Cardano founder Charles Hoskinson has recently dropped an $ADA Outperform Bitcoin prediction, saying $ADA could go to $80 or $800, 100× to 1000× if it becomes the DeFi yield layer of Bitcoin.

“ADA can do 100x, or 1000x. We’re not second class citizens. Cardano does more, and it will be the yield layer of Bitcoin DeFi,” he told Blockworks.

He further noted that the team once held 108,000 BTC (worth around $15 billion at today’s prices), but $ADA’s market cap reached $30 billion; outperforming Bitcoin two-to-one over the same timeframe.

Price Action, On-chain Metrics, and Momentum Signals

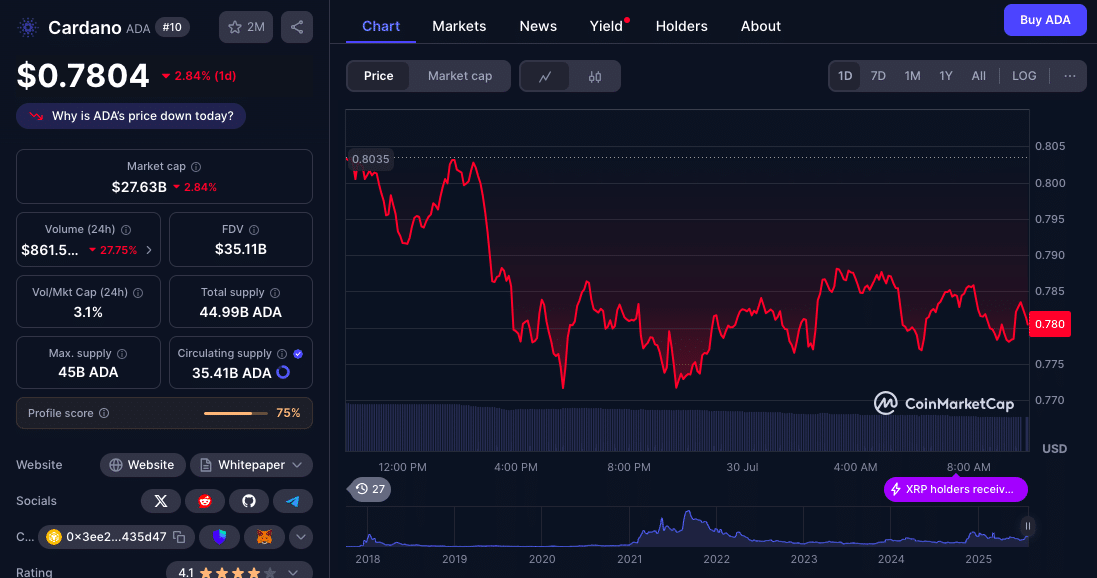

$ADA underperformed BTC for most of H1 2025, but reversed in June and rallied 30% more than Bitcoin. Still, on a longer term, $ADA is 88% down relative to BTC since 2021. On-chain data shows $2.33 million in net exchange outflows, indicating whale accumulation and reduced sell pressure.

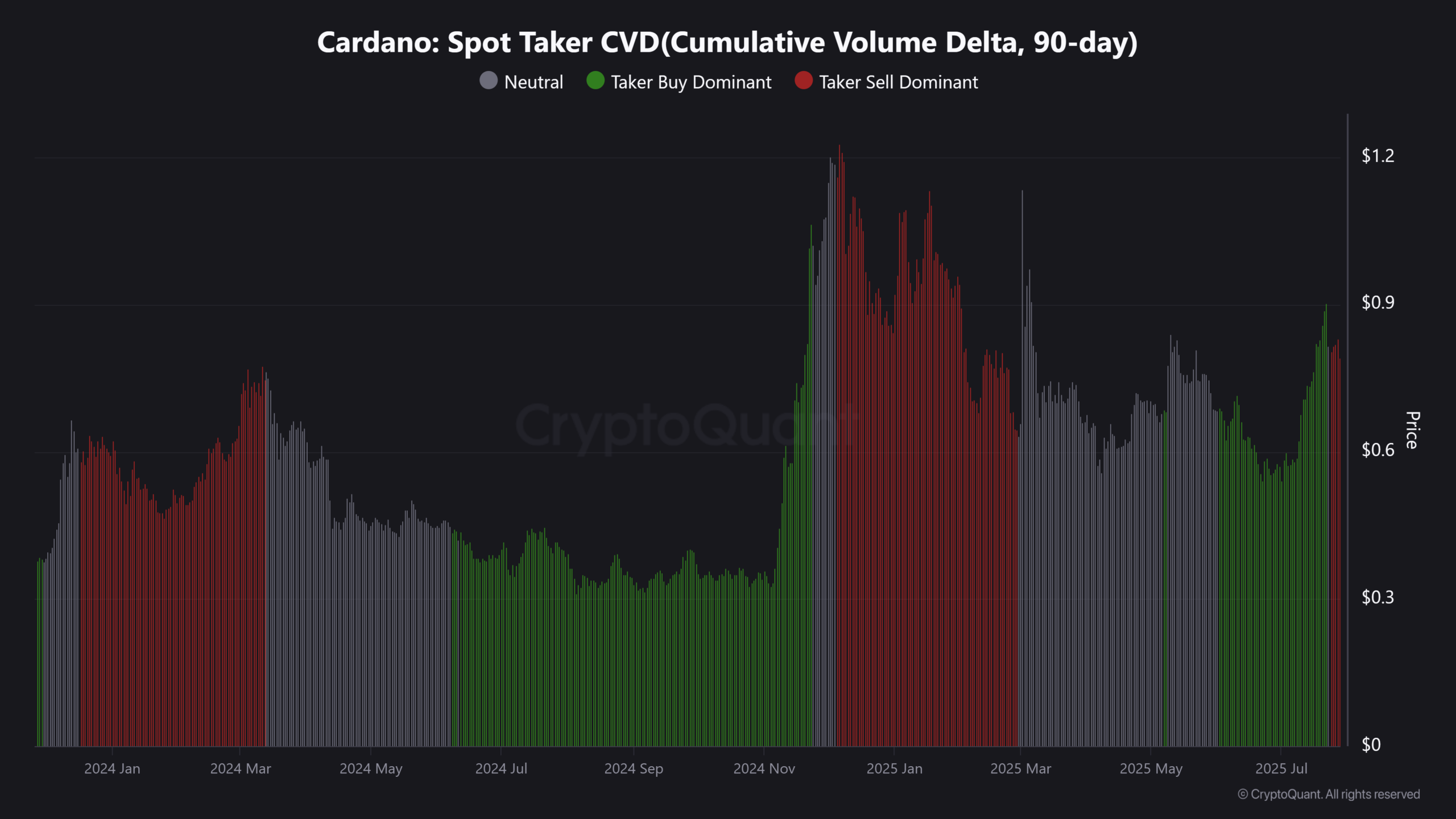

Realized cap has gone up from $23.4 billion to $23.6 billion, showing investor conviction. But Cumulative Volume Delta (CVD) is negative, indicating short-term selling.

$ADA is near a confluent resistance around $0.780-$0.80, where support could lead to a move to $1 or $1.15, and a break below the 200-day SMA could be bearish.

$ADA Price Prediction Scenarios

| Scenario | Price Range Estimate | Key Drivers |

| Bull Case | $80 – $800 | Successful Bitcoin–Cardano DeFi integration, strong ecosystem yield, institutional adoption, and explosive liquidity inflows. |

| Neutral Case | $1 – $1.15 | Gradual utility build-up, stable capital inflows, moderate market sentiment, resistance holding. |

| Bear Case | Below $0.80 | Failed integration, persistent negative CVD, loss of investor confidence, and breakdown of technical support. |

What Would $ADA Need to Outperform Bitcoin?

For the $ADA to outperform Bitcoin prediction to happen, Cardano needs to build the infrastructure for $ADA to be a yield-earning bridge within Bitcoin’s DeFi layer. That means secure cross-chain bridges, staking incentives within $BTC ecosystems, and widespread developer adoption.

While $ADA’s realized cap growth shows longevity of holdings, tangible roadmap execution is speculative, especially without confirmed partnerships or functional Bitcoin-Cardano interoperability.

Risks That Could Derail the Upside

Hoskinson’s prediction requires proper execution. Integration failures or delayed tech rollout could keep $ADA range-bound. As net selling pressure continues and resistance tightens at $0.80-$0.90, bearish narratives could gain traction.

A break below key levels would increase downside risk. The $ADA community’s ability to rally around shared goals such as ecosystem liquidity, staking yield, and Bitcoin connection will determine if this vision will come to light.

Conclusion

Based on the latest research, Charles Hoskinson’s $ADA outperforms Bitcoin prediction is one of the boldest in crypto. If $ADA can really become a yield-layer for Bitcoin DeFi with real utility and institutional interest, $80–$800 targets may be achievable.

But without foundational integration and broad market adoption, $ADA may stay in its current range or decline. Investors are advised to weigh on-chain conviction and realized cap growth against technical barriers and execution risk.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

Hoskinson’s prediction that ADA might reach $80 or $800 is based on Cardano becoming Bitcoin’s DeFi yield utility. Recent on-chain data shows growing conviction and short-term accumulation, realized cap growth and whale buying, but ADA is capped by resistance, negative volume delta signals and lack of Bitcoin-Cardano interoperability.

FAQs

What does “$ADA outperform Bitcoin prediction” mean?

Hoskinson says $ADA will outperform Bitcoin up to 100× or 1000× if Cardano becomes a yield-bearing layer for Bitcoin DeFi.

Why $80–$800?

That’s the range of massive valuation multiples driven by ecosystem yield, token rewards and institutional capital inflows if Cardano can serve Bitcoin-based DeFi.

What does rising realized cap mean?

It means fresh investment is entering the asset over time, even in sideways or weak price action; a sign of long-term conviction.

Why is negative CVD a concern?

It means short-term selling is greater than buying, which can suppress rallies and trap prices near overhead resistance zones.

Glossary

Cumulative Volume Delta (CVD) – Net aggressive buying vs selling volume.

Realized Cap – Total value of ADA based on last transfer price.

200‑day SMA – Long-term trend indicator; below or above means shift in sentiment.

Bitcoin DeFi yield layer – A theoretical system where Cardano is the yield infrastructure for the broader Bitcoin ecosystem.