The revival of Coinbase’s Stablecoin Bootstrap Fund comes at a critical time for decentralized financing. With active on-chain loans at an all-time high, the initiative intends to create more liquidity in money markets and trading venues, beginning with targeted placements of stablecoins to reduce borrowing rates and spreads. This increasing attention on Coinbase USDC indicates a greater institutional shift toward DeFi’s next phase.

Liquidity Meets Momentum: Why Now?

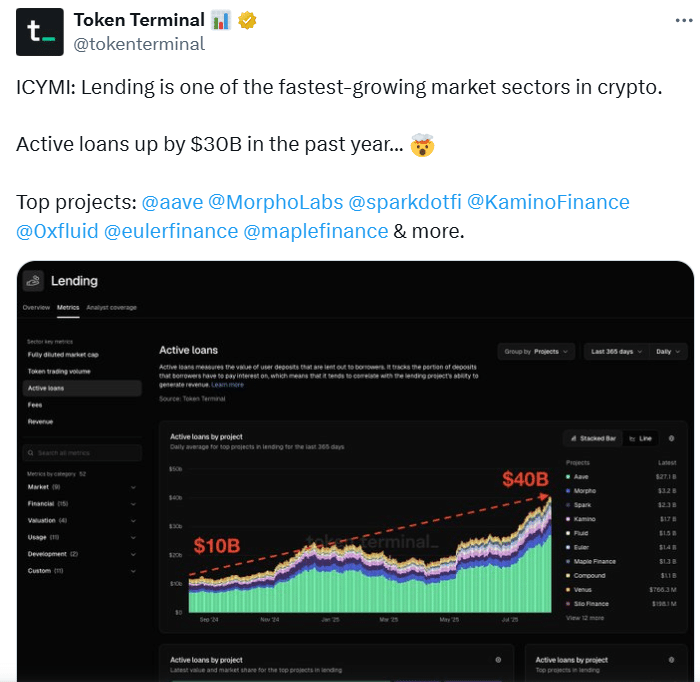

Active DeFi loans have risen to around $40.7 billion, indicating a significant increase in borrowing demand across protocols. The firm representative stated, “We’re at an inflection point in adoption of onchain financial services…” “We believe that now is the time to build.”

The fund’s objective is to route liquidity so that customers may receive dependable, market-rate funding without fragmentation—a clear reference to how Coinbase USDC can underpin lending rails at scale.

How It Works: Initial Placement and Management

Coinbase Asset Management facilitates the initiative, which begins with installations on Aave, Morpho, Kamino, and Jupiter, with plans to expand to more protocols and stablecoins. The company’s update also emphasizes the significance of EURC alongside Coinbase USDC, demonstrating a multi-asset strategy to on-chain credit markets.

Coinbase is structuring the fund to compress borrow APYs where depth counts most by focusing early firepower on high-throughput venues such as Ethereum and Solana.

Metrics That Matter: TVL, Volume, and Market Share

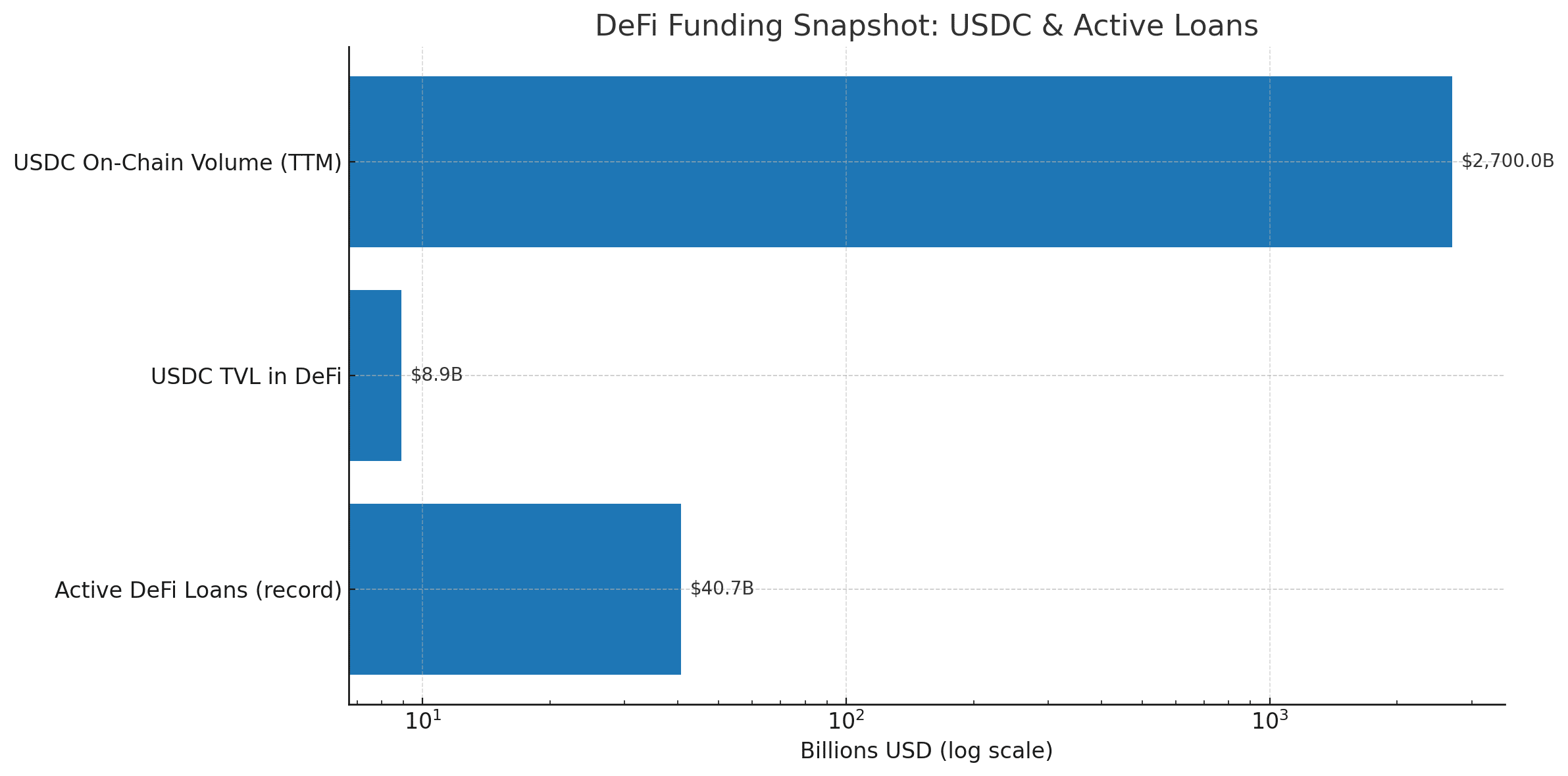

Coinbase’s blog estimates USDC’s DeFi footprint at $8.9 billion in TVL and $2.7 trillion in trailing 12-month on-chain activity, making Coinbase USDC an apparent liquidity lever. Meanwhile, category leaders are scaling.

Aave’s TVL has rapidly approached the $50 billion milestone across installations, demonstrating why it is a day-one beneficiary. These measurements confirm the hypothesis that seeding stablecoin inventories can reduce frictions for traders and treasuries, particularly during turbulent times.

DeFi Funding Snapshot

| Indicator | Latest reading |

|---|---|

| Active DeFi loans | ≈ $40.7B (record) |

| USDC in DeFi (TVL) | ≈ $8.9B |

| USDC on-chain volume (TTM) | ≈ $2.7T |

| Initial venues | Aave, Morpho, Kamino, Jupiter |

Market Impact: Rates, Depth, and Execution

If the placements increase, the most immediate consequence for borrowers should be narrower spreads and somewhat lower USDC borrow rates, especially in areas where usage often jumps. Deeper pools help market makers and treasuries prevent slippage during stress.

This is where Coinbase USDC may serve as a “settlement glue” across chains, supplementing collateralized lending and routing on Base and Solana. Analysts emphasize the need of persistence: one-time injections will not influence behavior unless depth is maintained across several cycles.

Related News: Lending Leaders Increase the Pie

Aside from Coinbase’s move, lending venues have seen consistent growth throughout 2025, with activity increasing with overall DeFi membership. The rise in active loans, as measured by independent analytics, lends credence to the idea that Coinbase USDC can build on current momentum rather than start from zero.

A Beneficial Approach for Investors and Builders

For long-term investors, the premise is straightforward: continuous liquidity availability may minimize volatility in financing markets while also improving institutional strategy execution. Builders benefit from more consistent depth during launch weeks and treasury operations. The key, however, is if Coinbase USDC capacity remains stable as markets shift, and whether deployments extend to risk-tiered pools that encourage prudent programmatic usage over mercenary flows.

Conclusion

A record lending background, growing TVL, and a focused rebranding give DeFi’s credit rails new life. Coinbase USDC intends to make borrowing cheaper and liquidity more reliable by sending stablecoin inventory to high-impact venues—two components that DeFi requires to attract the next cohort of consumers and institutions.

FAQs

What is the Stablecoin Bootstrap Fund?

A Coinbase-run program that seeds stablecoin liquidity into DeFi protocols to deepen markets and stabilize funding conditions.

Which protocols are included at launch?

Aave, Morpho, Kamino, and Jupiter, with room to expand as the program scales.

Why does the 40.7B active-loans figure matter?

It signals robust borrower demand, strengthening the case for sustained liquidity supply.

Will borrow rates fall immediately?

Rates respond to utilization and depth; lasting reductions depend on the size and persistence of placements.

Glossary

USDC: U.S. dollar-pegged stablecoin widely used in DeFi.

TVL (Total Value Locked): Capital deposited in a protocol, a proxy for usage.

Active Loans: Outstanding borrowed amounts across lending markets.

Liquidity Seeding: Supplying assets to pools to jump-start depth and price discovery.

Borrow APY: Annualized interest borrowers pay for on-chain loans.

EURC: Euro-denominated stablecoin referenced alongside USDC in placements.