This article was first published on Deythere.

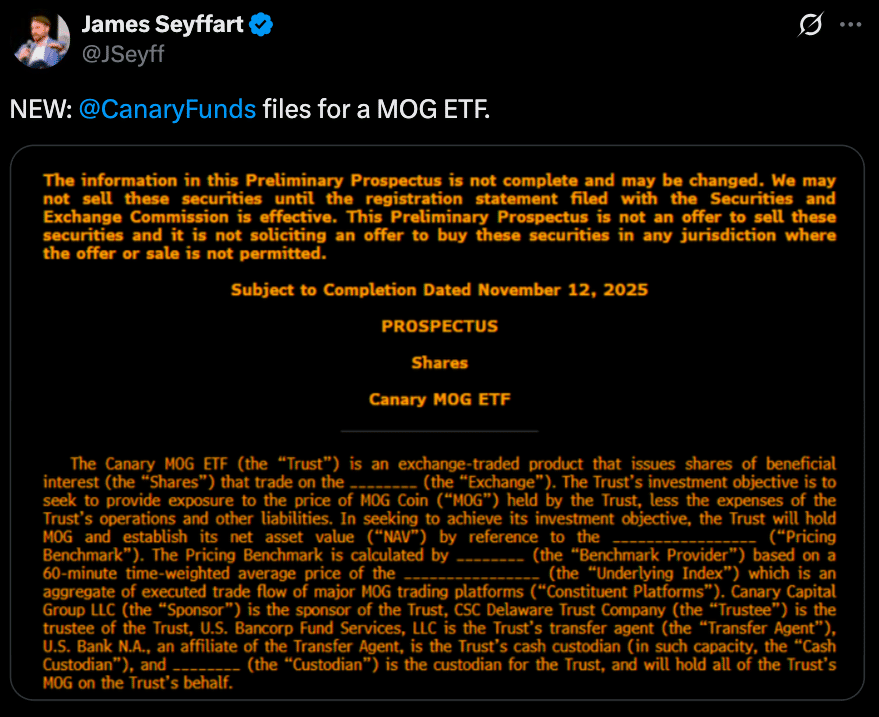

Canary Capital has filed with the U.S. Securities and Exchange Commission (SEC) to launch the first U.S. spot exchange-traded fund (ETF) to track a meme coin, the MOG Coin.

The filing defines MOG as a “meme coin” and reveals the fund may hold up to 5% of its assets in Ethereum to cover network transaction costs.

This is big because it brings a token driven by social media and online culture into the world of regulated investment products, a new chapter in meme coins and mainstream finance.

The Filing and What the Meme Coin ETF Covers

The S-1 for the Canary MOG ETF outlines a fund structured as a trust that will hold physical MOG tokens to track their price. According to the filing:

“The Trust’s investment objective is to seek to provide exposure to the price of MOG Coin (‘MOG’) held by the Trust… The Trust will hold MOG and establish its net asset value (‘NAV’) by reference to… a 60-minute time-weighted average price of the underlying index…”

The filing also says the Trust may hold up to 5% of its assets in Ethereum to pay transaction costs on the Ethereum network.

This is notable as most crypto ETFs so far have focused on big coins like Bitcoin and Ethereum, this meme coin ETF is for lower-cap, culture-driven assets, a new introduction of institutional finance to other speculative digital assets.

Market Reaction and Context for the Meme Coin ETF

The market reacted fast. Sources reported that the filing caused an 8.44% surge in price past hours and a 155% surge in trading volume. MOG Coin has a market cap of about USD $153 million and is ranked 243rd on CoinMarketCap’s list.

One crypto investor wrote on X that not even Pepe has an ETF. “MOG is at a position close to 200 of the crypto market cap. I don’t think people understand.”

It is noteworthy that MOG Coin isn’t listed on Binance yet, but is listed on the spot market on Coinbase.

It is also important to note that the SEC just cleared the way for dozens of new spot crypto ETFs tied to various assets, including smaller ones like Solana and Dogecoin.

By filing the first meme coin ETF, Canary Capital is testing how far the regulatory and investor appetite for social-token-driven investment products goes.

Why a Meme Coin ETF Matters

As Finimize said; meme coins are getting closer to the world of regulated finance. An ETF for a coin powered by community vibes not real utility means meme coins and mainstream finance are colliding.

From a bigger picture, this meme coin ETF shows asset managers are testing new product structures for digital assets previously too speculative or fringe for regulated products.

The Fund’s approach of holding MOG directly, plus minor ETH for Ethereum-network costs also shows how token economics and operational mechanics must work when being exposed to traditional investors.

What to Watch and Next Steps for the Meme Coin ETF

Now the questions are around regulatory approval; listing timeline and investor sentiment. The filing is just the first step; the SEC has to review and approve the product before shares can trade.

Other things to monitor revolve around these questions: will the Fund be listed on a major exchange, what will the fees be, how will creation/redemption work ?.

For the meme coin ETF space at large, this filing may open the door to other culture-driven digital-asset ETFs, shift investor focus, institutional flows and regulation.

Trading volumes, bid-ask spreads, regulatory comment letters and media coverage will be the indicators of how well this new product class is received.

Conclusion

The filing of the meme coin ETF by Canary Capital is a new one in crypto finance. For the first time, a regulated vehicle is proposed to track the price of a meme coin (MOG Coin), putting social-asset tokens into mainstream investment frameworks.

Much to be determined on regulatory approval and market adoption but this meme coin ETF is a signal that meme coins might just be moving from fringe to finance.

Between the ecosystem dynamics; token mechanics and investor interest, this new entry for meme coin ETFs may change how digital-asset exposure is packaged and accessed.

Glossary

Meme coin: a cryptocurrency born from internet memes or social-media culture; whose value is often driven by community sentiment rather than fundamentals.

ETF (Exchange-Traded Fund): a security that tracks an index; commodity or asset and trades on stock exchanges like a regular stock.

S-1 Registration Statement: a filing with the SEC by a company; to register securities for offering to the public.

NAV (Net Asset Value): the calculated value of a fund’s assets minus its liabilities; divided by the number of fund shares outstanding.

Authorized Participant: a financial institution that exchanges large blocks of shares in a fund for the fund’s fundamental assets; how ETFs manage creations and redemptions.

Frequently Asked Questions About MOG Meme Coin ETF

What is a Meme Coin ETF?

A meme coin ETF is an exchange-traded fund; structured to track the price of a meme coin via shares that trade on regulated exchanges.

Who filed the meme coin ETF?

Canary Capital filed the first U.S. spot meme coin ETF to track MOG Coin

What will the fund hold?

According to the filing, the Fund will hold MOG Coin and may hold up to 5% of its assets in Ethereum to cover network transaction costs.

Does filing mean the ETF is approved?

No. Filing with the SEC is just the first step. Final approval; listing on an exchange and launch date still pending regulatory review.

Why does this matter to investors and the crypto market?

This meme coin ETF filing means tokens once considered too speculative may enter mainstream investment products and how digital-asset exposure is packaged and regulated.