Cardano (ADA) is one of the most watched blockchain platforms in 2025, with its peer-reviewed development and sustainability model setting it apart from other smart contract platforms. As the broader crypto market moves into a more mature phase, long term investors are looking at assets that have strong fundamentals and real world use. Cardano’s ongoing upgrades including Hydra and Voltaire are attracting attention from both retail and institutional players.

- Recent Developments and Upgrades

- Monthly Cardano Price Forecast (June – Dec 2025)

- Expert Forecasts

- Technical Analysis (Mid-2025)

- Factors Affecting Cardano Price

- Short-Term vs Long-Term

- Conclusion

- FAQs

- Will Cardano (ADA) hit $1 by 2025?

- What affects Cardano price?

- Can ADA hit $100 or $10,000?

- What should Traders and Investors watch for in 2025?

- Glossary

Founded in 2015 by Ethereum co-founder Charles Hoskinson, Cardano is a proof-of-stake (PoS) blockchain for scalability, sustainability and interoperability. Its layered architecture separates the ledger and computational layers, to be faster and more energy efficient than proof-of-work chains.

The ADA token powers this ecosystem, used to pay fees and participate in network staking (over 70% of ADA is staked). Cardano’s goal is to support decentralized applications, DeFi platforms, digital tokens and NFTs, making it a major “third-generation” blockchain in today’s crypto terrain.

Cardano (ADA) has a reputation as a research-driven smart-contract platform, and investors want to know its long-term outlook. y

Recent Developments and Upgrades

Cardano’s roadmap is divided into eras (Byron, Shelley, Goguen, Basho, Voltaire). In 2024, the network saw several key updates: the Hydra layer-2 protocol was deployed to increase throughput, and Plutus smart-contract capabilities were improved, causing ADA to briefly break $1.20.

Partnerships in emerging markets have also been a focus. Cardano’s blockchain is being used in African and Latin American projects to provide digital IDs and financial services.

Looking into 2025, expected upgrades include the Voltaire governance system (on-chain voting for protocol changes) and continued Hydra rollouts to reduce fees and increase speed. If these upgrades are successful, it could increase Cardano’s adoption and strengthen its fundamental case.

Important ecosystem factors to watch are: Voltaire Era (Governance) involving on-chain voting for protocol changes, potentially increases community confidence; Hydra Scaling (Layer-2) which Increases throughput and reduces fees, making Cardano more competitive; Partnerships & Adoption such as government partnerships (e.g. Ethiopia’s digital ID project) and enterprise adoption may drive real world ADA usage; more Cardano-native DeFi apps and NFTs could increase network utility and ADA demand.

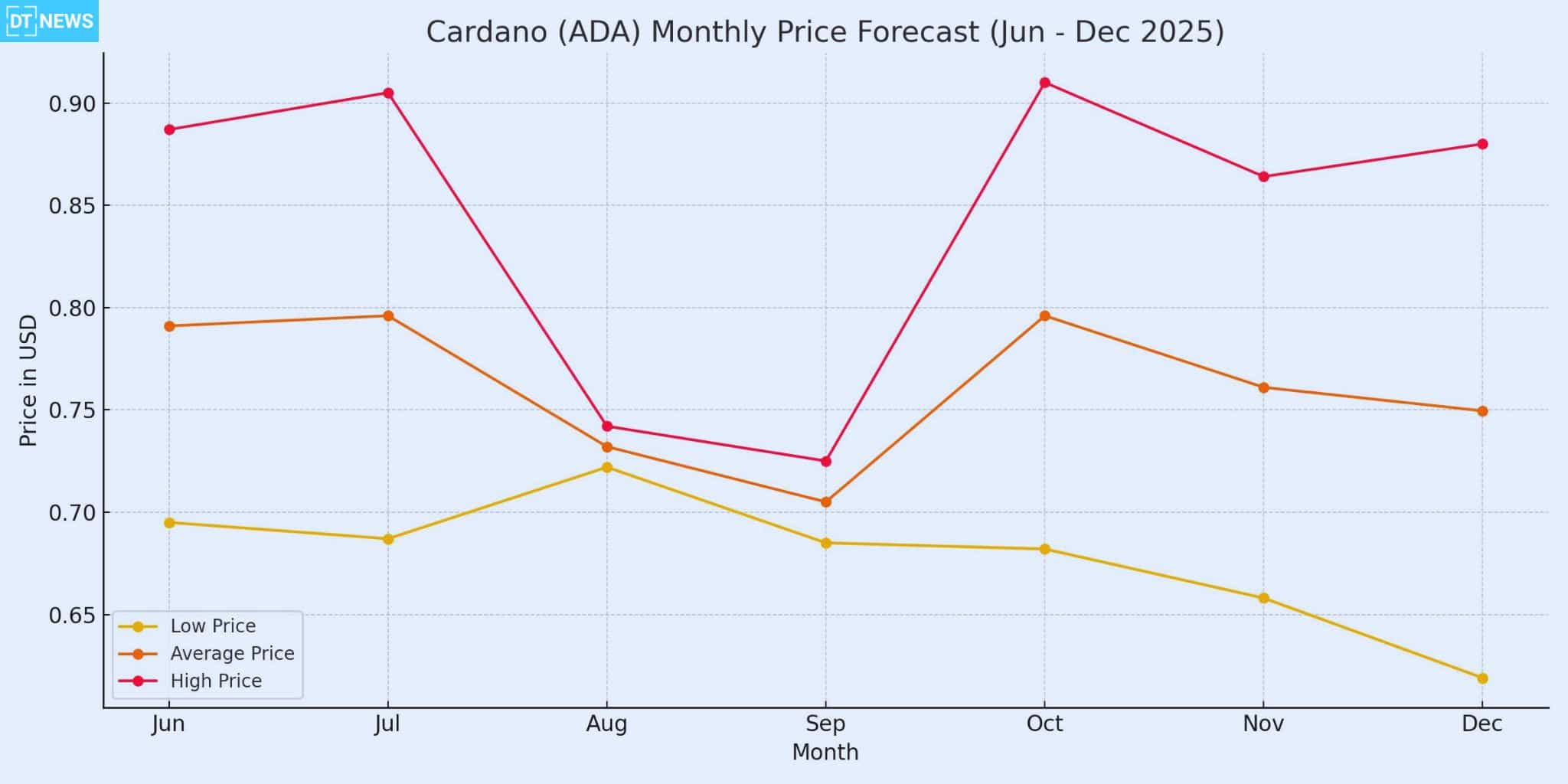

Monthly Cardano Price Forecast (June – Dec 2025)

Analysts provide monthly guidance for ADA through the second half of 2025. The table below shows forecast ranges for each month:

| Month | Price Prediction |

| June 2025 | $0.695 – $0.887 |

| July 2025 | $0.687 – $0.905 |

| Aug 2025 | $0.722 – $0.742 |

| Sept 2025 | $0.685 – $0.725 |

| Oct 2025 | $0.682 – $0.910 |

| Nov 2025 | $0.658 – $0.864 |

| Dec 2025 | $0.619 – $0.880 |

Overall, Cardano price growth is a slow growth. June 2025 average is slightly higher than mid 2024, summer lull (around $0.73 in Aug) and then uptick in autumn. By December 2025, average is near $0.75. So ADA is expected to probably trade around $0.62–$0.91 through late 2025.

Expert Forecasts

Different platforms have different targets for 2025. Changelly’s analysis says ADA will trade between $1.00 and $1.88 by end-2025 under a conservative scenario. Gov.Capital a crypto analytics firm is slightly bullish and projects $1.56 for year-end 2025. WalletInvestor’s algorithm is more cautious and predicts ADA around $1.05 by late 2025.

On the high end, there are some very bullish forecasts: one analysis cited by Bitpanda/Benzinga says ADA could reach $5.66 by the end of 2025 under a strong bull market and rapid adoption.

Flitpay, another forecasting site, projects a wide 2025 range of $0.71–$1.50 (average $0.90). CoinCodex’s model is more bullish, it predicts ADA to average around $0.75 in June and above $1.00 in August-September (e.g. $1.06 in Aug). CoinCodex’s end of year average is $0.96.

In summary, most of the experts see Cardano price in the range of $0.8–$1.0 by end-2025, but extreme bull scenarios go higher.

Technical Analysis (Mid-2025)

Looking at mid-2025, Cardano’s technicals look quiet. As of late May 2025, ADA’s price had broken below its 20 and 50 day exponential moving averages ($0.74 and $0.73 respectively). Its 14 day RSI was 42, slightly bearish. MACD line was below the signal line, upside momentum was waning. On the upside, Stochastic RSI was very low (oversold), any bounce could be met if bulls regain strength.

Support and resistance levels are around $0.63–$0.68 (recent lows), resistance around $0.76–$0.80 (recent highs). Charts shows ADA is between 50% and 61.8% Fibonacci retracement ($0.67–$0.80), so the next few closes are expected be crucial for the trend. Overall mid-2025 technicals look like consolidation; a break above $0.76–$0.80 would be bullish, below $0.63–$0.65 could expose lower supports.

Factors Affecting Cardano Price

Multiple things will shape Cardano price movements in 2025. They include:

Blockchain Upgrades: Cardano’s own development matters. Big updates (like Hydra and Voltaire) will improve speed, scalability and governance. Successful rollouts will boost confidence and utility.

Market Sentiment: Crypto-wide trends lift or sink altcoins. Whale accumulation of ADA and speculation about a Cardano ETF could lean Cardano price bullish. Risk aversion or negative news could lean the price bearish.

Macroeconomic Climate: Broader financial conditions such as interest rates, inflation, liquidity, impact crypto markets. Trade tensions or Fed policies will drive investors’ actions. Institutional flows also matter. Grayscale’s ADA fund added 20% to its holdings in 2024, indicating growth in institutional interest.

Regulatory Environment: Regulation is key. Clarity on crypto rules or an ADA futures/spot ETF could bring new capital into ADA. Stricter oversight e.g. SEC actions could pressure ADA and other altcoins.

Tokenomics: ADA’s economics support its price. A lot of ADA is reportedly staked (71%), reducing selling pressure. Total supply is capped, hence demand spikes will push the price up. Network fees (paid in ADA) create buy pressure.

Competition: Cardano competes with other smart-contract platforms (e.g., Ethereum, Solana). If those networks gain or lose ground, ADA could be affected. Cardano’s unique features and research-driven design must translate into real adoption to stay competitive.

Short-Term vs Long-Term

In the short term (through 2025), Cardano price forecasts are for moderate growth. Analysts expect ADA to be in the $0.60–$0.90 range by year-end 2025. Many estimates are around $0.9. The monthly table above shows a slightly rising but flat trend in the second half of 2025. Technically, ADA is rangebound until new catalysts arise.

Looking beyond 2025, Cthe ardano price outlook is more speculative. If the upgrades deliver and adoption accelerates, Cardano prices could go much higher. Some models have ADA at several dollars by 2030 e.g. $4.07 by 2029, or higher in bull-case scenarios. However, it is worth noting that all long-term predictions are highly uncertain in the crypto market.

ADA’s short-term will be mildly upwards or sideways unless major market moves, the long-term depends on Cardano’s execution of its roadmap and crypto cycles. Investors should consider both sides of the outlook, fundamental progress and external risks when thinking about ADA for 2025 and beyond.

Conclusion

Cardano’s outlook for 2025 is cautiously optimistic but ADA is backed by one of the most methodically developed ecosystems in the blockchain industry. Hydra and Voltaire governance will improve scalability and decentralization both of which are essential for long term growth.

Most forecasts suggest Cardano price will stabilize in the $0.80 to $1.00 range by year end with upside if broader market turns bullish or Cardano adoption accelerates. However, a lot depends on the execution of the roadmap, global regulatory clarity and macroeconomic sentiment.

Ultimately, Cardano’s 2025 price prediction is set with steady momentum but still in a competitive and fast moving environment.

FAQs

Will Cardano (ADA) hit $1 by 2025?

Many think so. Several analysts see ADA at $0.8–$1.0 by end of 2025. Conservative estimates have ADA at $0.9 by year-end, and a sustained bull run could take it above $1. But it’s all dependent on market conditions.

What affects Cardano price?

Upgrades and adoption (Hydra, governance); market sentiment (bull/bear cycles, big trades and ETF news); macro trends (interest rates, institutional flows); regulatory developments; competition from other chains. Tokenomics (supply cap, staking) also play a role.

Can ADA hit $100 or $10,000?

These can be tagged extreme targets and currently not seen as likely. A price of $100 per ADA would imply a market cap way beyond today’s levels which analysts don’t see happening in the near future.

What should Traders and Investors watch for in 2025?

Investors often look at Cardano’s roadmap (Hydra, Voltaire), adoption metrics (staking rates, active addresses) and macro factors (e.g. crypto regulatory news, Bitcoin’s performance).

Glossary

RSI (Relative Strength Index): A momentum oscillator (0–100) measuring recent price changes. RSI above 70 is “overbought”, below 30 is “oversold”.

MACD (Moving Average Convergence Divergence): A trend following indicator calculated from 12-day and 26-day EMAs.

Moving Average: The average price over a set period.

Market Cap: The total value of all circulating tokens (price × supply). It measures a coin’s size and rank among cryptocurrencies.

Support and Resistance: Price levels where an asset tends to stop falling (support) or rising (resistance).