settlement – The process of closing a futures contract, in this case, is done in U.S. dollars.