This article was first published on Deythere.

- How xStocks Work: Tokenizing Real-World Equities on Solana

- Chainlink Gatekeeper: Trustful Prices and Real-time Data from Data Streams

- Implications for Users, Traders and DeFi Ecosystem

- Conclusion

- Glossary

- Frequently Asked Questions About Chainlink + Solana Tokenized Equities

- What can one expect to find on Solana xStocks?

- Are xStocks actually supported by physical shares?

- How does Chainlink fit into this system?

- Can one use xStocks in DeFi to borrow or lend?

- Is this available worldwide?

- References

Real-world equities such as META, TSLA, NVDA, and GOOGL have all become tradable on-chain as tokenized shares, facilitated by Chainlink’s data infrastructure and delivered on Solana with xStocks.

This integration changes the game for equities in terms of access and utility. Now, instead of brokerage firms, individuals anywhere can easily trade tokens that represent a fraction of a share in companies onchain, with instant settlement, 24/7 trading, and composability with other DeFi projects.

How xStocks Work: Tokenizing Real-World Equities on Solana

The heart of this innovation is xStocks, a system released in the middle of 2025 that maps real-world U.S. stocks and ETFs into on-chain tokens on Solana.

Official xStocks review shows that all xStock tokens are 1 1 asset-backed by real shares, which are held with a regulated custodian.

From the moment of its issue, these tokens operate exactly the same as any SPL (Solana Program Library) token. They can be traded, held and used as collateral or supplied to liquidity.

This system allows for near 24/7, instant trading and eliminates traditional broker constraints.

Already as of August 2025, xStocks had scaled to deliver nearly $500M of on-chain trading volume for over 60 tokenized stocks and ETFs.

With the bringing of equities onchain, xStocks introduces opportunities for fractional ownership, global accessibility, composable utility in decentralized finance (DeFi) applications like lending and liquidity provision, and instant settlement which connects Wall Street assets to blockchain-native infrastructure

Chainlink Gatekeeper: Trustful Prices and Real-time Data from Data Streams

A system as audacious as xStocks demands strong, live and unmanipulable data. That’s where Chainlink comes in.

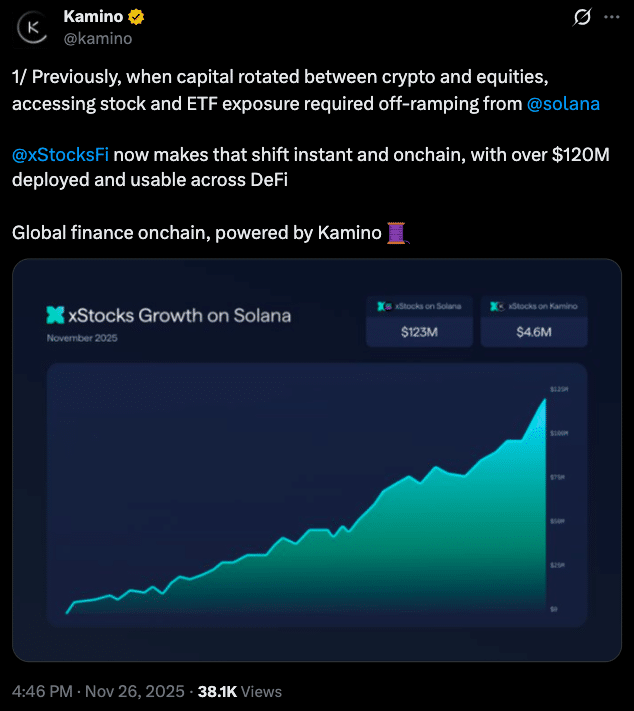

In July 2025, Kamino Finance, a leading DeFi protocol on Solana said they were integrating Chainlink Data Streams to support xStocks collateralized positions and trading operations.

On-chain xStocks are continually synchronized with their real-world equivalents via Chainlink’s on-chain-based price feeds and corporate action data (e.g., dividends, splits).

As one release explains it, the combination allows for reliable, high-accuracy, sub-second price latency, providing further ability to verify corporate actions in near real time.

Chainlink is the dominant oracle in DeFi, dominating about 63-70% of total value locked, consensus says.

Their infrastructure not only feeds crypto prices, but increasingly also a variety of real-world asset (RWA) use cases ranging from tokenized stocks and ETFs to institutional-grade on-chain funds or compliance frameworks.

Chainlink is effectively the data spine that allows tokenized equities to work reliably onchain, a vital component of the TradFi–DeFi bridge.

Implications for Users, Traders and DeFi Ecosystem

The introduction of tokenized equities on Solana, facilitated by Chainlink, is certainly a game-changer

U.S. equities are now available for investors anywhere (barring certain geographies) without needing a broker account, painful KYC or the same old market hours. A wallet creates a pathway to shares of companies such as Apple, Tesla, Nvidia or Meta.

As xStocks are standard tokens, they can be put into a lending protocol as collateral, or put in AMMs to provide liquidity and so on, enabling DeFi-like strategies with traditional assets.

For example, Kamino already permits borrowing stablecoins against xStocks like NVDAx or TSLAx.

Onchain tokens settle immediately and can be transferred almost anywhere in the world in seconds, eliminating traditional settlement delays and frictions. This increases liquidity and cuts down on overhead in cross-border investment.

With Chainlink providing verifiable data and secure proof-of-reserve and custody standards, tokenized equities merge the regulatory discipline of TradFi with the programmability and transparency of blockchain.

This could substantially reduce the barrier to entry into the stock market, particularly for those in regions with little access to international brokers, and democratize access to global equities via DeFi.

Conclusion

The release of tokenized equities on Solana, backed by Chainlink’s data-stream infrastructure, is a new era for U.S. stocks and ETFs in on-chain finance.

Using xStocks, investors from anywhere in the world can instantly, composablely and transparently trade, borrow or lend stocks.

This combination of TradFi assets and DeFi rails may change the way money moves globally, making equity exposure more accessible, programmable and borderless.

Chainlink serves as the cornerstone of this evolution, weaves together oracle trust, audit nodes and mass protocol usage.

As liquidity deepens, integrations proliferate and tokenized equities on Solana could very well become a noteworthy on-chain asset class.

Glossary

xStocks: A set of tokenized real-life equities (stocks/ETFs) on Solana represented as an SPL token backed 1:1 with actual shares held in custody.

SPL token: A Solana blockchain standard token (like ERC-20 on Ethereum); xStocks is built according to this standard, to allow transaction execution, transfer, lending and Defi deployment.

Oracle / Price Feed: A service that provides off-chain retrieval of data (e.g., the price of a stock), so that smart contracts can use real-world values as inputs or conditions. xStocks is integrated with the oracle solution Chainlink.

Tokenized equities (or Real World Assets): Legacy financial assets (stocks, bonds and ETFs) as blockchain tokens, marrying the best of both worlds: traditional finance’s valuation principles with blockchain’s accessibility/efficiency.

Collateral in DeFi: Leveraging a tokenized asset (like xStocks) for borrowing funds or stablecoins on a blockchain protocol (on Kamino).

Frequently Asked Questions About Chainlink + Solana Tokenized Equities

What can one expect to find on Solana xStocks?

xStocks board features top U.S.-listed stocks and ETFs, including such as META (Meta Platforms), TSLA (Tesla), NVDA (Nvidia) and GOOGL (Alphabet) along with over 60 other tokenized assets in total.

Are xStocks actually supported by physical shares?

Yes. Representing equity ownership, xStocks are fully collateralized on a 1:1 basis, where each token represents an actual share held in custody by regulated custodians.

How does Chainlink fit into this system?

Ensuring constant and accurate pricing, Chainlink powers an end-to-end, tamper-proof market data delivery mechanism (Data Stream), as well as a proof-of-reserves solution that guarantees xStocks remain based on assets they represent.

Can one use xStocks in DeFi to borrow or lend?

Yes. Similar to Kamino, protocols like xIM also enable the use of xStocks as collateral for borrowing stablecoins and power lending, swapping, and other DeFi processes.

Is this available worldwide?

xStocks targets is for worldwide accessibility (with the exception of a couple of banned regions). They’re also being sold on Solana, so they can be purchased with a compatible wallet and no traditional brokerage middleman or time constraints.