Cardano (ADA) has emerged as a significant player in the cryptocurrency market, offering a platform for decentralized applications and smart contracts. As of March 21, 2025, ADA is trading at approximately $0.705061, reflecting a slight decrease of 0.02545% from the previous close. The day’s trading range has seen a high of $0.751754 and a low of $0.702273.

Cardano Price Predictions for 2025

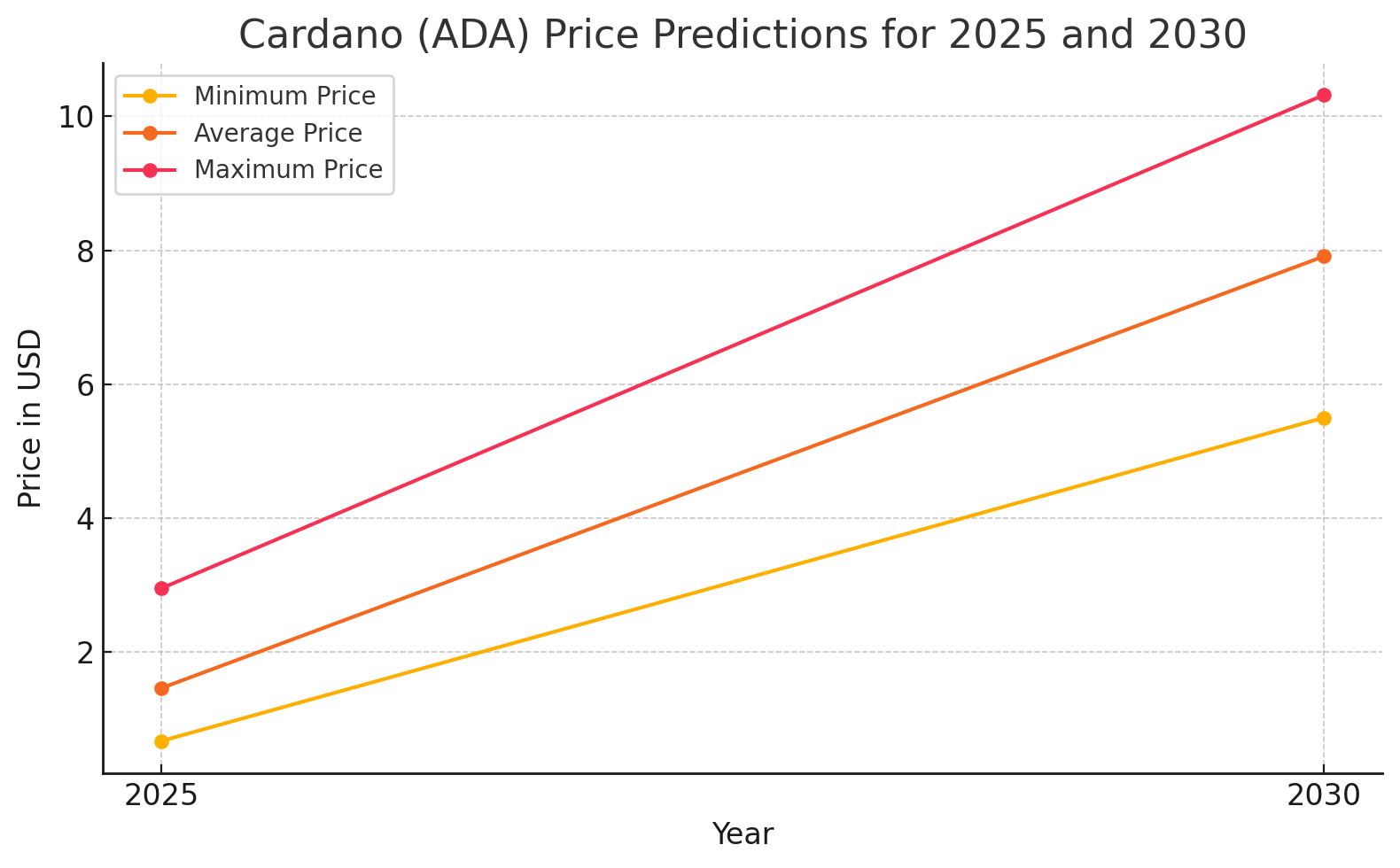

Various analysts have provided forecasts for ADA’s price in 2025:

Changelly: Projects ADA’s price to reach between $0.8 and $1 by the end of 2025.

Investing Haven: Predicts a price range from a low of $0.67 to a high of $2.21, with a potential bullish target of $2.95.

Coinfomania: Estimates a potential price range of $1.81 to $2.62, with a chance to surpass its all-time high of $3.10 if conditions are favorable.

These projections suggest a cautiously optimistic outlook for ADA in 2025, with potential growth influenced by market conditions and technological advancements.

ADA Price Predictions for 2030

Looking further ahead, analysts have provided the following forecasts for 2030:

Coinpedia: Predicts that ADA could reach between $9.12 and $10.32 by 2030, driven by increased blockchain adoption and institutional investments.

Changelly Experts: Forecasts ADA’s price to range between $5.50 and $6.58 by the end of 2030, reflecting a bullish outlook based on Cardano’s technological advancements and market positioning.

These long-term predictions indicate a positive sentiment among analysts regarding ADA’s potential, contingent upon factors such as technological developments, regulatory landscapes, and market adoption.

Price Table: Cardano (ADA) Price Predictions

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2025 | $0.67 | $1.46 | $2.95 |

| 2030 | $5.50 | $7.91 | $10.32 |

Note: These figures are based on various expert analyses and are subject to market conditions.

Factors Influencing Cardano’s Price

Several key factors could influence ADA’s price trajectory:

Technological Developments: Enhancements in Cardano’s blockchain technology, such as scalability and interoperability improvements, can attract more users and developers, positively impacting ADA’s value.

Market Adoption: Businesses’ and decentralized applications’ increased adoption of Cardano’s platform can drive demand for ADA tokens.

Regulatory Environment: Favorable regulatory policies towards cryptocurrencies can boost investor confidence and contribute to price appreciation.

Macroeconomic Factors: Global economic conditions, including inflation rates and geopolitical events, can influence investor behavior in the cryptocurrency market.

Conclusion

Frequently Asked Questions (FAQs)

Q1: What is Cardano (ADA)?

A1: Cardano is a decentralized blockchain platform that enables the development of smart contracts and decentralized applications (dApps). ADA is the native cryptocurrency of the Cardano platform.

Q2: Can Cardano reach $10 by 2030?

A2: Some analysts, such as those from Coinpedia, predict that ADA could reach between $9.12 and $10.32 by 2030, depending on factors like technological advancements and market adoption.

Q3: Is Cardano a good investment?

A3: Cardano has shown potential due to its strong technological foundation and growing ecosystem. However, as with any investment, it carries risks, and individuals should assess their risk tolerance and conduct thorough research before investing.

Q4: What are the main factors affecting ADA’s price?

A4: Key factors include technological developments, market adoption, regulatory environment, and broader macroeconomic conditions.

Q5: How does Cardano differ from other cryptocurrencies?

A5: Cardano distinguishes itself through its research-driven approach, focusing on scalability, interoperability, and sustainability. Its proof-of-stake consensus mechanism, Ouroboros, is designed to be more energy-efficient than traditional proof-of-work systems.

Glossary of Key Terms

Blockchain: A decentralized digital ledger that records transactions across a network of computers.

Smart Contracts: Self-executing contracts with the terms directly written into code, enabling automated and trustless agreements.

Decentralized Applications (dApps): Applications that run on a blockchain network, outside the control of a single authority.

Proof-of-Stake (PoS): A consensus mechanism where validators are chosen based on the number of tokens they hold and are willing to “stake” as collateral.

Market Capitalization: The total value of a cryptocurrency, calculated by multiplying its current price by its circulating supply.

By understanding these aspects, investors can make more informed decisions regarding Cardano and its potential as a long-term investment.