Coinbase has opened a new chapter in crypto lending with the launch of ETH-backed Loans on its Base network. The exchange lets verified United States customers borrow up to 1 million dollars in USDC against Ethereum without selling their coins. ETH-backed Loans arrive as on-chain credit volumes surge and Ethereum trades through a volatile, sentiment-driven phase.

A New Liquidity Rail For Ethereum Holders

The idea behind ETH-backed Loans is simple as instead of selling ETH to raise cash, users deposit wrapped Ether as collateral and receive USDC that can fund trading, bills, or business plans. Because the service runs on Base, an Ethereum layer 2, transactions settle quickly and at low cost, so the experience feels closer to a margin line at a brokerage account than to a complex DeFi interface.

Under the surface, the product connects to the Morpho lending protocol, while Coinbase provides the front end and handles identity and compliance checks. Loans use a loan-to-value ratio of up to about 75 percent, with liquidations if the collateral value falls toward predefined triggers. The structure gives borrowers room for normal volatility, but it still demands active risk management and respect for downside risk.

From Bitcoin Credit To A Multi Asset Strategy

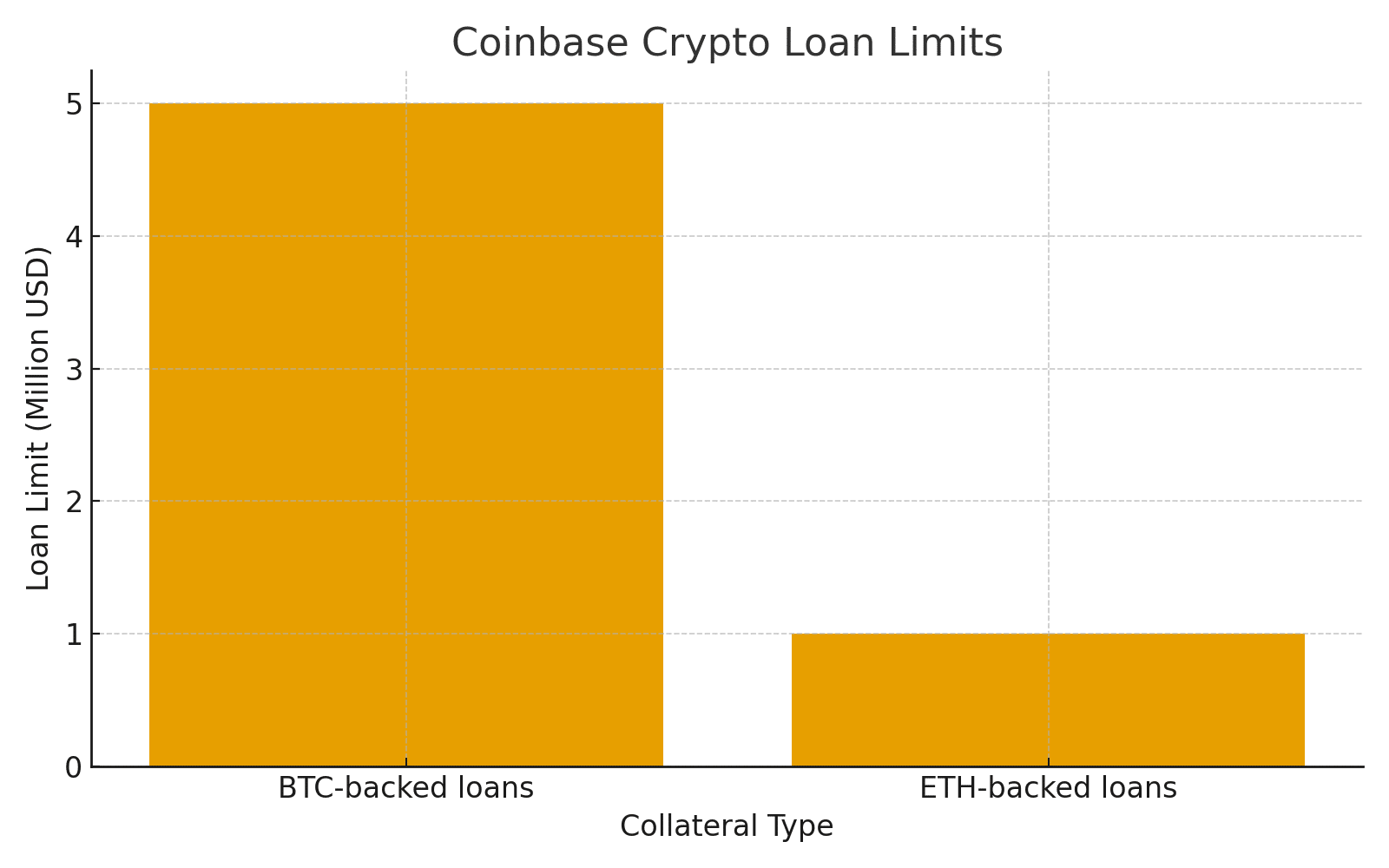

Earlier in the year, the company relaunched crypto collateral lending with a product backed by Bitcoin. That line has already crossed 1 billion dollars in originations and now offers limits of up to 5 million dollars. ETH-backed Loans now sit beside that product on the same Base rails, which shows that onchain credit is becoming part of the core strategy for the platform rather than a side experiment.

This pairing of BTC and ETH-backed Loans reflects a wider shift in portfolio construction. High net worth clients can treat leading crypto assets more like securities that support a credit line, while active traders gain a familiar leverage tool that plugs directly into their existing accounts.

Why ETH-backed Loans Matter For Ethereum

For the Ethereum ecosystem, the arrival of ETH-backed Loans touches several key indicators. A rising share of ETH is locked in staking and DeFi, which already reduces liquid supply on exchanges. When long term holders move coins into this credit line instead of selling them outright, short term sell pressure can ease at the margin and order books can absorb shocks with less strain.

The growth of on-chain credit is another important signal. Crypto collateral loans have expanded into the tens of billions of dollars, with non-custodial protocols responsible for a large share of activity. By routing its service through Base and a public lending protocol, Coinbase aligns with that shift instead of competing against it with opaque balance sheet lending.

Risks And Responsible Use

The promise of this structure does not erase risk. Crypto markets can still swing sharply in short windows, and borrowers can face forced liquidation when that happens. Careful users watch loan to value ratios, test downside scenarios, and avoid stacking excessive leverage. For many participants, the safest approach is to treat this facility as a temporary source of liquidity instead of a permanent lifestyle subsidy tied to rising prices.

Conclusion

The launch of ETH-backed Loans on Base marks an important step in the evolution of crypto credit. On-chain lending has moved from niche DeFi experiments into products that live inside large, regulated exchanges. For Ethereum holders, ETH-backed Loans offer a way to stay invested while putting capital to work. For the wider market, they show how collateral, credit, and settlement can share the same transparent rails and gradually reshape the structure of digital finance.

Frequently Asked Questions

What are ETH-backed Loans on Base?

ETH-backed Loans on Base are collateralised products that let users lock Ether and receive stablecoins while retaining price exposure.

Who can use the new lending service?

The service focuses on eligible customers in supported United States jurisdictions, with regional limits set by compliance rules.

Do these loans change Ethereum sell pressure?

They can reduce immediate sell pressure by offering liquidity without spot sales, although borrowers still face liquidation if prices fall sharply.

Glossary

Collateral

Assets that a borrower posts to secure a loan, which may be sold if risk thresholds are breached.

Liquidation

The automated closing of a position when the value of collateral falls below required levels.

Layer 2

A scalability system that processes transactions off the main chain and then settles them back for lower fees and faster confirmation.