This article was first published on Deythere.

- How the Coinbase Solana On-Chain Trading Works

- What Changes for Users?

- User Experience: Keeping Up the Status Quo While Decentralizing

- Conclusion

- Glossary

- Frequently Asked Questions About Coinbase Solana On-chain Trading Feature

- What is the Coinbase on-chain trading feature for Solana?

- When was this feature announced?

- Does that affect the way staking tokens are being listed on Coinbase?

- Can users continue to interact with the app’s Coinbase user interface?

- References

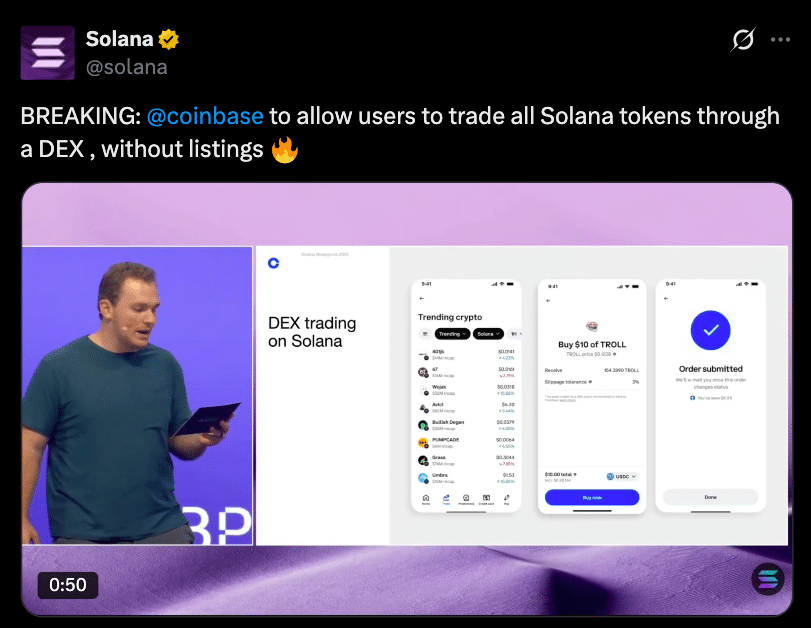

Coinbase has finally debuted the long-awaited Solana on-chain trading feature, an integration that brings Solana-powered trading to millions of users who can now trade virtually any Solana token right from the app without traditional listings.

Announced at the Solana Breakpoint event in Abu Dhabi, this new feature works by routing the trades through on-chain Solana liquidity pools, and allows for real time execution and the use of the same user-friendly Coinbase interface that traders are used to.

How the Coinbase Solana On-Chain Trading Works

Coinbase’s new Solana on-chain trading provides the ability to trade Solana tokens directly on the native Solana blockchain with order execution, routing and slippage management conducted entirely within the blockchain despite users interacting through Coinbase’s front-end experience.

Once a Solana token has established enough liquidity on the blockchain, it is automatically trade-able within the app as opposed to having to go through a more formal vetting or listing process typical of centralized exchanges, explained Coinbase product specialist Andrew Allen at Solana Breakpoint.

The backend directly accesses DEX liquidity on Solana, so users provide swaps with USDC, fiat balances, bank transfers or debit cards.

What Changes for Users?

Before the announcement, users traded assets that went through a listing process and were officially in compliance with the exchange teams at Coinbase.

That bottleneck has been eliminated with on-chain exchange trading via Coinbase for SPL tokens (Solana Program Library assets), and it’s available as soon as assets exist on the Solana chain with on-chain liquidity available.

As one industry overview explained, every Solana token will be instantly available to trade by 100 million users on Coinbase.

This enables users to have a trading experience that juxtaposes the user-friendly app of Coinbase with Solana’s lightning-quick, low-cost blockchain rails.

Liquidity is being drawn directly out of Solana’s DEX pools, trading occurs on blockchain infrastructure as opposed to centralized order books.

User Experience: Keeping Up the Status Quo While Decentralizing

Despite the innovative backend switch, Coinbase has ensured the Solana on-chain trading experience remains familiar for existing traders.

On the same dashboard, users can see their portfolio alongside the ability to make trades instantly with a single click.

Sabs Sachdeva, a software engineer at Coinbase, said that;

“On the surface it looks the same as existing centralized trading, but on the backend all functions operate on-chain.”

This combination of simplicity and lack of centralization is intended to reduce the barriers to on-chain markets, enabling anyone with limited DeFi experience to access Solana’s deep liquidity ecosystem with no need for additional wallets or interfaces.

Conclusion

The integration of Coinbase into the Solana ecosystem brings global access to Solana tokens outside of typical listing paths and empowers millions of users to tap directly into on-chain liquidity through a trustworthy interface.

By being able to send trades directly to the blockchain and maintaining the Coinbase experience users are accustomed to, this feature is a new era in trading that combines the ease of use of centralized exchanges with the transparency and visibility that can only be delivered by decentralized protocols.

Glossary

Solana (SOL): A high-performance blockchain that makes it easy to build and deploy decentralized applications (dApps) and create cryptocurrencies.

On-chain: An activity performed on the blockchain instead of using off-chain agents.

DEX (Decentralized Exchange): Direct trading market of cryptocurrencies with no intermediary holding money.

SPL Token: A generic token format for the Solana blockchain, equivalent to ERC-20 on Ethereum.

Liquidity: The depth of token supply available on exchanges that don’t severely impact price when users buy and sell tokens.

Frequently Asked Questions About Coinbase Solana On-chain Trading Feature

What is the Coinbase on-chain trading feature for Solana?

It is an integration that would let Coinbase users directly trade Solana tokens via on-chain liquidity pools with their Coinbase accounts, circumventing standard token listings.

When was this feature announced?

Coinbase announced the integration at the Solana Breakpoint conference in Abu Dhabi on Dec. 11, 2025.

Does that affect the way staking tokens are being listed on Coinbase?

Yes. Instead of needing specific listings, Solana tokens are tradable as soon as they exist with enough on-chain liquidity.

Can users continue to interact with the app’s Coinbase user interface?

Yes. The interface is familiar, but order execution and routing are conducted on the Solana blockchain under the hood.

References

BanklessTimes

COIN360

MEXC

Coinpedia Fintech News

coinspeaker

CryptoRank