Cardano (ADA) is getting attention from investors again as fresh signs of whale accumulation emerge, setting the stage for a big move. Over the past few weeks, the network has shown accumulation led momentum with deep pocketed investors buying and price bouncing back up.

- A Breakout That Changed The Narrative

- Whale Accumulation Strengthens But Selectively

- On-Chain Activity Slows But Hints At Accumulation

- Technical Outlook: ADA Holds Key Levels

- Conclusion: Macroeconomic Crosswinds Could Impact Momentum

- FAQs

- What is whale accumulation in crypto?

- Why is $0.75 a key support for ADA?

- What is OBV and why is it important for ADA?

- How are whale cohorts defined in Cardano?

- What to watch for with ADA?

- Glossary

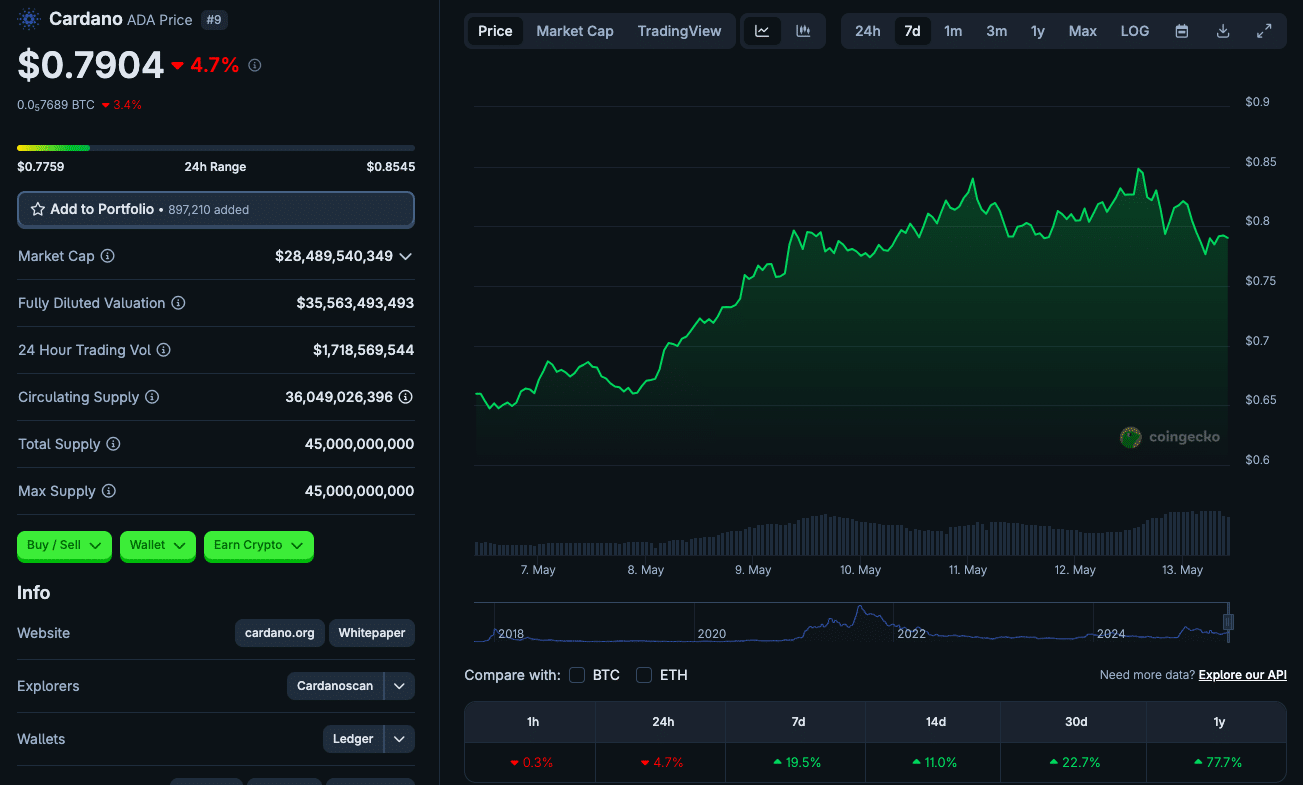

As of press time, ADA is sitting around the $0.80 support level after reclaiming the territory lost in late March. The price bounce was accompanied by on-chain developments that suggest bigger hands are accumulating before the next move up.

A Breakout That Changed The Narrative

On May 8th, ADA broke out of the descending channel it was in for the short term. The breakout was notable not only for the structure but for what followed: $880,000 in ADA short liquidations in 24 hours. This liquidation added fuel to the breakout and got ADA back into its February range.

The price surge also saw Cardano retest and hold the $0.75-$0.80 support band, a key range that analysts say could be the springboard for a retest of $0.91, the mid range resistance. The 20-day and 50-day moving averages are up, so the short term is bullish.

Whale Accumulation Strengthens But Selectively

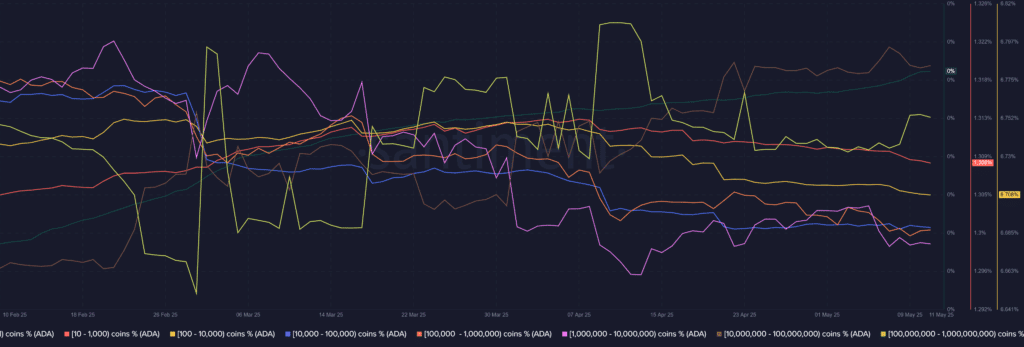

On-chain data shows a mixed but telling picture of ADA holder behavior. The whale cohort holding 10-100 million ADA (some of the most influential participants in the ecosystem) have accumulated 1% of the supply in the last 30 days. At current prices, that’s $296 million worth of ADA.

Interestingly, accumulation wasn’t uniform across all whale groups. While the 100-1 billion ADA cohort joined the accumulation in the last 3 days, smaller whales and mid-sized holders seemed to stall or reduce their positions. Retail investors have been buying since February and that’s in line with the idea of broader grassroots confidence in ADA’s long term.

On-Chain Activity Slows But Hints At Accumulation

Despite the price and whale action, Cardano’s on-chain activity has slowed down in the last few days. Transaction volume and daily active addresses dropped significantly on Friday May 9th and remained low over the weekend, a pattern that’s unusual for transaction volume especially on weekends.

The drop in token velocity (a measure of how fast ADA is changing hands) suggests the recent rally hasn’t triggered much profit taking. The slowdown might be a sign of reduced sell pressure and that accumulation is happening not distribution.

Additionally, despite transaction counts falling, daily active addresses are still above most of April’s numbers so core network participation is healthy.

Technical Outlook: ADA Holds Key Levels

The price action chart shows how important the $0.75 level is. ADA dropped below the range lows of $0.68 at the end of March but has since reclaimed that territory. Bulls have held and momentum indicators are backing up the case for more upside.

The On-Balance Volume (OBV) is rising, the MACD is bullish and the RSI is just below 60, so ADA has room to go before it gets overbought.

Technical analysts are now looking at $0.91 as the next resistance level, a mid-range target that has been a local top before. A breakout above that could open up the $1.10-$1.20 range if whale accumulation continues and broader market conditions are favorable.

However risks remain. A break below the $0.75-$0.80 zone could invalidate the current setup and shift momentum back to the bears.

Conclusion: Macroeconomic Crosswinds Could Impact Momentum

While Cardano’s internal dynamics are looking good, macro factors could still play a role. The US Federal Reserve’s June meeting and ongoing speculation around monetary policy could fuel more growth in crypto or short-term volatility depending on the outcome.

Until then, accumulation trends and support-resistance structure will drive ADA’s price action and whales will be playing a bigger role.

FAQs

What is whale accumulation in crypto?

Whale accumulation means large holders (usually wallets holding millions of tokens) buying large amounts of a cryptocurrency. This often means they are very bullish and can precede price increases.

Why is $0.75 a key support for ADA?

This level has been an important zone for ADA price action and was crucial during the last breakout. Holding above it strengthens the bullish setup.

What is OBV and why is it important for ADA?

OBV (On-Balance Volume) measures ‘buying and selling pressure by volume. A rising OBV for ADA means more buying than selling and supports a price increase.

How are whale cohorts defined in Cardano?

On-chain analytics platforms categorize holders by wallet size. For example, a cohort with 10M-100M ADA is considered a whale class based on the value of holdings.

What to watch for with ADA?

Breakdowns below support zones, decreasing whale activity or broader market pullbacks (especially from macro news) could reverse the trend.

Glossary

Whale: A holder of a large amount of a specific crypto.

OBV (On-Balance Volume): A technical indicator that uses volume to predict price changes.

Token Velocity: How often a crypto changes hands in a given time frame.

Support Level: A price where an asset tends to find buying interest and won’t go lower.

Descending Channel: A bearish pattern where two downward sloping trend lines contain price action.

Sources

TradingView – Cardano Technical Charts

Disclaimer: This is for informational purposes only and not financial advice. Crypto investments are risky and not suitable for all. Always do your own research and consult a financial advisor before ‘making any investment decisions.