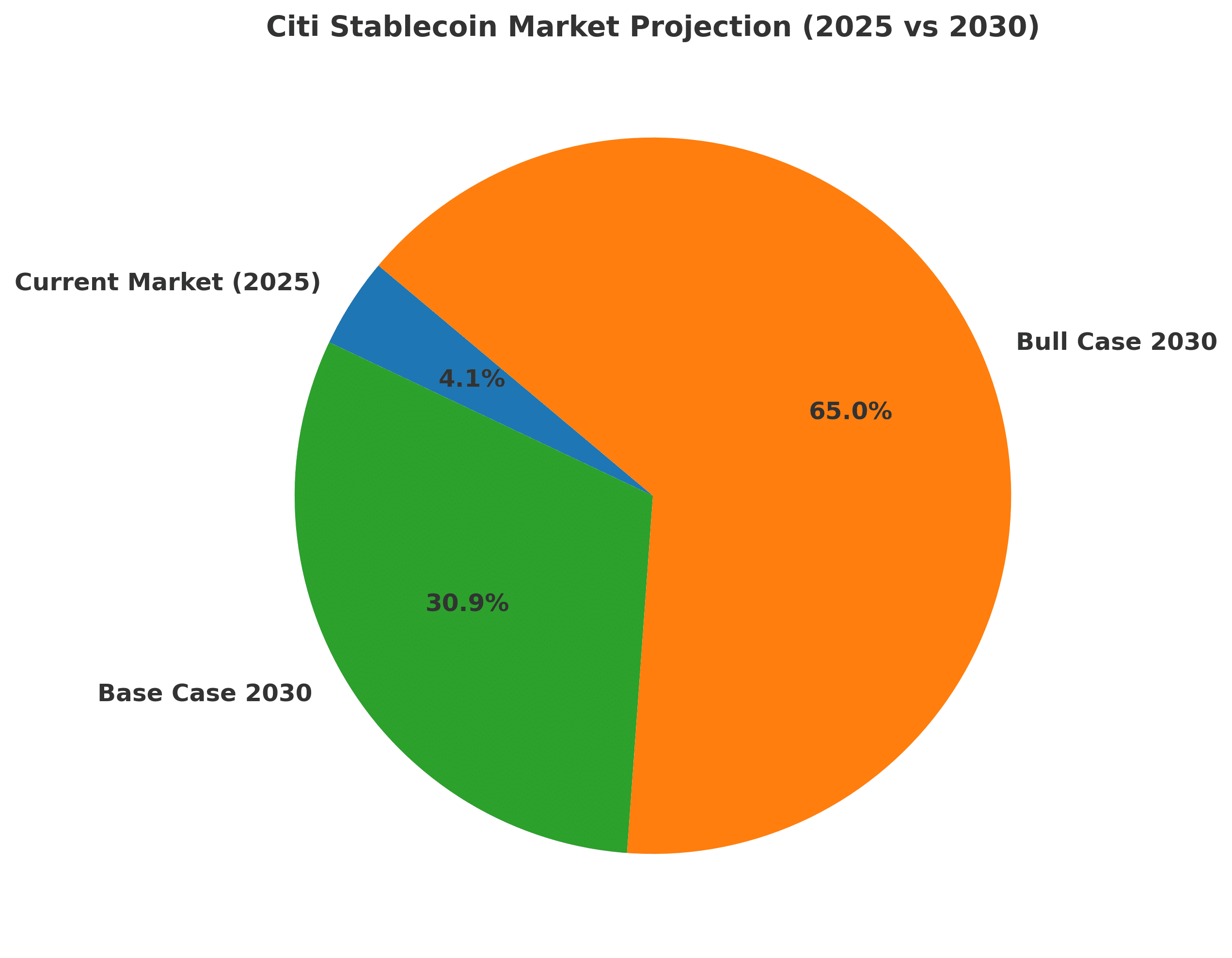

Every few months, a fresh prediction grabs the crypto crowd’s attention. This week, it came from Citi, which raised its stablecoin outlook to a staggering $1.9 trillion by 2030.

If things go exceptionally well, the bank sees a bull run pushing issuance closer to $4 trillion. That’s no small number, it’s the size of entire economies folded into a single slice of the digital asset market.

The update signals more than optimism. It reflects the growing belief that stablecoins may become the rails for both crypto-native transactions and traditional finance. But as with most forecasts, there’s a catch.

Why Citi Stablecoin Numbers Are Surging

Citi’s research leans heavily on recent momentum. Stablecoin issuance already grew nearly 40% in the past year, showing that demand is no longer niche. Policy is also tilting in their favor. Frameworks like MiCA in Europe and new U.S. legislation have built a clearer rulebook for issuers.

Stephen Cunningham, who heads digital asset strategy at Citi, remarked, “We’re seeing the beginnings of a structural shift. The pace of adoption suggests this is more than just speculative noise”.

In other words, the Citi stablecoin forecast is not based on hype alone; it’s pinned to regulation, infrastructure, and usage.

The Institutional Gap No One Can Ignore

Still, a wide gap lies between vision and reality. A senior executive from Visa recently quipped that stablecoin maturity for institutions is “maybe half a point out of ten.” That blunt honesty reminds us that banks and corporates are still dipping toes rather than diving in.

Citi’s own report acknowledges that deposit tokens, digital assets issued by banks themselves, could end up stealing the show. These tokens might enjoy smoother regulatory approval and more trust from conservative institutions, leaving independent stablecoins competing for attention.

Market Buzz and Reactions

The reaction across trading circles was mixed. Some hailed the Citi stablecoin forecast as proof that digital assets are inching into the mainstream. Others rolled their eyes at the $4 trillion bull case, suggesting it will take more than rosy charts to get there.

On X, one analyst wrote, “$1.9T is bold but feasible. $4T? That’s moon talk unless corporates and governments use them daily”. It’s the kind of skepticism that gives balance to the discussion, showing that not everyone is buying into the trillion-dollar dreams.

Meanwhile, rival banks have trimmed their stablecoin expectations. JPMorgan, for instance, halved its earlier forecasts over the summer, warning that adoption curves may flatten if regulation moves too slowly.

What Traders and Builders Should Take Away

For everyday traders, the Citi stablecoin story points to one thing: more liquidity could be on the horizon. If issuance scales into the trillions, stablecoins will be harder to ignore, offering smoother entry and exit points for digital assets.

For developers and startups, the challenge is bigger. Moving from $250 billion in supply today to multi-trillion levels requires more than regulatory green lights.

It demands trust, transparency, and infrastructure that can handle global settlement speeds. Without those, even the most ambitious Citi stablecoin target will look like wishful thinking.

Conclusion

The Citi stablecoin forecast has added fresh fuel to a debate that refuses to fade. On one side, there’s the promise of trillions in circulation and stablecoins powering everyday finance. On the other, the reality check: adoption remains shallow, and bank tokens might crowd the lane.

Whether $1.9 trillion is destiny or daydream, one truth stands out. Stablecoins are no longer fringe experiments. They’re becoming the quiet backbone of digital money, and Citi’s call only accelerates that conversation.

FAQs about Citi’s stablecoin prediction

Q1: What is Citi’s stablecoin projection for 2030?

Citi expects $1.9 trillion in stablecoins, with a bullish scenario hitting $4 trillion.

Q2: What factors support this growth?

Rising issuance, regulatory clarity, and increasing demand in payments and DeFi.

Q3: What risks could slow adoption?

Institutional caution, regulatory hurdles, and competition from deposit tokens.

Q4: How would this affect crypto markets?

A surge in stablecoins would increase liquidity and speed up mainstream use.

Glossary

Stablecoin: A cryptocurrency pegged to a stable reserve like the U.S. dollar.

Tokenization: Turning traditional assets into digital tokens on a blockchain.

Deposit Token: A bank-issued digital currency tied directly to deposits.

Liquidity: The ease of buying or selling an asset without major price impact.

MiCA: European Union regulation for crypto assets, offering legal clarity.

DeFi: Decentralized finance applications running without intermediaries.