This article was first published on Deythere.

- CME’s Expansion into Altcoin Futures

- Institutional Implications of the Launch

- What This Means For Cardano, Chainlink and Stellar

- Market Situation Around the Launch

- Conclusion

- Glossary

- Frequently Asked Questions About CME Altcoin Futures Launch

- What is the CME altcoin futures launch?

- Why is CME listing altcoin futures?

- What are the sizes of contracts that will be available?

- Will these futures have immediate impact on prices?

- How do futures improve the participation of institutional?

- References

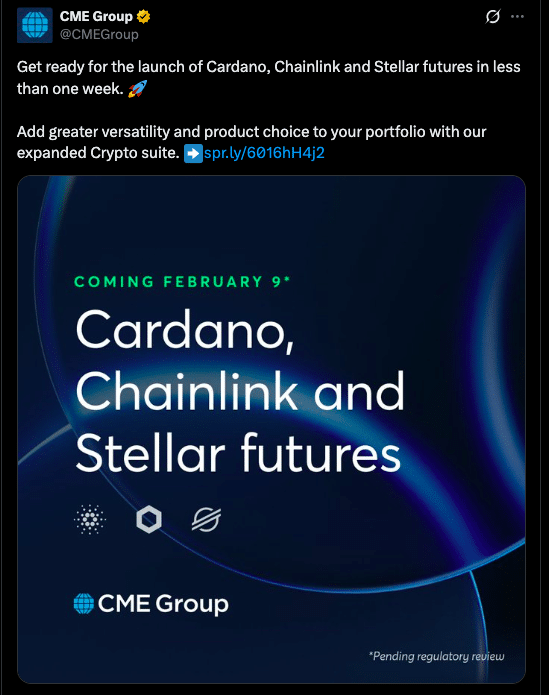

The Chicago Mercantile Exchange (CME Group), is set to begin trading for futures for Cardano (ADA), Chainlink (LINK), and Stellar (XLM). The CME altcoin futures launch will go live on February 9th, 2026.

The contracts, build on the exchange’s already existing cryptocurrency derivatives offering, including standard and micro futures aimed at institutional and retail traders respectively.

CME’s Expansion into Altcoin Futures

CME Group announced on January 15, 2026, that it will expand its suite of regulated cryptocurrency derivative products to include Cardano, Chainlink, and Stellar futures, pending final regulatory review by the U.S. Commodity Futures Trading Commission (CFTC).

This extends beyond their previous offerings that covered Bitcoin, Ether, XRP and Solana futures.

According to the proposed system, two contract sizes will be assigned to each asset. Cardano futures will feature 100,000 ADA for standard contracts and 10,000 ADA for micro versions.

Chainlink futures will consist of 5,000 LINK for the larger contracts and 250 LINK for micro futures. Stellar futures will be based on 250,000 XLM for Standard contracts and 12,500 XLM for Micro contracts.

These set-ups allow a wider range of market participants from large funds to active individuals, to access regulated trading.

CME global head of cryptocurrency products, Giovanni Vicioso, said the new offerings provide “greater choice with greater flexibility and more capital efficiencies” for industry participants who want to gain regulated exposure and manage risk.

Institutional Implications of the Launch

The CME altcoin futures launch is not a mere product upgrade, but widely seen as a signal that institutions have started engaging in digital assets beyond the popular chains.

Futures have been more in line with professional markets for decades by giving market participants tools to hedge against price risk, enable better price discovery and make trades without needing to own the basic asset.

Regulated futures could also draw in institutional money that is blocked from trading on the crypto exchanges directly. Through the trading and clearing of these products on the CME Globex electronic trading platform and clearing them via CME ClearPort, the exchange aligns altcoin derivatives with established market infrastructure used by traditional futures markets.

What This Means For Cardano, Chainlink and Stellar

The introduction of regulated futures for Cardano, Chainlink and Stellar provides exposure and legitimacy to these networks in traditional finance.

For Cardano, the futures contracts become new hedging tools that can facilitate institutional investment strategies based on ADA price exposure. This happens as the Cardano ecosystem continues its ongoing enhancement such as the integration of USDCx stablecoin on its blockchain platform, designed to enable liquidity and DeFi activity on its network.

Chainlink could leverage from greater institutional usage of its ecosystem, especially as its oracle infrastructure is widely adopted across DeFi and tokenized markets. Futures markets can provide professional traders the ability to manage risk associated with LINK’s changing price in addition to being used by a wide range of market participants looking to hedge positions in LINK.

Stellar, which focuses on payment and transfer protocols, benefits from futures listing by creating further connections to traditional derivatives markets.

While Stellar’s price dynamics have been influenced by broader crypto market volatility, regulated futures contracts could provide clearer risk management and exposure tools for professionals looking to add XLM in their portfolios; especially so when considering rising institutional demand for tokenized assets and cross-border liquidity solutions.

Market Situation Around the Launch

In the past, the market’s response to regulated futures listing has been mixed at best and price action has often been muted or even downwards in the short term. For example, when Solana’s CME futures launched in March 2025, they saw notional trading volume of roughly $12 million, while the price continued to trade sideways below $130 as sentiment remained battered.

Likewise, XRP’s CME futures debut in May 2025 achieved around $19 million of notional volume, yet the price of XRP then fell.

These are few early samples which show that futures listings could increase access to institutional investors but don’t guarantee the bullish price reaction.

That pattern may extend with the CME altcoin futures launch for ADA, LINK and XLM. The prices of these assets have been weak in early 2026, due to a general risk-off tone across crypto markets.

However, regulated futures could play a role in attracting liquidity and decreasing trading friction as institutional participation increases.

Conclusion

The launch of the CME altcoin futures on February 9, 2026 would be an integration between digital assets and regulated financial markets.

CME Group is responding to the institutional demand for regulated exposure, hedging tools and risk management with the addition of Cardano, Chainlink and Stellar to its crypto derivatives offerings.

Now, with the availability of both full and mini contracts, these markets are available to a large section of traders. History has it that this product launches may not necessarily lead to immediate price hikes, but they increase the infrastructure on which professional traders and settlement depend.

Glossary

CME altcoin futures launch: refers to the scheduled introduction of regulated futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar (XLM) on the CME Group exchange, set for February 9, 2026.

Futures contract is a standardized contract between two parties to buy or sell an asset at a certain time in the future at a specific price, commonly used for both hedging and speculation.

Micro contract: a smaller futures contract intended to allow exposure for traders who have smaller capital available than what would be used for the standard contract type.

Regulated derivatives: financial products traded on exchanges that are subject to regulatory supervision and offer transparency and risk management features for institutional investors.

Frequently Asked Questions About CME Altcoin Futures Launch

What is the CME altcoin futures launch?

It is the planned listing of options on regulated futures contracts for Cardano (ADA), Chainlink (LINK) and Stellar (XLM) for trading on February 9, 2026, after all relevant regulatory review periods.

Why is CME listing altcoin futures?

This will make it easier for a range of regulated firms to get involved in the digital asset market as these institutions and smaller traders hedge risk on price movements or stand to benefit from one.

What are the sizes of contracts that will be available?

Cardano futures will include standard contracts of 100,000 ADA and micro contracts for 10,000 ADA. Chainlink futures products will offer 5,000 LINK and 250 LINK micro contracts. Stellar futures will be provided with 250,000 XLM and12,500 XLM micro contracts.

Will these futures have immediate impact on prices?

Futures listings have usually created mixed short-term impacts. Altcoins launched by CME in the past had low trading volumes and neutral prices of the actual coins.

How do futures improve the participation of institutional?

Futures offer a regulated way for managing price risk and exposure, attracting institutional traders that prefer regulated derivatives over unregulated crypto exchanges.

References

CME Group

CoinCentral

AMBCrypto

nasdaq