Cardano (ADA) is roaring back into the spotlight after staging a sharp 13% rebound in late May 2025, climbing from $0.71 to over $0.85 in just a week. This renewed bullish momentum is stirring hopes of a breakout above the long-standing $1 psychological barrier, a level ADA hasn’t convincingly held since early 2022.

- Cardano Price Surge Backed by Whale Confidence

- Price Table: ADA Performance Over the Past Week

- Technical Signals Favor the Bulls

- What’s Fueling the Breakout?

- Near-Term and Long-Term Price Forecasts

- Conclusion

- FAQs

- Why is ADA approaching the $1 level important?

- How significant is whale accumulation?

- What role does Hydra play in ADA’s future?

- Glossary

Driven by whale accumulation, improving market sentiment, and a technically bullish structure, ADA’s performance now mirrors a broader altcoin recovery, coming on the heels of Bitcoin’s consolidation above $105,000.

Cardano Price Surge Backed by Whale Confidence

Data from Santiment shows over 80 million ADA were purchased by whale wallets in a 48-hour window this week — signaling institutional and high-net-worth investors are betting big on Cardano’s next move.

This accumulation coincides with ADA reclaiming key technical levels, pushing past its 20-day and 50-day moving averages and now challenging the 100-day SMA around $0.799. Analysts believe this momentum could accelerate if ADA clears resistance in the $0.85–$0.90 zone, paving the way for a potential test of $1.

“Whale accumulation before a breakout is usually the quietest, and smartest, phase of a bull move,” tweeted crypto analyst @LunaQuant.

Price Table: ADA Performance Over the Past Week

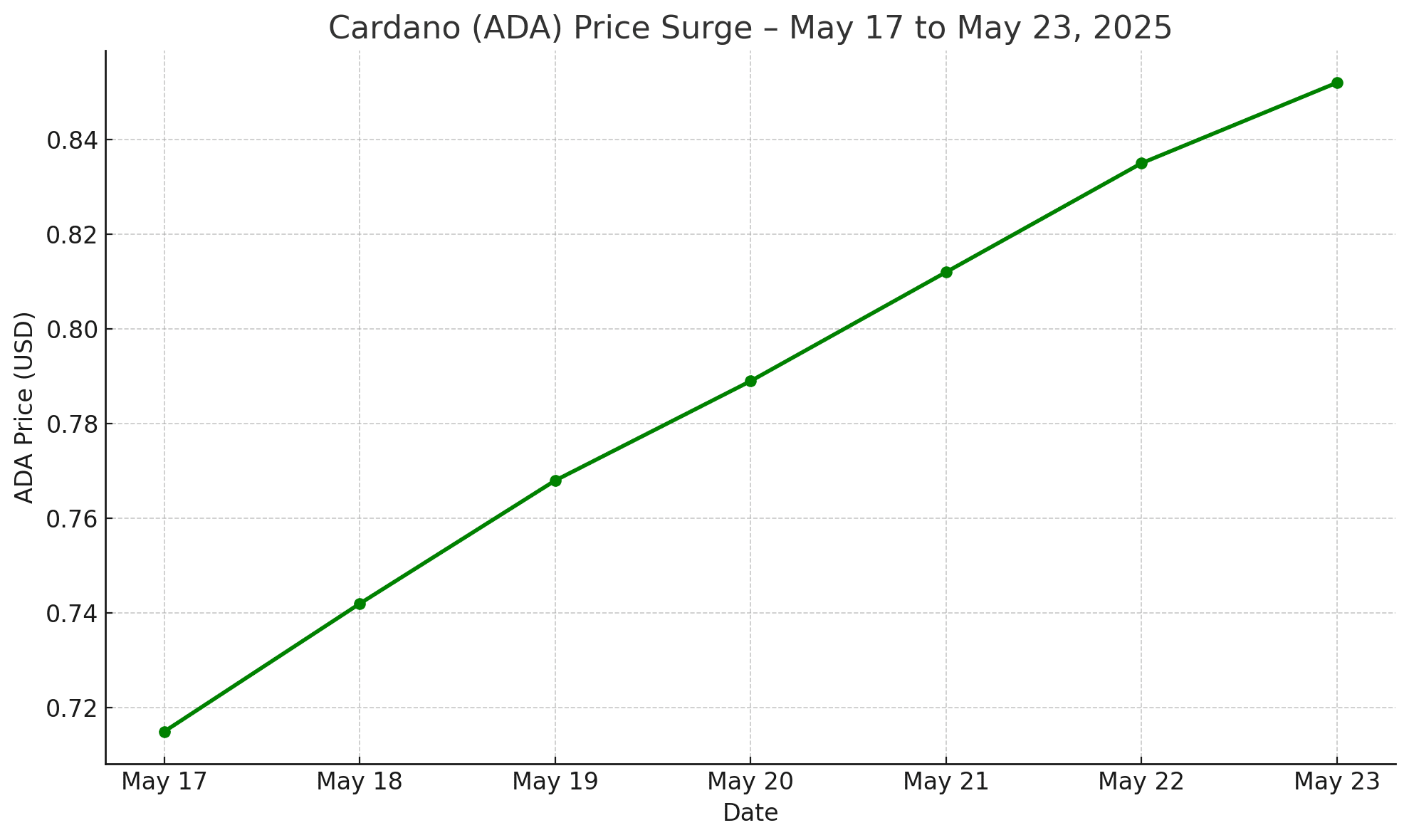

The table below tracks Cardano’s price progression from May 17 to May 23, showing a steady climb in market value and technical strength.

| Date | ADA Price (USD) |

|---|---|

| May 17, 2025 | $0.715 |

| May 18, 2025 | $0.742 |

| May 19, 2025 | $0.768 |

| May 20, 2025 | $0.789 |

| May 21, 2025 | $0.812 |

| May 22, 2025 | $0.835 |

| May 23, 2025 | $0.852 |

This rebound of over 13% reflects growing trader optimism and a shift in market dynamics, especially with altcoins drawing renewed attention.

Technical Signals Favor the Bulls

Cardano’s chart is currently flashing several bullish signals:

Bullish Pennant Formation: ADA recently broke out of a bullish pennant, a continuation pattern typically followed by further upside.

Heikin Ashi Candles: Recent daily candles show no lower wicks, a sign of strong directional buying pressure.

RSI (Relative Strength Index): Hovering below 70, ADA still has upside room before becoming overbought, supporting short-term bullish continuation.

If ADA convincingly breaks above $0.90, the next major resistance lies at $1.15, a historically high-liquidity zone where price action has previously reversed. Breaching this could trigger rapid gains toward $1.30 and beyond.

What’s Fueling the Breakout?

While technicals are strong, fundamentals are also supporting ADA’s rally:

Hydra Scaling Update: Cardano’s Hydra protocol continues to evolve, promising massive transaction throughput and real-world adoption use cases.

DeFi Growth: Cardano’s Total Value Locked (TVL) has slowly climbed in Q2 2025, with new dApps and liquidity entering the ecosystem.

Regulatory Tailwinds: MiCA and global crypto frameworks create safer investment climates, benefiting projects with strong governance like Cardano.

Once criticized as slow, Cardano’s academic, peer-reviewed development model now appears to be a strength in a market favoring compliant, secure blockchains.

Near-Term and Long-Term Price Forecasts

Short-Term (June 2025)

If ADA holds above $0.84, technical models suggest a target range of $0.95 to $1.15 over the next few weeks, depending on Bitcoin stability and macro risk sentiment.

Mid-Term (2025 End)

Analysts from InvestingHaven and CoinDCX project ADA will range between $1.20 and $1.88 by the end of 2025, with bullish scenarios seeing a push to $2.36, especially if major milestones like Hydra’s full deployment are achieved.

Long-Term (2030 Outlook)

Some analysts forecast Cardano reaching $5 to $10 by 2030, supported by institutional partnerships, growing DeFi activity, and increased global blockchain adoption, particularly in Africa and Southeast Asia, where Cardano is building infrastructure.

Conclusion

Cardano’s latest rally is more than just a technical bounce. It’s a convergence of bullish momentum, whale confidence, and ecosystem development — all pointing toward a breakout attempt at the $1 level. If ADA clears the key resistance zone ahead, it could spark a new chapter for one of crypto’s most academically grounded projects.

Still, traders should remain cautious of resistance at $0.90 and $1.15. But as momentum builds, the upside potential is beginning to outweigh the downside risks — at least in the short term.

FAQs

Why is ADA approaching the $1 level important?

The $1 mark is a major psychological and technical resistance. Breaking it could fuel bullish momentum and draw fresh liquidity from traders and investors.

How significant is whale accumulation?

Large-scale ADA purchases by whales reduce available supply and often precede major price moves. It signals institutional confidence in future gains.

What role does Hydra play in ADA’s future?

Hydra is Cardano’s Layer-2 scaling solution designed to enable high-throughput dApps and enterprise use cases, which could increase demand for ADA.

Glossary

SMA (Simple Moving Average) – An indicator that smooths price data to identify trends over time.

Bullish Pennant – A pattern formed by converging trendlines after a strong upward move, indicating a potential breakout.

Whale – A wallet or entity that holds a significant quantity of a given cryptocurrency.