The race to incorporate digital assets into retirement savings has escalated as Coinbase and OKX Australia pension crypto products gain traction. With Australia’s superannuation system worth more than $2.8 trillion, both exchanges are focusing on the expanding number of self-managed superannuation funds (SMSFs).

This step is changing the way Australians see cryptocurrency, not only as a speculative asset, but as part of long-term financial planning.

SMSFs and Crypto Adoption

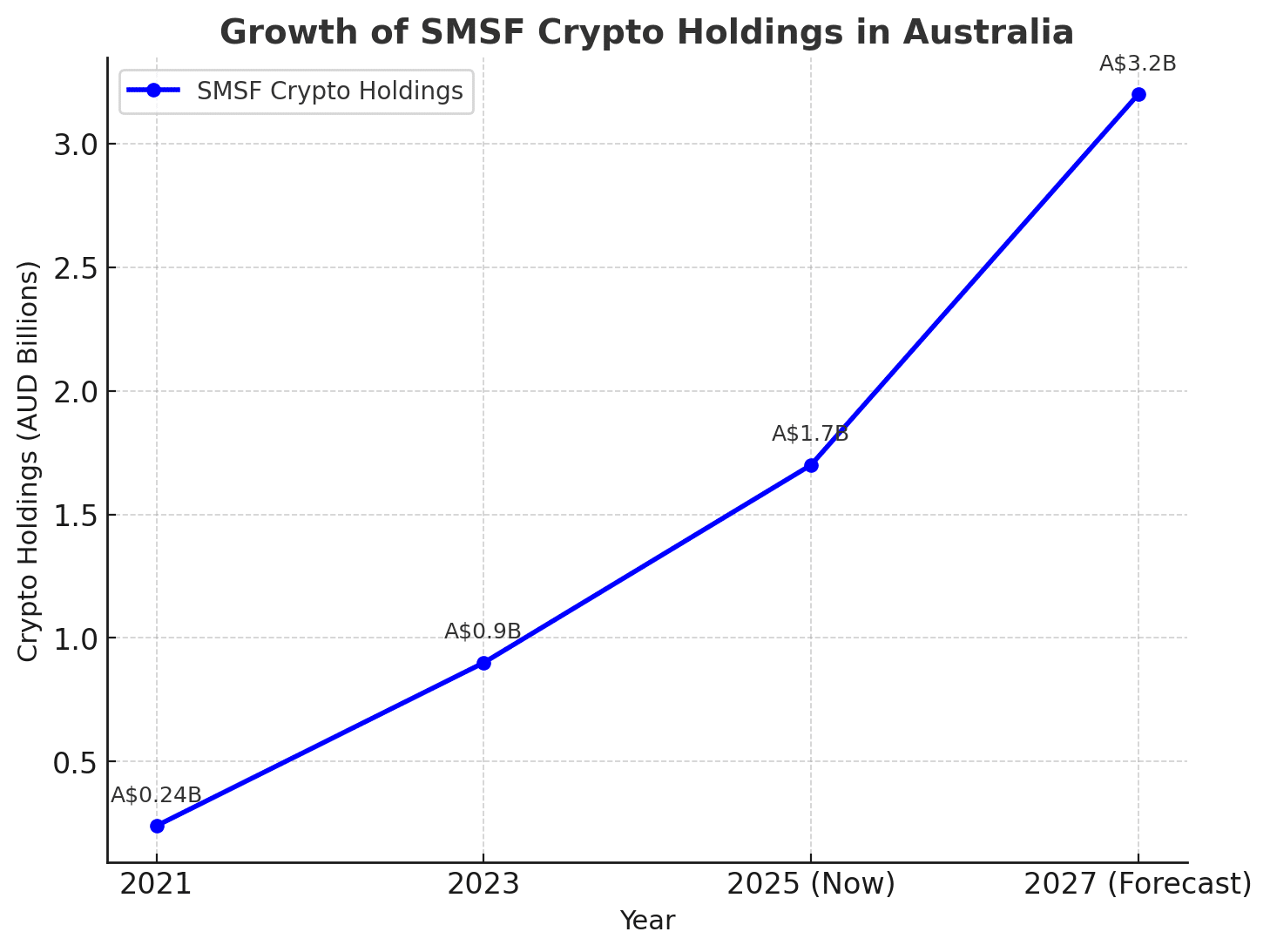

Self-managed superannuation funds (SMSFs) are a common structure in Australia, providing people direct management over their retirement investments. By 2021, SMSF crypto exposure was minimal, but within four years, it had increased sevenfold to A$1.7 billion. This increase indicates the growing demand for alternative investments in the pension sector.

Jane Hume, a Treasury official, previously stated: “Australians are known for their willingness to experiment with new financial technologies, but we must balance innovation with the responsibility of retirement security.” Her sentiments are now echoed as SMSFs take the lead in incorporating cryptocurrency into conventional finance.

Why SMSFs are the entry point

Coinbase and OKX Australia pension crypto products are geared for SMSFs, and they provide references to accountants, legal experts, and custody solutions. Exchanges make it easier to manage cryptocurrency within regulated retirement plans by including compliance and security in their services.

Bloomberg has reported that SMSFs account for approximately 25% of Australia’s total pension assets. This gives them the ideal entry point for digital asset producers. Fabian Bussoletti of the SMSF Association stated, “We are perhaps a bit more interested in cryptocurrency in the self-managed super fund industry first. The need is undeniably there.”

Institutional Momentum

Coinbase stated that over 500 investors are currently on the waiting list, with the majority wanting to spend up to A$100,000 apiece. OKX is also developing custody and regulatory frameworks to attract long-term savings rather than short-term trading.

A policy paper from Australia’s Securities and Investments Commission (ASIC) warned that “crypto remains a volatile asset class. While diversity is appropriate, trustees must keep retirement portfolios balanced. This official caution highlights the contradiction between fast adoption and regulatory supervision.

At the same time, demand from younger Australians is increasing. Many new SMSFs invest 4-10% of their portfolios to cryptocurrency, demonstrating trust in digital assets as an inflation hedge and diversification tool.

Predictions

If acceptance continues, economists predict that SMSF crypto holdings will treble by 2027, topping A$3 billion. The Coinbase and OKX Australia pension crypto products may not only strengthen crypto’s position in retirement planning, but also cause traditional pension funds to reassess their attitude. AMP is the only major superannuation provider with direct crypto exposure, but competition may compel others to follow suit.

Conclusion

The debut of Coinbase and OKX Australia pension crypto products marks a watershed moment for the $2.8 trillion superannuation system. Exchanges that cater to SMSFs get access to a valuable source of investor control and flexibility.

With increased demand, wary regulators, and traditional institutions keeping a close eye, cryptocurrency is no longer on the outside of retirement planning; it is quickly becoming an integral part of Australia’s financial future.

Glossary

SMSF (Self-Managed Superannuation Fund): A private pension fund controlled by individual trustees.

Custody: Secure storage of digital assets by a regulated entity.

ASIC: Australia’s Securities and Investments Commission, the main financial regulator.

Diversification: Spreading investments across different assets to reduce risk.

Volatility: The degree of variation in asset prices over time.

Inflation Hedge: An asset used to protect against rising consumer prices.

FAQs

1. What are Coinbase and OKX Australia pension crypto products?

Specialized services for self-managed superannuation funds, offering compliance, custody, and crypto investment options.

2. How much crypto do Australian SMSFs currently hold?

As of March 2025, SMSFs held around A$1.7 billion in crypto, a sevenfold increase since 2021.

3. Are regulators supportive of crypto in pensions?

ASIC has expressed caution, noting volatility risks, but has not banned SMSF allocations into crypto.

4. What is the potential long-term impact?

Analysts believe SMSF adoption could push crypto holdings beyond A$3 billion by 2027 and pressure traditional funds to adopt similar products.