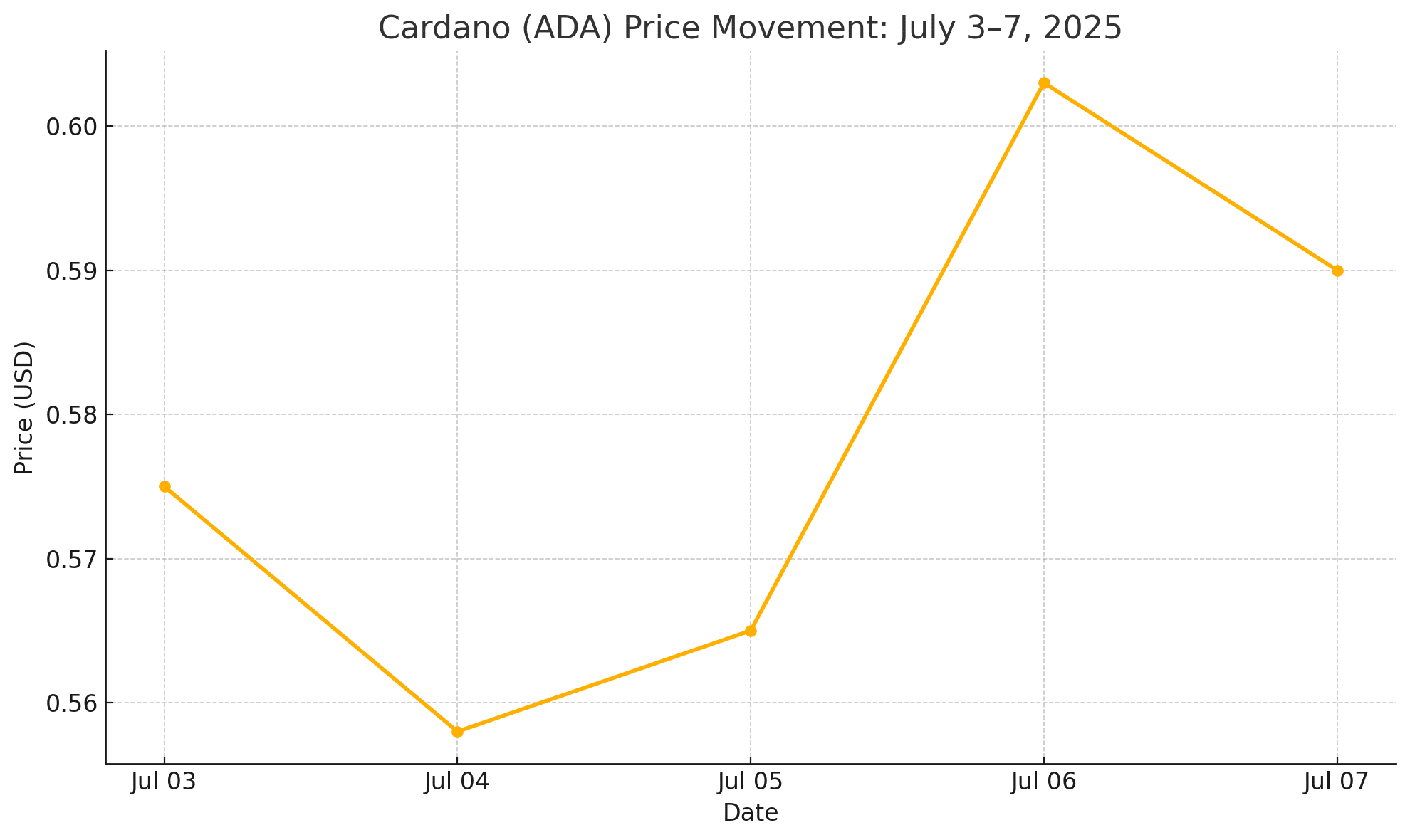

Cardano’s native token ADA is pushing for its first decisive close above 60 cents since mid-June. A rebound from the 56.5-cent floor has carried price back over the 100-hour simple moving average and broken a short-term down-trend line traced from the month’s $0.6107 swing high. Market focus now shifts to whether the rally can gain the final four cents needed to confirm a trend reversal.

Cardano Bulls Momentum Returns Above 58 Cents

Intraday charts show ADA reclaiming the 50 percent Fibonacci level of the June 28 to July 5 decline and stalling near $0.5925, the 61.8 percent retracement.

Hourly MACD has crossed into positive territory while the RSI hovers just above the neutral fifty mark, suggesting room for an extension if buy-side volume persists. The immediate hurdle sits at $0.600–0.602; a daily close above $0.620 would invalidate the prior lower-high structure and expose $0.650 next.

| Date 2025 | Close (USD) | Daily Change | Note |

|---|---|---|---|

| Jul 03 | 0.575 | +1.2 % | Volume uptick ahead of U.S. holiday |

| Jul 04 | 0.558 | −2.9 % | Profit-taking triggers dip |

| Jul 05 | 0.565 | +1.3 % | Bounce from 0.5650 floor |

| Jul 06 | 0.603 | +6.7 % | Break of trend line sparks bid |

| Jul 07 | 0.590 | −2.1 % | Consolidation under 0.60 |

Cardano Whale Wallets Bulk-Buy ADA

On-chain analytics firm IntoTheBlock flagged an accumulation of roughly 120 million ADA by large holders between June 9 and June 11, a pattern mirrored later in the month when another 80 million tokens moved into whale wallets. Such clustered buys historically precede multi-week advances and help explain why support at 54–56 cents has held despite wider alt-market softness.

Crypto analyst Ali Martinez notes that “whales are front-running the breakout” and points to a visible uptick in dormant coin activity, an indicator that long-term holders are starting to reposition ahead of a potential move beyond 65 cents.

Governance Debate May Deepen Liquidity

The Cardano bulls community is simultaneously weighing a treasury proposal that would convert up to 140 million ADA into Bitcoin and native stablecoins to bootstrap decentralized finance liquidity.

Proponents argue that diversifying idle treasury assets could increase total value locked and broaden yield opportunities, while critics fear near-term selling pressure. The dispute highlights Cardano’s ongoing push to seed a self-sustaining DeFi layer that could ultimately support higher network fees and token demand.

Key Chart Levels Traders Are Watching

Support cluster: 0.5850 initial, followed by 0.5650 and 0.5450 if momentum stalls

Resistance band: 0.5925 minor, 0.600 psychological, 0.620 breakout trigger

Technical indicators: Hourly MACD trending up, RSI above fifty, 100-hour SMA now below price, classic components of an early trend shift

Aayush Jindal, senior analyst at NewsBTC, warns that failure to clear 59 cents convincingly could send ADA back toward 54 cents “where sidelined bids appear to be waiting, but bullish enthusiasm would cool sharply.”

Conclusion

Cardano bulls latest bounce combines improving short-term momentum, renewed whale accumulation, and a governance narrative that promises deeper liquidity for the ecosystem. A candle close above 60 cents followed by confirmation at 62 cents would flip the mid-term structure bullish and put 65–67 cents on the radar for July.

Until that breakout arrives, traders are likely to treat the current up-move as a range play, using 56-cent dips for accumulation and 60-cent pushes for measured profit-taking.

Frequently Asked Questions

What resistance level confirms a breakout?

A daily close above $0.620 clears the May-to-July descending channel and signals a fresh leg higher.

Where is the strongest support right now?

Technical confluence sits at $0.5650, marked by prior lows, whale purchases, and the 0.786 Fibonacci of the April rally.

Why are whales important for ADA?

Large-holder inflows tighten circulating supply and often foreshadow directional moves because whales typically accumulate ahead of catalysts, absorbing sell-side liquidity before momentum shifts.

How could the treasury proposal affect price?

Deploying ADA into stablecoin liquidity pools could lift network activity and yield, supportive for long-term value, but initial conversions might add temporary supply pressure.

Is Cardano development still active?

Yes. Cardano remains among the top two protocols for GitHub commits in July, indicating sustained builder engagement despite market volatility.

Glossary of Key Terms

Cardano: A proof-of-stake blockchain focused on peer-reviewed research and layered smart-contract design

ADA: The native token of the Cardano network used for fees, staking, and governance

Whale: An address or entity holding a large amount of cryptocurrency capable of moving markets

Fibonacci Retracement: A technical tool plotting potential support and resistance zones based on key percentage levels of a prior move

Total Value Locked: The sum of assets deposited in decentralized-finance protocols, used as a metric for network utility and liquidity.