Long-term Cardano holders are resisting the market’s volatility and abrupt profit-taking. Even as ADA rises on the strength of ETF speculation and overall positive momentum, these dedicated investors remain steadfast, indicating a strong belief in the asset’s future.

Why Are Long-Term Cardano Holders Not Selling?

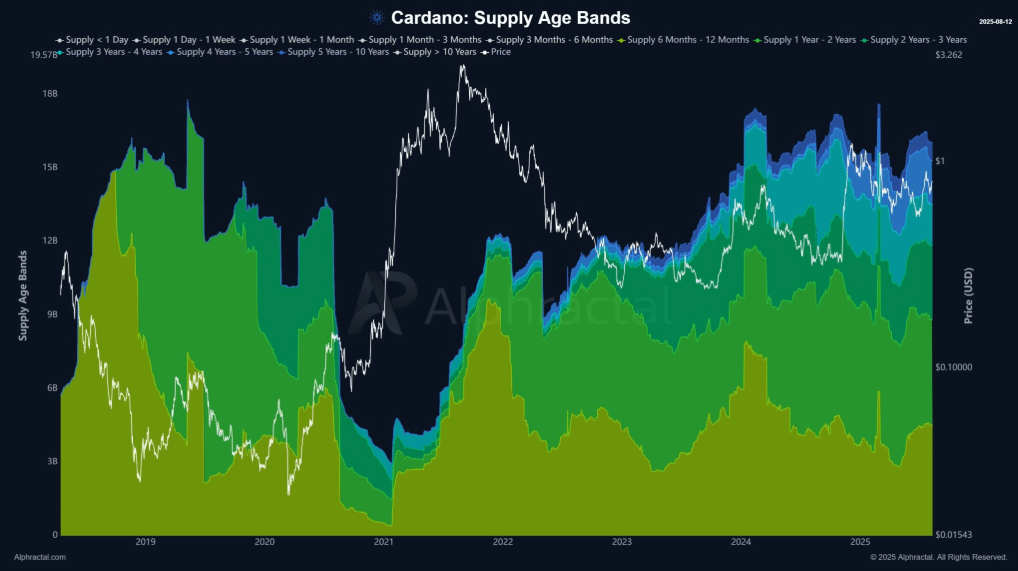

Recent on-chain data shows that long-term Cardano holders have been continuously accumulating since 2021 and show no indications of selling their investments. Despite recent significant upward trend in ADA, the token remains almost 75% behind its all-time high of $3.09.

This big disparity appears to be diminishing the motivation to take profits, particularly among investors who expect a long-term recovery. One market expert stated, “These holders are playing the long game. They see this as the beginning of a larger movement, rather than a pinnacle.

The conduct contrasts significantly with that of short-term investors, who approach the market with prudence, using rallies to lock up modest profits rather than doubling down.

Institutional Whales Drive the Momentum

Large investors, sometimes known as “whales,” have made major movements in recent weeks, adding to the positive narrative. According to reports, approximately $150 million in ADA has been amassed in only two days, bringing whale-controlled supply to more than 10% of all circulating tokens.

This jump in institutional participation corresponds with a substantial increase in ETF approval probabilities, which are presently above 75%, according to prediction market statistics. Many observers believe that the combination of whale accumulation and steadfast long-term Cardano holders is a powerful combination that has the potential to maintain momentum.

Technical Signals Point to Breakout Potential.

From a technical standpoint, ADA’s chart shows indicators of strength. A 58% price increase in July drove the asset into major resistance levels, and traders are now keeping a careful eye on the $0.94 zone. A clean breakout over here might go to $1 and possibly $1.20 in the near future.

Patterns such as a rounded bottom and bullish moving average crossings support the notion that the market is preparing for a prolonged upward rise. If ETF certification is granted, some forecasters predict a long-term surge toward $2.90, a level not seen since the last market cycle apex.

Governance and Ecological Development Boost Confidence

Beyond market speculation, Cardano’s governance and ecosystem expansion are also contributing to investor trust. A recent community vote allocated $70 million in treasury money to support infrastructure, developer tools, and community projects.

This decentralization milestone indicates a developing network with stakeholders actively shaping its future. The steady proliferation of decentralized apps and network usefulness strengthens the belief of both whales and long-term Cardano holders.

Conclusion

The tenacity of long-term Cardano holders in the face of a thriving market reflects a larger shift in investor sentiment. Rather than pursuing short-term returns, these investors are committed to Cardano’s long-term goal, which is supported by increasing institutional interest, excellent technical indicators, and a healthy governance environment.

While concerns persist, especially given cryptocurrency’s inherent volatility, the confluence of these variables portrays a positive picture for ADA’s future.

FAQs

Why are long-term Cardano holders not taking profits now?

They believe ADA is still undervalued compared to its all-time high and are confident in its long-term potential.

How much ADA have whales accumulated recently?

Over $150 million worth in just 48 hours, indicating strong institutional conviction.

What could push ADA prices higher in the short term?

Breaking resistance at $0.94 and positive ETF-related news could trigger a strong rally.

How does Cardano’s governance impact its price outlook?

Decentralized decision-making and treasury funding support ecosystem growth, boosting investor confidence.

Glossary

Long-term Cardano holders – Investors who have held ADA for an extended period, often resisting short-term market fluctuations.

Whales – Large-scale investors whose trades can significantly influence market trends.

ETF (Exchange-Traded Fund) – A regulated investment vehicle that could provide broader market access to ADA.

Rounding bottom – A bullish chart pattern suggesting a gradual shift from a downtrend to an uptrend.

Decentralized governance – A system where network participants collectively decide on project funding and development priorities.

Treasury vote – A community-led process to allocate funds for network and ecosystem growth.