Coinbase demands transparency

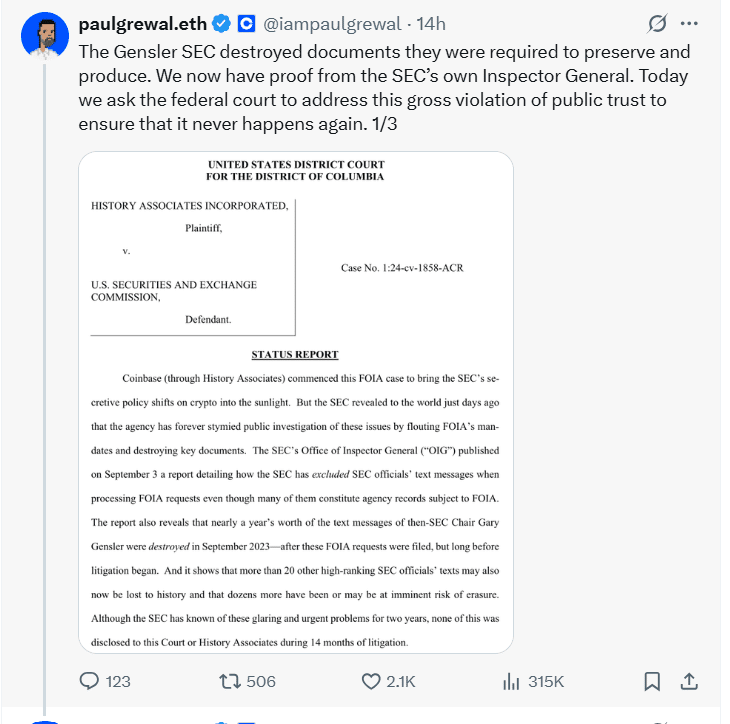

Coinbase and the United States Securities and Exchange Commission have spat again, this time over missing correspondence from the agency’s previous head. The discovery that nearly a year’s worth of Gary Gensler’s text conversations were erased sparked uproar and spurred Coinbase to pursue legal action.

The missing documents cover the period from October 2022 to September 2023, which includes the collapse of major exchanges, substantial enforcement actions, and disputes over whether digital assets should be categorized as securities.

Coinbase’s action mirrors the company’s larger commitment to regulatory clarity and openness, which has been a prominent topic in continuing conflicts with the Commission.

A Legal Battle over Missing Records

Coinbase claims that the deletion of these messages breaches current court orders and Freedom of Information Act responsibilities. According to its papers, the SEC was obligated to retain and produce correspondence related to current cases, including as talks about Ethereum’s regulatory categorization and enforcement objectives.

Coinbase’s Chief Legal Officer, Paul Grewal, stated on X, “The SEC deleted papers that they were supposed to retain and release. “We now have proof from the SEC’s Inspector General.” His remark emphasized the gravity of the allegations and encouraged concern that the destroyed material may have affected important regulatory decisions.

Technical failures or deliberate mistakes?

The SEC has recognized technical shortcomings in protecting its executives’ communications. According to reports, the deletion occurred because devices that had been unplugged from the SEC’s network for more than 45 days were set to automatically delete. More than 20 top officials apparently lost SMS messages in similar instances, raising concerns about institutional responsibility.

Critics claim that, whereas private companies have suffered severe fines for failing to keep records, the SEC appears to have ignored its own rules. This double standard has added gasoline to the flames and heightened calls for reform. According to one industry expert, “The SEC cannot hold the private sector to standards it does not uphold.” Trust demands constancy.”

Implications of Crypto Regulation

The missing data incident occurs at a critical time for the cryptocurrency sector. The industry has been advocating for clear rules, while regulators continue to emphasize enforcement activities. If the courts rule in Coinbase’s favor, the verdict might shift the balance of control and fairness in the US banking system.

Investors are eagerly monitoring the aftermath, especially since regulatory trust has a direct impact on market confidence.

According to market analysts, this issue has the potential to be a watershed moment in how regulators approach digital asset regulation. The missed messages not only reveal flaws in internal systems but also highlight the importance of ongoing responsibility.

Summing Up

The drama surrounding missing Gary Gensler text messages has put the SEC under heavy scrutiny, giving Coinbase new impetus in its fight for openness. The legal and political ramifications is expected to continue in the coming months, influencing the narrative around cryptocurrency legislation in the United States.

FAQs for Gary Gensler’s text messages

Q1: What texts were deleted from the SEC?

Nearly a year of Gary Gensler’s text messages, from October 2022 to September 2023, were deleted.

Q2: Why is Coinbase demanding accountability?

Coinbase argues the SEC violated court orders and FOIA obligations by failing to preserve required records.

Q3: How does this impact crypto regulation?

The case highlights transparency issues at the SEC and could influence broader regulatory reforms.

Q4: Could the courts sanction the SEC?

Yes, Coinbase has requested sanctions and expedited discovery to hold the agency accountable.

Glossary of Key Terms

SEC: The U.S. Securities and Exchange Commission, regulator of securities markets.

FOIA (Freedom of Information Act): U.S. law allowing public access to government documents.

Enforcement Action: Legal measures taken by regulators against individuals or companies for violations.

Transparency: The principle of open and accessible information in governance and regulation.