This article was first published on Deythere.

- Instant Wallet Creation Changes Developer Speed

- Three Core Features Define On-Chain Autonomy

- From Human Speed to Machine-Speed Markets

- Coinbase’s Billion-Agent Vision Comes Into Focus

- Conclusion

- Glossary of Key Terms

- FAQs About Agentic Wallets

- How fast can Agentic Wallets be created?

- Do agents need custom transaction coding each time?

- Why is the billion-agent goal important?

- Are AI transactions secure on Base?

- References

Agentic Wallets are moving from concept to reality as artificial intelligence gains direct access to blockchain finance. The innovation allows software to hold identity, manage funds, and execute value transfers without human approval. Such capability hints at a financial system where intelligent code operates beside people as an independent economic force rather than a passive tool.

According to the source, Coinbase introduced this infrastructure through its developer platform, giving autonomous agents secure wallets, programmable limits, and gas-free execution on the Base network. The design ensures uninterrupted AI transactions while creating a standard framework for the growing overlap between artificial intelligence and on-chain finance.

Instant Wallet Creation Changes Developer Speed

A defining feature of Agentic Wallets is how quickly they can be deployed. Developers can generate full wallet functionality for AI agents within minutes using the command-line tool npx awal, removing the slow setup that once limited automation. Coinbase also introduced dedicated developer portals to standardize how autonomous software connects to blockchain financial services.

This rapid deployment matters because friction often blocks innovation. When infrastructure becomes simple, experimentation expands. Easier onboarding allows more builders to test AI transactions across trading, services, and decentralized coordination. Over time, convenience often shapes adoption as much as technology itself.

Three Core Features Define On-Chain Autonomy

The architecture of Agentic Wallets rests on three precise pillars: programmable spending policies, non-custodial identity, and safe permissioned execution. Spending rules allow creators to define strict transaction limits. Non-custodial identity records each agent directly on the blockchain. Safe permissioned execution ensures transactions occur only within approved boundaries.

Together, these controls allow agents to fund wallets and execute payments without developers crafting a custom transaction each time. This operational shift transforms automation from fragile scripting into dependable financial behavior.

Industry analysis has long argued that programmable value exchange could unlock continuous digital commerce once identity and payments merge onchain (source). Agentic Wallets now provide working infrastructure for that vision.

From Human Speed to Machine-Speed Markets

Autonomous software already analyzes data and triggers trading signals. Direct financial control expands that role into execution. Agentic Wallets allow agents to rebalance portfolios, pay for compute resources, or participate in decentralized organizations independently. Each action increases the scale of AI transactions happening without manual approval.

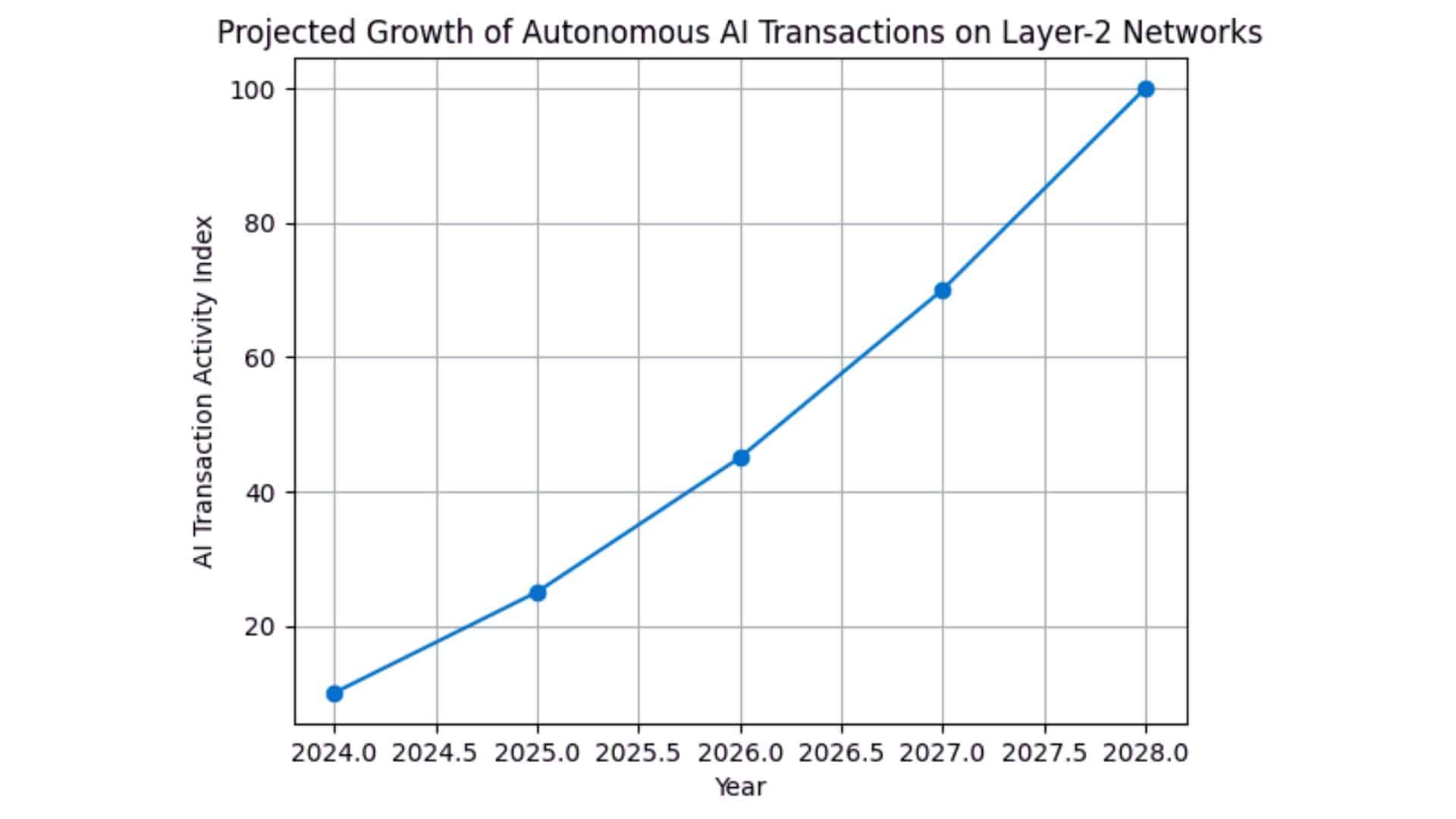

Blockchain analytics show rising automated activity across scalable networks, with transaction growth increasingly linked to programmed behavior rather than human clicks (data). If momentum continues, machine-driven payments and micro-services could form a meaningful share of on-chain volume. Such trends suggest a gradual shift toward continuous, real-time economic coordination.

Coinbase’s Billion-Agent Vision Comes Into Focus

Beyond technical design, the strategy behind Agentic Wallets reveals long-term ambition. Coinbase positions Base as a foundation for onboarding a billion users or even a billion autonomous agents onchain. Native commerce between agents and humans represents a major step toward that scale.

Security remains central to reaching this goal. Programmable caps, transparent ownership, and permissioned execution aim to balance openness with protection. Trust will likely decide how quickly institutions and developers adopt AI transactions powered by autonomous wallets.

Conclusion

The emergence of Agentic Wallets signals more than a product launch. It marks the early structure of an economy where software can safely hold value and move it with purpose. By enabling secure AI transactions, instant deployment, and rule-based autonomy, Coinbase is helping shift finance toward machine-speed coordination.

The lasting question is not whether autonomous agents will participate in markets, but how society will guide a system where code increasingly shares economic power.

Glossary of Key Terms

Agentic Wallets: Blockchain wallets that allow autonomous AI agents to control funds using programmable rules and on-chain identity.

AI transactions: Financial transfers executed automatically by artificial intelligence without manual approval.

Safe permissioned execution: Security framework ensuring transactions occur only within predefined authorized conditions.

Layer-2 network: Scalable blockchain infrastructure designed for faster and lower-cost transaction processing.

FAQs About Agentic Wallets

How fast can Agentic Wallets be created?

Developers can deploy them within minutes using the npx awal command-line tool.

Do agents need custom transaction coding each time?

No. Wallet funding and execution occur automatically within preset programmable rules.

Why is the billion-agent goal important?

It reflects a future where autonomous software becomes a major participant in digital economic activity.

Are AI transactions secure on Base?

Security relies on spending limits, non-custodial identity, and safe permissioned execution controls.