This article was first published on Deythere.

- Coinbase 2026 Framing and Positioning

- S&P 500 Inclusion and What It Means

- Acquisitions and the Build-Out of a Full-Stack Platform

- Market Access, Listings and Retail Reach

- The Base Platform

- Conclusion: The Road into 2026

- Glossary

- Frequently Asked Questions About Coinbase 2026

- Did Coinbase announce a fresh regulatory license in 2026?

- Is Coinbase exiting the exchange business?

- Are there forward-looking financial projections in the statement?

- References

2026 is being targeted as the year of evolving corporate identity for Coinbase, beyond the narrow view as a cryptocurrency exchange toward what it describes as a global market operator.

Making the announcement public recently on X, Coinbase is saying that their achievements in 2025 are evidence that it already functions in retail, institutional, and on-chain financial planes.

Although no new product or regulatory approval is announced in the message. Instead, it makes a cumulative argument that the company’s reach, its infrastructure and its place in the market have grown to match those of a full-stack financial platform rather than just another trading venue.

Coinbase 2026 Framing and Positioning

For Coinbase, 2026 would be a year of continuity, not a clean start. The firm presents the year as a logical extension of what was achieved in 2025, while focusing on execution, infrastructure and market access rather than making promises about what may happen in the future. The language is transformed through the accumulation of capabilities, not a sudden lurch.

The company itself describes its evolution from being “a crypto exchange to a global market operator”; words that hint at the larger responsibilities of market creation, access, custody and settlement.

Importantly, the statement does not assert regulatory parity with respect to traditional international exchanges or clearinghouses. Rather, it places Coinbase as serving in all the layers of crypto market structure at once: retail access, institutional trading, custody, and on-chain participation.

This framing tells regulators, investors and users how Coinbase 2026 would like to be perceived as having evolved, not just a platform for trading one asset, but an integrated financial marketplace.

S&P 500 Inclusion and What It Means

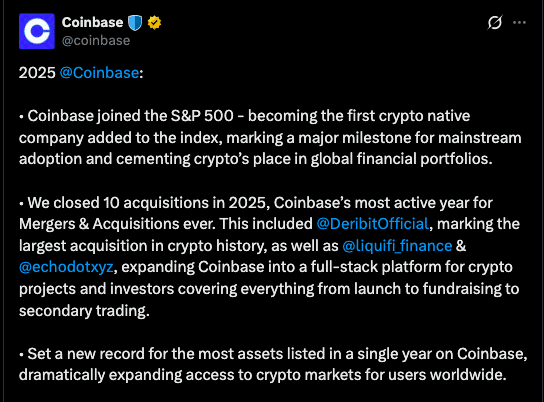

One of the clearest achievements that Coinbase names is its S&P inclusion in 2025. The index addition made Coinbase the first crypto-native firm on the board, the company said.

From a market structure standpoint, S&P 500 inclusion increases the shareholder base for Coinbase to include passive index funds and institutional portfolios that track the index by mandate.

This changes Coinbase’s investor profile, and embeds the company further within traditional capital markets. This is seen as groundwork for the company’s next chapter.

Acquisitions and the Build-Out of a Full-Stack Platform

Coinbase said with ten acquisitions completed, 2025 was its most active year yet for mergers and acquisitions. The deals, the company says, added capacity to manage its presence throughout the crypto lifecycle, from asset launch and fundraising through to secondary trading.

“We closed 10 acquisitions in 2025, Coinbase’s most active year for Mergers & Acquisitions ever … expanding Coinbase into a full-stack platform for crypto projects and investors covering everything from launch to fundraising to secondary trading.”

The point here is not the quantity of acquisitions but the logic that Coinbase pins to them. The company explicitly describes these offerings as taking it closer to the goal of being a full-stack platform for crypto projects and investors.

This indicates that Coinbase is no longer just looks to facilitate trades but also offer infrastructure for both creating and distributing assets at various stages.

Coinbase does not disclose timeframes, revenue breakdowns or performance metrics associated with these deals.

Market Access, Listings and Retail Reach

Coinbase also stated that it set a record in 2025 for the number of assets listed in a single year and that it had expanded global market access as a result.

The announcement also mentions the debut of token sales on Coinbase, which is said to reimagine a way to help bring regulated early access to new digital assets back to retail.

This model gives preference to smaller buyers, has issuers lockups, and opens U.S. access.

Adding to that, Coinbase Institutional launched a 24/7 CFTC-regulated futures trading and U.S. perpetual-style cryptocurrency futures, enabled futures and spot cross-margin trading, and now serves as crypto’s largest custodian with $300 billion in assets under custody.

The Base Platform

The announcement further pointed to the worldwide rollout of the Base App, an “everything app” for social, trading, and payments, according to Coinbase.

This is an effort to integrate on-chain activity with consumer-facing applications.

This complements Coinbase’s story that it’s constructing a coherent platform across institutional, retail, and on-chain environments.

Conclusion: The Road into 2026

According to Coinbase, 2025 was the year of execution and infrastructure build-out and 2026 is described as the year that those efforts come together in a single, integrated platform.

The company’s closing language emphasizes scale, access, and consolidation rather than disruption or novelty.

There’s one thing for certain, Coinbase has grown across listings, acquisitions, institutional services, custody, and consumer applications.

What remains to be seen is how these elements will work together in a marketplace with changing regulations and strategy.

The company’s message, in the end, is about positioning, presenting itself as an operator of markets rather than just a participant in them.

Glossary

Global marketplace: A platform that offers the custody, infrastructure, access and trading across a variety of market layers not just one function.

Assets under custody: The combined value of clients assets held by a custodian on behalf of customers.

Cross-Margin: A system where margin is shared across multiple positions to manage risk more efficiently.

Token sales: Formalized opportunities to purchase digital assets (access rights) in accordance with specific terms and conditions.

Frequently Asked Questions About Coinbase 2026

Did Coinbase announce a fresh regulatory license in 2026?

No. The announcement doesn’t say anything about new regulatory approvals.

Is Coinbase exiting the exchange business?

No. Coinbase is positioning the change more as a move beyond exchange-only operations than away from them.

Are there forward-looking financial projections in the statement?

No. There are no income estimates, price predictions or performance forecasts.