Senate momentum and the CLARITY Act

After weeks of drift, senators have reopened bipartisan talks on a market-structure package widely referenced as the CLARITY Act. The revival centers on getting a committee markup on the calendar, a practical test of whether the deal has real votes or just hopeful talk. In recent briefings, the chair overseeing commodities policy said the panel intends to finish its section and move “very, very soon,” signaling the most concrete progress in months.

A spokesperson for the banking panel confirmed that negotiations are active again and described the chair as “encouraged” by the return to the table. That on-the-record signal matters because it shows senior lawmakers are willing to wear the process in public rather than keep it in the shadows. As one aide put it,

“Mr. Scott is encouraged that bipartisan negotiations on market structure have resumed, and he looks forward to working with his colleagues to advance meaningful legislation.”

What Sparked the Revival

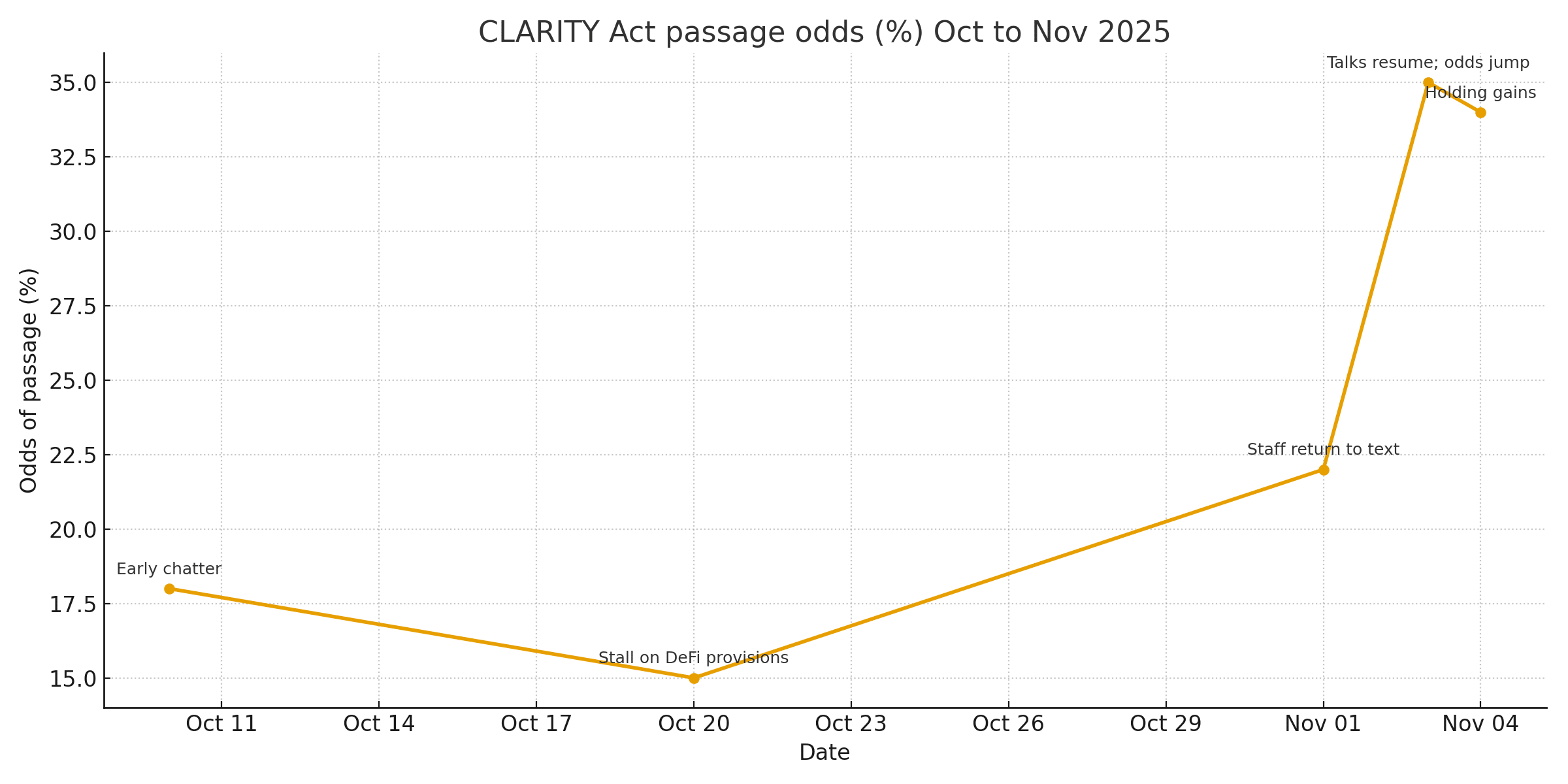

The CLARITY Act moniker has become shorthand for a wider push to give digital assets predictable rules across spot markets, supervision, and enforcement. The new effort follows a pause triggered by a leaked approach to decentralized finance that spooked negotiators and hardened opposition. After industry leaders engaged, talks restarted, and staff returned to bill text instead of press statements. If the committee can mark up the package, the CLARITY Act path would shift from rumor to scoreboard.

CLARITY Act Odds Jump to 35%

Prediction markets moved fast. Odds of passage this year jumped from roughly 15 percent to about 35 percent after news of the restart, an unusually sharp repricing that reflects how starved the space is for legislative traction. Those odds are not destiny, but they do tell readers that informed speculators see a viable window. The CLARITY Act narrative now has both a political track and a market signal to watch.

What the CLARITY Act Could Change

What would the CLARITY Act actually change for day-to-day crypto users and builders? First, it would sketch clearer lines between commodities and securities so projects know which rulebook applies. Second, it would give agencies firmer mandates over spot markets so surveillance, custody, and disclosures are not guesswork. Third, it would plant definitions in statute, which courts can apply without reading tea leaves. In short, the CLARITY Act aims to swap ambiguity for instructions.

Investors have already priced in the possibility of cleaner guardrails. When odds rose, sentiment improved even as macro headwinds lingered. This is the practical effect of policy clarity: capital becomes a little less shy, builders plan multi-quarter roadmaps, and liquidity does not vanish at the first sign of turbulence. With the CLARITY Act back in motion, desks are watching the committee calendar like it is earnings day.

Political Challenges Ahead

None of this guarantees a smooth landing. The CLARITY Act must survive markup, a floor vote, and a conference process that can sand down key provisions. Election-season timing adds friction, and any fresh dispute over decentralized finance could stall momentum. Even so, the current window is the best one in months, and staff from both parties know it.

Direct signals from principals help. One chair told reporters the panel will “finalize our part of the bill and release a bipartisan proposal very, very soon” and added that the goal is to complete the work this year. That is a measurable promise that committees can meet or miss, which is exactly the accountability markets wanted. The CLARITY Act is now a live test of legislative will, not just a headline.

Conclusion

The Senate is back at the table, prediction markets have noticed, and the CLARITY Act has a credible lane if lawmakers hold to the markup plan. The next few weeks will show whether crypto policy finally gets a rulebook that matches the scale of the industry or slips back into limbo. Either way, the clock is running.

FAQs

Is the bill already law?

No. It must clear committee, pass the Senate, reconcile with the House, and then be signed.

Why did odds jump to 35 percent?

Prediction markets repriced after signs of renewed bipartisan talks and a possible markup.

Glossary of Key Terms

Markup

A committee session where lawmakers debate and amend a bill before a vote.

Prediction Market

A market where participants trade contracts on future events, creating real-time probability signals.

Market Structure

The legal and operational framework that governs how assets trade, settle, and are supervised.