Cardano (ADA) is trading in a key support range of ‘$0.66 and $0.80, a zone that has been important in the past. As the overall crypto market is volatile, traders are watching to see if ADA will hold this level or get sold further. Over the last 24 hours, ADA has dropped 2.65%, and 20.20% in the last week. With large transactions down and whale interest fading, is ADA going to regain momentum or more downside?

- Key Support and Resistance Levels: ADA’s Make or Break Moment

- Technical Indicators are Uncertain on ADA’s Next Move

- Whale Activity is Down—Is That a Problem for ADA?

- Industry Impact: How ADA’s Price is Affecting the Market

- Market Sentiment: Are Traders Losing Faith in ADA?

- ADA Price Prediction: Where’s Cardano Headed?

- Conclusion: A Decisive Moment for ADA

- Glossary

The crypto market is getting more uncertain with investors reacting to macro factors like US inflation reports, regulatory attention and changing market sentiment. Altcoins like ADA are getting more vulnerable and often follow Bitcoin.

Key Support and Resistance Levels: ADA’s Make or Break Moment

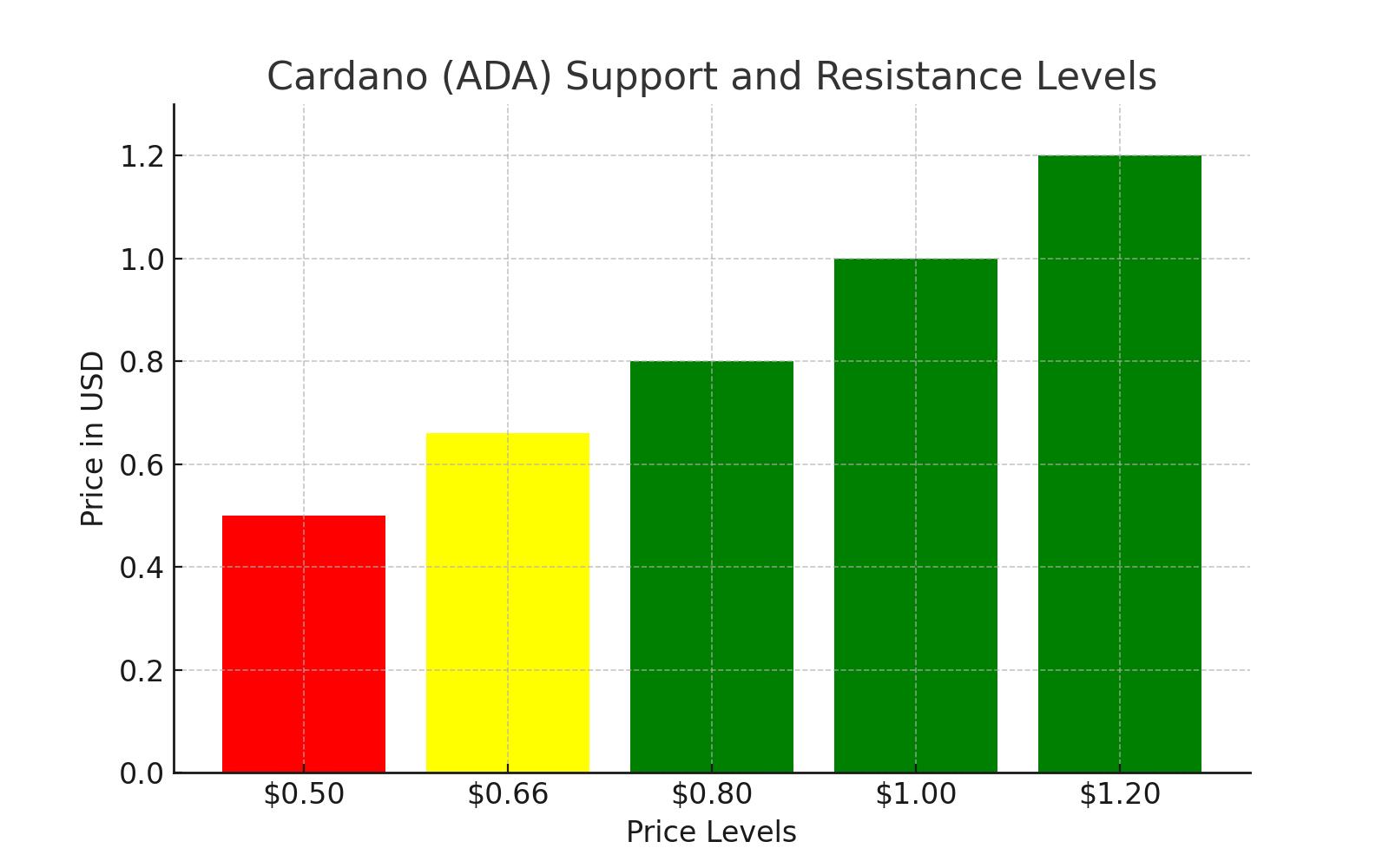

ADA’s price has been heavily influenced by the $0.66 and $0.80 range which has been both resistance and support in previous cycles.

– Mid 2022, ADA failed to hold this range and dropped big.

– In 2023, the coin faced rejection at this level and then broke out in early 2024.

– Now, the price is back testing this range making it a pivotal moment for ADA.

If ADA holds above $0.80, a move to $1.00 or higher could be possible. But if it breaks $0.66, it could open up lower levels and a deeper correction.

Technical Indicators are Uncertain on ADA’s Next Move

A combination of key technical indicators are showing market is unsure about ADA:

| Indicator | Current Value | Implication |

|---|---|---|

| Bollinger Bands | Price near lower band | Potential oversold conditions |

| RSI (Relative Strength Index) | 47.04 | Neutral—needs to move above 50 for bullish signal |

| MACD (Moving Average Convergence Divergence) | Bearish crossover (MACD line: -0.0018, Signal line: 0.0019) | Downtrend continuation unless momentum shifts |

| Volume (24h Change) | +17.97% ($2.09 billion) | Slight market participation |

| Open Interest | -9.49% ($831.18 million) | Traders closing positions amid uncertainty |

The MACD bearish crossover is bearish, but RSI is neutral, so the market is at a make-or-break.

Whale Activity is Down—Is That a Problem for ADA?

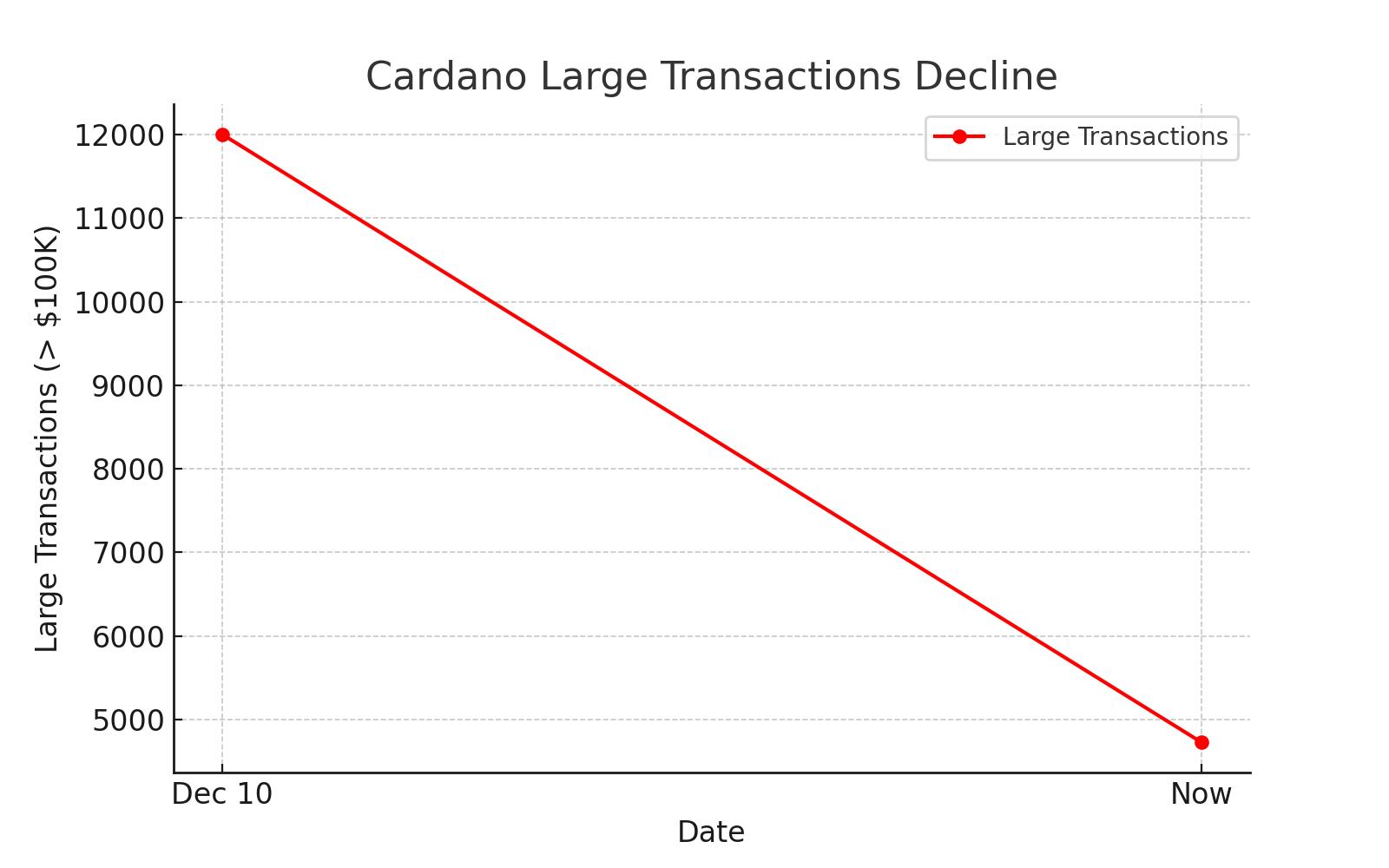

A red flag is the decline in large transactions (over $100,000) on the Cardano network. According to IntoTheBlock, large transactions peaked at 12,000 on December 10 and have since dropped to 4,730 in the last 24 hours.

Why is this important?

– Large transactions are often driven by institutional investors and whales.

– A decline means less interest from big players, which limits buying pressure and makes price recovery harder.

If this trend continues, ADA will struggle to bounce back, leaving room for more downside.

Industry Impact: How ADA’s Price is Affecting the Market

Cardano is one of the largest blockchain platforms, often seen as a competitor to Ethereum. As ADA’s price struggles, here’s what’s happening:

1. DeFi and NFT Market Influence:

– Cardano has a growing ‘DeFi ecosystem. If ADA drops, investor confidence in Cardano-based DeFi applications might wane, leading to less liquidity and participation.

– The NFT space on Cardano might take a hit as collectors and traders get cautious.

2. Institutional Adoption and Development:

– Institutions exploring Cardano-based applications might delay investments because of the price uncertainty.

– Bearish sentiment could slow down development as projects assess the network stability.

3. Altcoin Market Trends:

– ADA’s performance often mirrors the altcoin market, so if it struggles, it might signal broader weakness for other major cryptos like Solana, Polkadot and Avalanche.

– If Cardano recovers, it could trigger altcoin interest and push capital back in.

Market Sentiment: Are Traders Losing Faith in ADA?

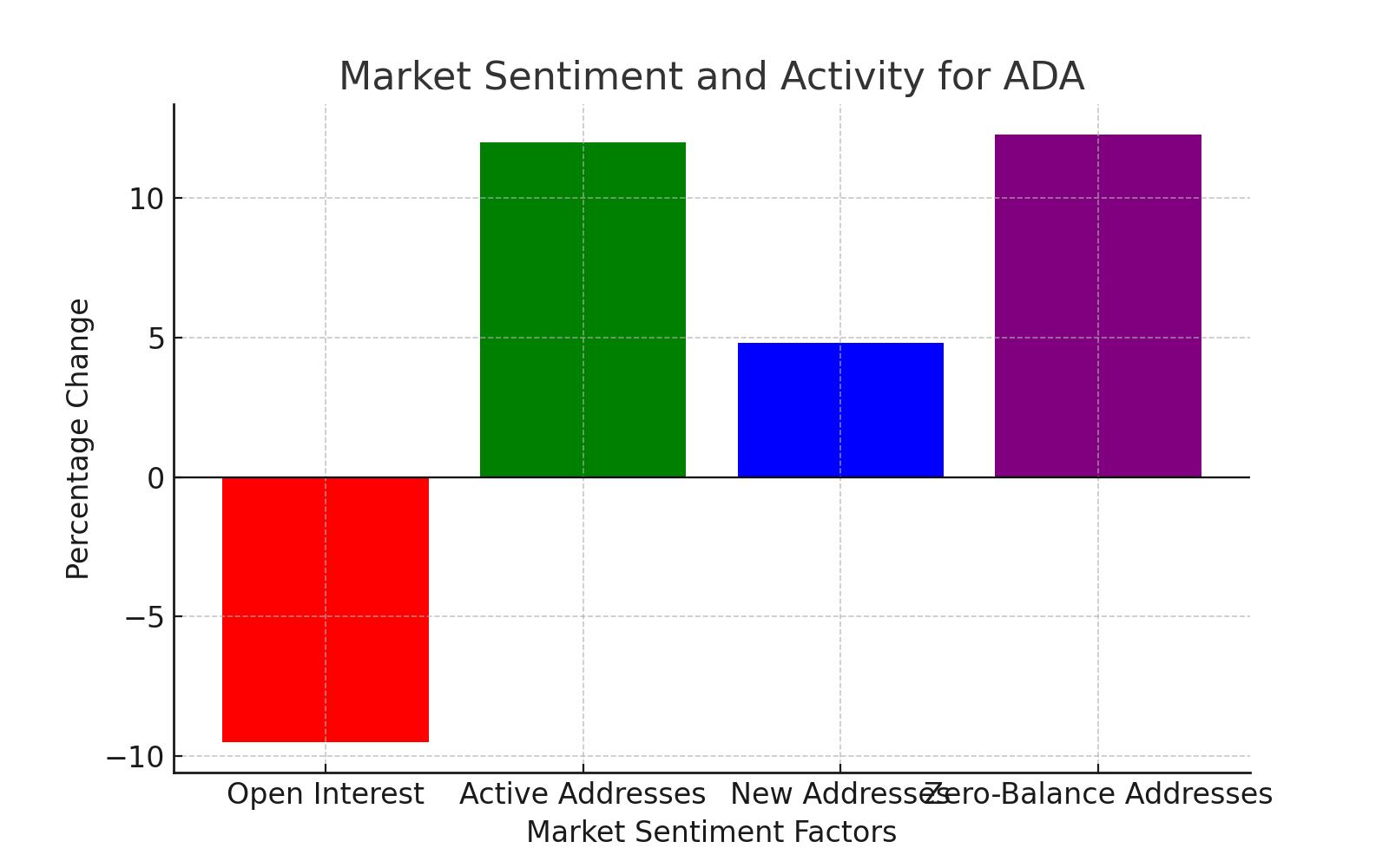

The derivatives market gives us more clues.

– Open Interest (OI) has dropped 9.49%, showing less speculative activity.

– Options volume has plummeted 92.94%, indicating lower trading appetite for ADA derivatives.

But on-chain data contradicts this:

– Active addresses are up 11.99% (more user engagement).

– New addresses are up 4.79% (fresh network adoption).

– Zero-balance addresses have surged 12.26% (wallet movement and potential re-accumulation).

What Does This Mean?

Traders are cautious but on-chain activity shows the ecosystem is still active. If sentiment shifts, ADA could bounce from current levels.

ADA Price Prediction: Where’s Cardano Headed?

Traders are looking at two scenarios:

Bullish Case: ADA holds above $0.80 and reclaims $1.00- If ADA stays in the $0.80–$0.66 range, a rebound to $1.00 is possible.

– A break above $1.03 (upper Bollinger Band) could trigger a strong move to $1.20–$1.30.

– Support from on-chain activity and whale interest could fuel the upswing.

Bearish Case: ADA goes below $0.66—Next Target $0.50

– A break below $0.66 could intensify selling.

– The next major support zone is $0.50–$0.45 where ADA found buying interest before.

– If Bitcoin is volatile, altcoins like ADA could see deeper corrections.

Conclusion: A Decisive Moment for ADA

Cardano is at a crossroads, with $0.66 and $0.80 as the make-or-break zone.

– If bulls hold, a bounce to $1.00 is possible.

– If sellers take over, ADA could drop to $0.50–$0.45.

With traders watching the price action, the next few days will decide what’s next for ADA.

Stay updated with Deythere as we’re available around the clock, providing you with updated information about the state of the crypto world.

FAQs

1. What’s Cardano’s key support?

Cardano’s key support zone is $0.80 and $0.66. A break below this range could lead to further down.

2. Why has ADA’s price dropped?

ADA has been affected by broader market volatility, declining whale transactions and reduced speculative interest.

3. What technical indicators will trigger a trend reversal for ADA?

A bullish RSI crossover above 50 and MACD bullish turn will signal upside.

4. Could ADA drop below $0.50?

If ADA breaks below $0.66 the next big support is $0.50–$0.45. But buying interest could emerge at these levels.

5. What could push ADA above $1.00?

A bounce off support, renewed whale interest, and improving macro sentiment could send ADA to $1.00 and beyond.

Glossary

RSI (Relative Strength Index) – Momentum indicator to measure overbought or oversold.

MACD (Moving Average Convergence Divergence) – Trend following indicator to signal momentum shifts.

Bollinger Bands – Volatility indicator to define upper and lower price bands.

Open Interest (OI) – Total number’ of outstanding derivative contracts.

Large Transactions – Transactions above $100,000 indicating ‘whale activity.

References

Disclaimer:

This article is for informational purposes only and not financial advice. Cryptocurrency investments are extremely volatile. Always do your own research before making any financial decisions.