The CFTC crypto guidance withdrawal marks an important shift in U.S. regulations for digital assets. It provides cryptocurrency exchanges with greater freedom to manage transactions and offer services like margin and leverage.

- What Does the CFTC Crypto Guidance Withdrawal Mean?

- Why Was the Guidance Withdrawn?

- How Will Exchanges and Traders Be Affected?

- How the Withdrawal Fits Into the Push for Modern Digital-Asset Oversight?

- How Are Experts Reacting?

- Conclusion

- Glossary

- Frequently Asked Questions About CFTC Crypto Guidance Withdrawal

Experts say this move reflects a more supportive and market-friendly approach by U.S. authorities. Traders and analysts view it as a significant step toward modernizing rules while maintaining proper oversight and protecting market participants.

What Does the CFTC Crypto Guidance Withdrawal Mean?

The CFTC crypto guidance withdrawal is the agency’s decision to take back its advisory on how cryptocurrencies are considered delivered in retail commodity transactions. Originally issued in March 2020, the guidance explained the rules for when a crypto transaction should be considered actually delivered.

This determination played an important role in deciding whether exchanges could provide margin or leverage products to their clients. Acting Chairman Caroline Pham stated that the advisory had become outdated and no longer accurately reflected the current conditions and realities of the market.

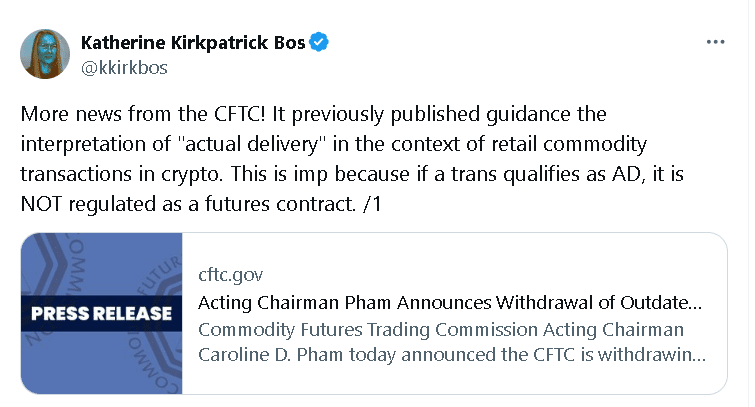

Katherine Kirkpatrick Bos, general counsel at StarkWare, explained that the withdrawal provides much more flexibility for exchanges, as the previous guidance made it more difficult to offer margin unless actual delivery happened within 28 days.

Why Was the Guidance Withdrawn?

The CFTC said the guidance had become outdated and too complicated, and this could penalize the crypto sector and slow innovation. Pham explained that removing it through the CFTC crypto guidance withdrawal fits with the administration’s plan to modernize rules while keeping proper oversight in place and supporting healthy market growth.

The CFTC crypto guidance withdrawal also followed recommendations from the President’s Working Group on Digital Asset Markets, which urged the agency to clarify how cryptocurrencies should be treated as commodities and to review the rules that define actual delivery.

How Will Exchanges and Traders Be Affected?

With the CFTC crypto guidance withdrawal, exchanges now have more freedom to design their products and offer leverage without being restricted by strict delivery deadlines.

Even so, questions remain because there is no clear definition of what counts as actual delivery anymore. Todd Phillips from the Roosevelt Institute noted that both exchanges and traders will likely need to wait for the CFTC to issue new guidance before they can know exactly who must register and what the rules will require.

How the Withdrawal Fits Into the Push for Modern Digital-Asset Oversight?

The CFTC crypto guidance withdrawal aligns with a broader shift toward updating digital-asset rules to match how today’s markets actually operate. By removing an outdated framework, the agency is signaling that it wants regulations that can evolve with new technology rather than restrict it.

This approach supports clearer oversight while giving the industry more room to grow, fitting into ongoing efforts to modernize how digital assets are supervised in the U.S.

How Are Experts Reacting?

Industry observers see the CFTC crypto guidance withdrawal as a move toward regulation that can grow with the market and function more effectively. Garry Krugljakow, head of Bitcoin strategy at aifinyo AG, said in an X post that the decision points to clearer authority for the CFTC and a regulatory path built for expansion rather than hesitation.

He explained that actual delivery may have made sense in 2020, but it is far less relevant today because custody, collateral systems, and Bitcoin-backed credit have advanced significantly. Analysts believe this shift will help support a more modern and scalable regulatory environment.

Conclusion

The CFTC crypto guidance withdrawal removes older rules that no longer fit today’s market and gives exchanges more freedom in how they operate. Even though there is still some short-term uncertainty about what counts as actual delivery, many see this change as a positive move toward clearer and more innovation-friendly regulation.

It also shows that the CFTC is trying to update its approach based on how the market has evolved over the last five years, while still aiming to protect traders. Overall, the decision supports the continued growth of the U.S. digital asset markets.

Glossary

CFTC: U.S. agency regulating commodity and crypto markets.

Margin Trading: Trading with borrowed funds to increase position size.

Collateralization: Using crypto as security for loans or leveraged trades.

Custody: Safely storing and protecting cryptocurrencies.

Actual Delivery Rule: Rule requiring crypto to be delivered within 28 days for margin trading.

Frequently Asked Questions About CFTC Crypto Guidance Withdrawal

Why did the CFTC withdraw the 2020 guidance?

The guidance was outdated, too complicated, and slowed innovation, so the CFTC withdrew it to modernize the rules.

What was the 2020 “actual delivery” rule?

It required crypto to be fully delivered within 28 days for exchanges to offer margin or leverage products.

How does this withdrawal affect exchanges?

Exchanges now have more flexibility to offer margin and leverage products without being limited by strict delivery deadlines.

How does this withdrawal affect traders?

Traders can access services like margin trading more easily, but some rules remain unclear until new guidance is issued.

Who announced the withdrawal?

Acting Chairman Caroline Pham announced it and explained that the guidance no longer reflected current market realities.