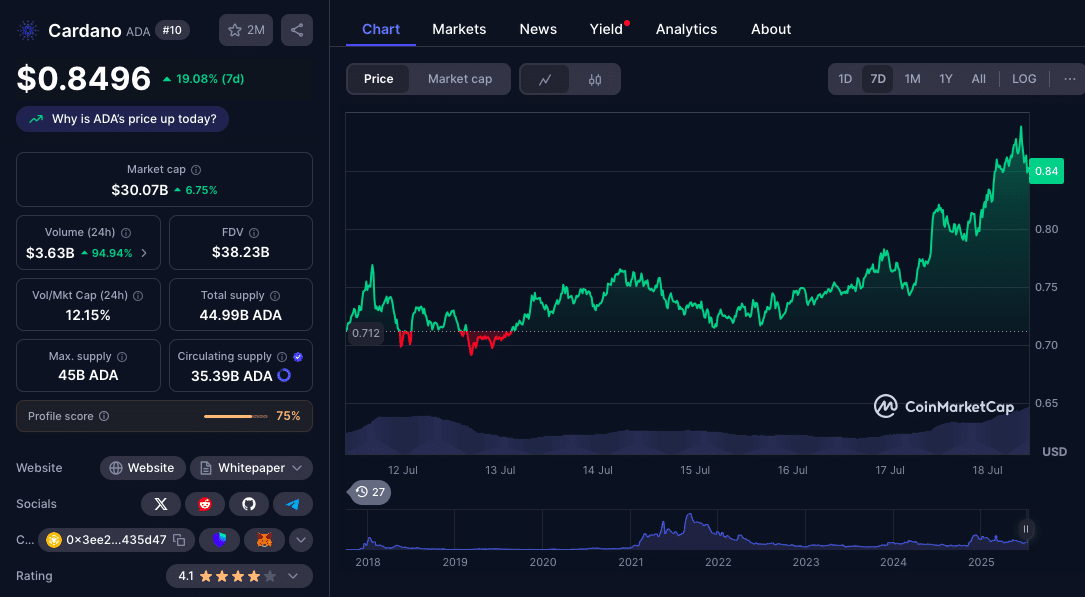

After months in a tight range, Cardano (ADA) is finally gathering momentum, but will it hold? ADA’s recent breakout from $0.72 to $0.86 has got the market excited again, but analysts are cautious for Cardano price predictions as the broader altcoin recovery is favoring high-beta tokens right now. Currently, ADA trades at $0.8496.

- ADA Rebounds, But Will Momentum Remain

- Market Context: Altcoins Up, Cardano Down

- Cardano Price Prediction

- Expert Forecasts: What the Experts Expect for Cardano

- Conclusion: ADA’s Future Hinges on Volume and Breakout Confirmation

- FAQs

- What is the current resistance for Cardano (ADA)?

- Can ADA reach $1 in 2025?

- What’s the downside risk for ADA?

- Is now a good time to buy ADA?

- Glossary

ADA Rebounds, But Will Momentum Remain

Cardano’s price action is looking better technically. After bouncing from $0.72, ADA cleared the $0.75 and $0.80 resistance levels and briefly tested $0.8650, a zone that rejected bulls multiple times, before retracing to $0,8496. This came as Bitcoin and Ethereum went up too, lifting the whole altcoin market.

ADA is above its 100-hour simple moving average and holding a bullish trendline at $0.8280. The Relative Strength Index (RSI) is above 50, so it’s still bullish, although some investors are hesitant to call this a full-blown trend reversal.

Market Context: Altcoins Up, Cardano Down

According to CoinMarketCap, the total crypto market cap excluding Bitcoin is at $1.47 trillion this week, up 37% from prior levels. Analysts noted that ADA’s large holder netflows are neutral, while whale accumulation in ETH and SOL is visible.

This divergence in capital rotation is raising questions about ADA’s near-term appeal. Analysts say ADA is structurally improving. Smart contract activity is picking up; but investors are skeptical and probably chasing higher returns elsewhere.

Nevertheless, the long-term fundamentals are still in place. Messari on-chain data shows that Cardano developer activity is still high and the network is growing TVL; thanks to DeFi platforms like Minswap and Indigo Protocol.

Cardano Price Prediction

Bull Case: $1.00 If Breakout Holds

In the bull case, ADA needs to break $0.8650 decisively. A daily close above this level could take it to $0.90, with the next immediate target at $0.98. Changelly analysts say a close above $0.90 will trigger FOMO among sidelined investors and give momentum to break $1.

The hourly MACD is getting stronger in the bullish zone and ADA is holding $0.8280, so a new up leg is possible. If ADA follows the broader market up, $1.00 could be reached this quarter.

Bear Case: Weak Volume, Resistance at $0.90 Could Cap Upside

Despite the bullish structure, traders are watching the $0.8650 level closely. If it doesn’t break this resistance, it could see a pullback to $0.80; a support zone that’s backed by the 50% Fibonacci retracement from the $0.7113 swing low. A break below $0.7880 would invalidate the bullish thesis and bring back the risk of sub-$0.75.

Sentiment is still fragile. If Bitcoin or Ethereum get hit with volatility, ADA’s low relative strength will make it more prone to deeper pullbacks. A reversal in macro risk appetite or another altcoin sell-off could delay ADA’s breakout indefinitely.

Cardano Price Prediction Table: Q3 2025 Outlook

| Scenario | Short-Term Target (Q3 2025) | Comment |

| Bullish Case | $0.98 – $1.10 | If ADA clears $0.90 on high volume |

| Base Scenario | $0.84 – $0.90 | If ADA maintains current trend and support |

| Bearish Case | $0.75 – $0.78 | If resistance at $0.8650 holds and BTC stalls |

Expert Forecasts: What the Experts Expect for Cardano

Experts are still cautiously optimistic on Cardano Price Prediction:

CoinCodex says ADA could reach $0.94 in the next 30 days if the market holds, but warns “resistance at $0.90 could be a short-term cap.” WalletInvestor, which is conservative, sees ADA trading in the $0.76-$0.84 range in the next few weeks with “neutral signals in large-holder activity.”

3Beasts, a technical analysis group, expects a Q3 breakout to $1.10 if ADA clears $0.88 on strong volume.

While these are different, most experts agree that ADA needs a catalyst whether it’s DeFi adoption, staking growth or CIPs; to sustain a move above $1.00.

Conclusion: ADA’s Future Hinges on Volume and Breakout Confirmation

Based to the latest research, Cardano price prediction says ADA is at a critical point. Its recent push above $0.80 has improved the technicals, but failing to clear $0.8650 will trap it in a range. On-chain strength and developer momentum is good long term but short term, ADA needs to show it can attract capital and outperform its high beta peers.

As always, investors and traders are advised to watch market-wide trends, especially Bitcoin’s dominance, to see if ADA will be taken up in the next wave or left behind again.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

Cardano (ADA) just broke $0.80, bullish momentum is back but $0.8650 is the major hurdle. On-chain data is looking good. A breakout above $0.90 could take ADA to $0.98 or even $1.10 in Q3 2025, failing to break resistance will send it back to $0.75.

FAQs

What is the current resistance for Cardano (ADA)?

$0.8650 is the key resistance, with a target of $0.90 and above.

Can ADA reach $1 in 2025?

If ADA holds volume and clears $0.90 convincingly; $1.00 is possible in Q3 2025.

What’s the downside risk for ADA?

If ADA fails to hold $0.80 it will revisit $0.78 or $0.75.

Is now a good time to buy ADA?

This depends on trader’s risk tolerance. ADA has potential but is in a fragile breakout. As always, Do your own research before investing.

Glossary

RSI (Relative Strength Index): A momentum indicator measuring the speed and change of price movements.

MACD: Moving Average Convergence Divergence, used to identify changes in momentum.

TVL (Total Value Locked): The total value of assets locked in a blockchain’s smart contracts.

Whale: A term for entities or individuals holding large amounts of a cryptocurrency.

Support/Resistance: Price levels where an asset tends to stop and reverse.