This article was first published on Deythere.

- Whales Accumulate Millions of ADA as Price Consolidates

- Market Sentiment Indicators Show Neutral

- Easing Sellers, Waiting for Confirmation

- Current Price Structure Confirms Descending Channel

- Conclusion

- Glossary

- Frequently Asked Questions About Cardano Whale Accumulation

- Why was the Price of ADA in a Channel, Despite Accumulation?

- Will funding rates have an impact on the direction of price?

- What do exchange balance declines mean?

- Is whale accumulation an assurance of price rise?

- References

Cardano continues to attract interest from whales even as Cardano’s price consolidates under $0.40. On-chain metrics indicate that Cardano whale accumulation has been escalating in the past weeks, as large addresses have cumulatively added over 210 million ADA tokens to their holdings.

This is unfolding while the token is trading in a multiple-month descending channel, with some technical indicators suggesting stabilization rather than clear directionality.

Whales Accumulate Millions of ADA as Price Consolidates

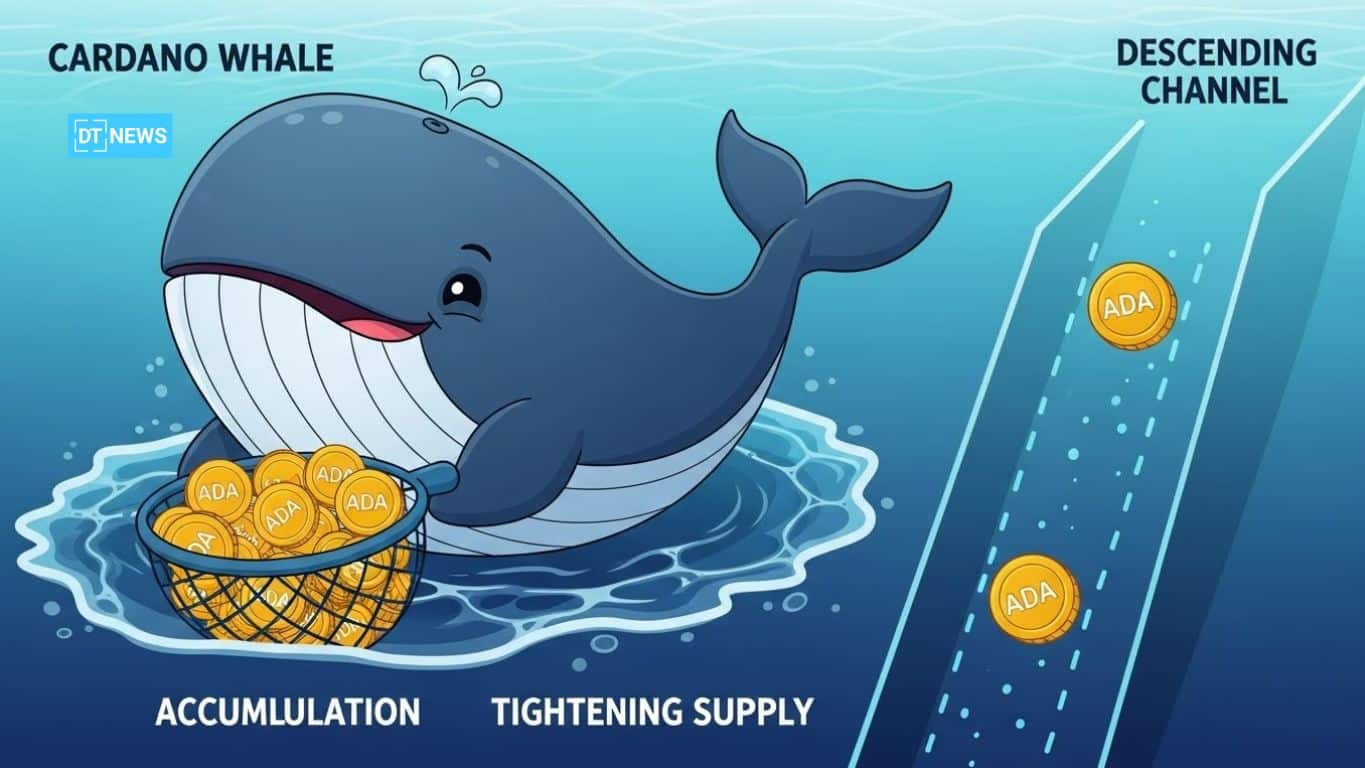

Recent on-chain data is showing that Cardano’s biggest whales have been boosting their ADA bags over the past three weeks. This accumulation occurred while $ADA traded between $0.38 and $0.39, a range that the market regarded as a support region that was strongly defended by buyers.

This increase in holdings has not occurred during an obvious price breakout, which points to the fact that whales have been positioning themselves for structural changes rather than just reacting to ongoing upward momentum.

Exchange balances, which are the amount of ADA held on centralized trading platforms, have decreased slightly over this time frame as well, suggesting that some ADA is being extracted from its liquid supply and shifted into self-custody or long-term wallets.

These movements can create a shortage of available physical stocks, and marginal demand will become a more substantial factor in the future for price action.

Market Sentiment Indicators Show Neutral

Analytics from Binance’s top trader accounts show a clear directional bias; approximately 72.52% of these accounts were positioned long, while the remainder held short exposure.

This suggests that some experienced traders might still be taking an optimistic stance; however, it measures conviction rather than the size of the leveraged position so it captures sentiment rather than risk concentration.

Meanwhile, funding rates in derivatives markets which shows the premium that longs or shorts need to pay to keep their positions live, have moved back into slightly positive territory.

Here, the OI-Weighted Funding Rate is reported at +0.0018%, showing that short side pressure relief and bearish control is weak.

However, these rates are low, and do not suggest there is heavy leverage being put on either long or short in the market, implying that the focus is more on keeping everything balanced and even.

Easing Sellers, Waiting for Confirmation

Trend strength indicators, meanwhile, suggest that although buyers have some degree of directional control, the overall trend is very weak. Indicators such as the Average Directional Index (ADX) remained low, a phenomenon that usually indicates while momentum hasn’t turned bearish yet, it has also not put in forces to confirm the start of a new uptrend.

This is typical of price-basing phases, where the sellers are losing their grip but the buyers haven’t developed quite enough activity to take the price higher.

In this regard, Cardano whale accumulation functions as preparatory positioning instead of a direct indication that price expansion is imminent.

While whales buying added bags can pave the way for an eventual move, the move needs to be confirmed with sustained volume and a structural breakout of important resistance areas.

Current Price Structure Confirms Descending Channel

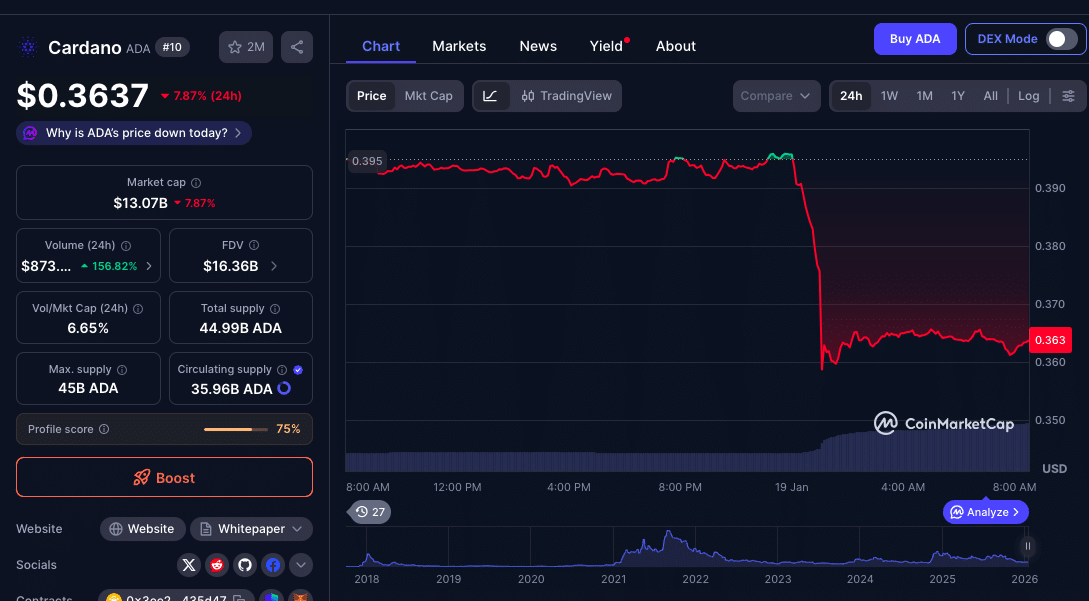

On a technical standpoint, following the latest macroeconomic hit to the market, as of press time, ADA has broken below the $$0.38-$0.40 support area, which it had held since December. The daily MACD indicates a bearish crossover, whereas RSI (37.38) is at the brink of the oversold territory without a positive bias.

This breakdown confirmed the descending channel, and it has attracted technical sellers. Volume expanded by 146% on the decline to confirm bearish commitment. ADA now encounters the next support at $0.35.

ADA’s plunge combines macro uncertainty, technical breakdown, and some derivatives deleveraging. While a bounce could emerge from oversold conditions, an extended recovery requires stability of BTC and ADA, upholding $0.35.

If sentiment returns to the market and reclaims or overcomes previous support, for Cardano, the next upside reaction could be somewhere near $0.47 and then $0.60 in a very bullish scenario.

Conclusion

The market structure of Cardano this month is characterized by a period of consolidation while whales accumulate and the pressure from derivatives is in check, coupled with recent macroeconomic conditions.

Big holders seemed to have accumulated quietly, exchange supply tightened, and sentiment readings are tilted. Price has eventually broken below the $0.38 support, confirming the descending channel.

Until ADA decides to make a move out of its current forms with volume confirming such moves, these developments show positioning rather than immediate price direction.

Glossary

Cardano whale accumulation: The process where large holders (whales) add more ADA tokens to their holdings.

Descending channel: Movement contained between two parallel trend lines, which involve lower highs and lower lows to signal a consolidation in the bullish background.

Exchange balance: The amount of ADA on centralized exchanges is an indicator of liquidity.

Directional positioning: The long or short stance of trader accounts representing sentiment in derivatives markets.

Funding rate: A recurring payment to be exchanged between long and short positions at the perpetual futures contract market, representing leverage imbalance.

ADX: A technical indicator used to ascertain the quality of a trend.

Frequently Asked Questions About Cardano Whale Accumulation

Why was the Price of ADA in a Channel, Despite Accumulation?

The accumulation is signaling a position, but price requires structural confirmation in the form of a break and an expansion in trading volumes to move out from within a consolidation channel.

Will funding rates have an impact on the direction of price?

Futures funding rates represent the balance between longs and shorts in the derivatives market; mild positive rates are usually a sign of reduced bearish momentum, but not necessarily high bullish leverage.

What do exchange balance declines mean?

Decreasing exchange balances indicate that more ADA is being sent out of the liquid trading supply and into personal wallets, potentially decreasing available sell-side pressure.

Is whale accumulation an assurance of price rise?

No. It’s a large holders strategy, but it needs price confirmation to break/ market participation for any meaningful upside moves.

References