This article was first published on Deythere.

- Institutions Flows Show Decoupling From Top Tokens

- Total Value Secured Emphasizes Network Adoption

- The Role of Chainlink in Global Stablecoin Infrastructure

- Conclusion

- Glossary

- Frequently Asked Questions About Chainlink Institutional Interest

- Why is Chainlink being adopted by institutions?

- What does TVS mean for Chainlink?

- How does Chainlink’s ETF compare with other assets?

- How does Chainlink fit into stablecoin ecosystems?

- Does Chainlink only exist for DeFi?

- References

Recent trends data have shown that while assets such as Bitcoin and Ethereum saw net outflows from exchange-traded products (ETPs), Chainlink ETFs continued to take in funds.

Apart from the ETF flows, Chainlink ecosystem growth, such as its inclusion in global stablecoin projects and large amounts of Total Value Secured (TVS) metrics, shows that it might just be moving away from short-term trading and toward infrastructure confidence in the long run.

Institutions Flows Show Decoupling From Top Tokens

Investment patterns among institutions in crypto have varied in recent weeks. Products tied to Bitcoin and Ethereum saw large outflows over a week of recent period, pointing to overall hesitation among institutional allocators.

Meanwhile, Chainlink’s Grayscale LINK ETF (GLNK) has seen inflows of about $4 million, compared to larger outflows from Ethereum ETF products.

This difference is also further seen when compared to other asset classes. For instance, though Dogecoin has a market cap much larger than Chainlink, it didn’t draw anything near the same level of ETF inflows in the period, meaning that capital flows into Chainlink do not appear to be mere short-term price action but rather could be an overall confidence about its infrastructure role.

Total Value Secured Emphasizes Network Adoption

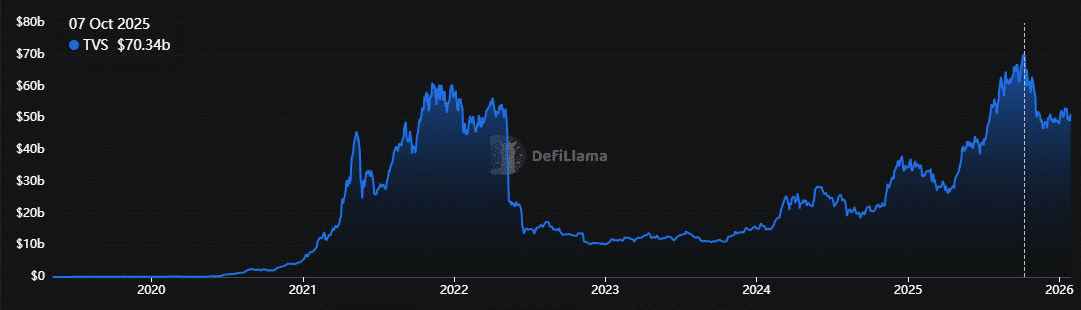

The Total Value Secured (TVS), an index that assesses the notional amount of assets supported by a data feed and oracle systems in a decentralized network, hit all-time highs towards the end of 2025, for Chainlink.

In Q4 2025, Chainlink’s TVS reached around $70 billion, showing the scale of assets using its oracle services in lending, stablecoins, real-world asset tokenization and other DeFi use cases.

This TVS number is commonly regarded as a good measure of adoption, since it represents the real economic value shielded by the oracle feed. A high TVS indicates that a large number of DeFi protocols and other smart contract systems such as stablecoins and lending platforms, rely on Chainlink for reliable, secure data. It shows that the network’s influence goes beyond just price feeds, but cuts across blockchains and use cases.

The focus on TVS also explains why some institutional investors are looking beyond mere token price action. The measure points to actual usage, integration into financial primitives and trust by developers who are building mission critical applications. In finance, infrastructure which supports flows of value can attract attention irrespective of short term volatility.

The Role of Chainlink in Global Stablecoin Infrastructure

Institutional interest in Chainlink also intersects with developments around regulated stablecoin infrastructure. Chainlink Labs recently joined the Global Alliance for KRW Stablecoins (GAKS), a WEMADE-led consortium consisting of compliance, security, and fintech partners designed to create a compliant ecosystem specifically around Korean won-pegged stablecoins.

The deployment of Chainlink into GAKS will add a leading oracle provider to the initiative, boosting technological functionalities centered on data integrity, cross-chain linkages, and pricing veracity, all of which are characteristics required for stablecoin systems in regulated operations.

Alliance members, including Chainalysis, CertiK, and Sentbe, provide additional capabilities around compliance and security, whereas Chainlink offers core data feeds and oracle frameworks enabling on-chain validation and settlement logic.

GAKS partners like WEMADE pointed out that Chainlink’s participation in this collaboration is an achievement in terms of technical excellence and stablecoin operation trust.

Conclusion

Chainlink’s recent performance on institutional-based metrics shows that of confidence based on infrastructure.

Although major assets such as Bitcoin and Ethereum have experienced varied flows from institutions, LINK’s ETFs have been raking up the capital.

The network’s large TVS numbers, roughly $70 billion locked, speaks of wide adoption across decentralized applications, and its involvement in global stablecoin efforts like the GAKS alliance points to the growing role of the project in regulated digital finance.

As institutional demand for Chainlink does not appear to be slowing down, this will likely result in the evolution of Chainink’s place within the DeFi ecosystem as well as throughout cryptocurrency at large.

Glossary

Total Value Secured (TVS): measure of the aggregate value of digital assets that rely on a network’s oracle services or infrastructure for data and execution. High TVS suggests strong integration and trust by developers and protocols.

ETF inflows: net capital inflows into ETFs.

Global Alliance for KRW Stablecoins (GAKS): a WEMADE-led, multi-party initiative to establish a compliant infrastructure for Korean won

Frequently Asked Questions About Chainlink Institutional Interest

Why is Chainlink being adopted by institutions?

The network’s oracle services support vital DeFi and stablecoin infrastructure, from blockchains to banking, demonstrating use rather than mere speculative interest

What does TVS mean for Chainlink?

TVS stands for Total Value Secured, which is the amount of economic value that relies on Chainlink’s oracle network. A high TVS means DeFi and finance protocols are well integrated and trusted.

How does Chainlink’s ETF compare with other assets?

While larger assets saw net outflows in some ETF products, Chainlink’s LINK ETF maintained positive inflows.

How does Chainlink fit into stablecoin ecosystems?

Chainlink provides data feeds, price oracles, and interoperability solutions that facilitate the provision of accurate pricing in stablecoin systems, ensuring operational soundness, such as within KRW-pegged stablecoin infrastructure, through partnerships like GAKS.

Does Chainlink only exist for DeFi?

No. Chainlink’s infrastructure design extends into everyday use cases for blockchain technology, such as regulated stablecoin systems and cross-chain interoperability, along with compliant data feeds for enterprise, financial, and many other types of applications.