Arthur Hayes has never been shy about making bold moves in crypto, and his latest play has once again put him at the center of attention. The BitMEX co-founder has purchased 1,630 AAVE tokens worth roughly $442,000.

The move landed just as AAVE hovers around a key technical zone, with the market debating whether his entry could spark a rally, or whether it’s just a ripple in choppy waters.

The timing matters. AAVE has been fighting to reclaim its 200-day moving average after losing a critical uptrend line built earlier this year. Traders who follow whale signals now find themselves at a crossroads, questioning whether to mirror Hayes’ confidence or wait for confirmation from the charts.

Technical Picture: AAVE in the Balance

The charts paint a mixed story. On the one hand, AAVE tokens have slid below their April uptrend, a break that weakened bullish conviction. Price is now testing the 200-day moving average, often a litmus test for whether momentum can flip back in the bulls’ favor.

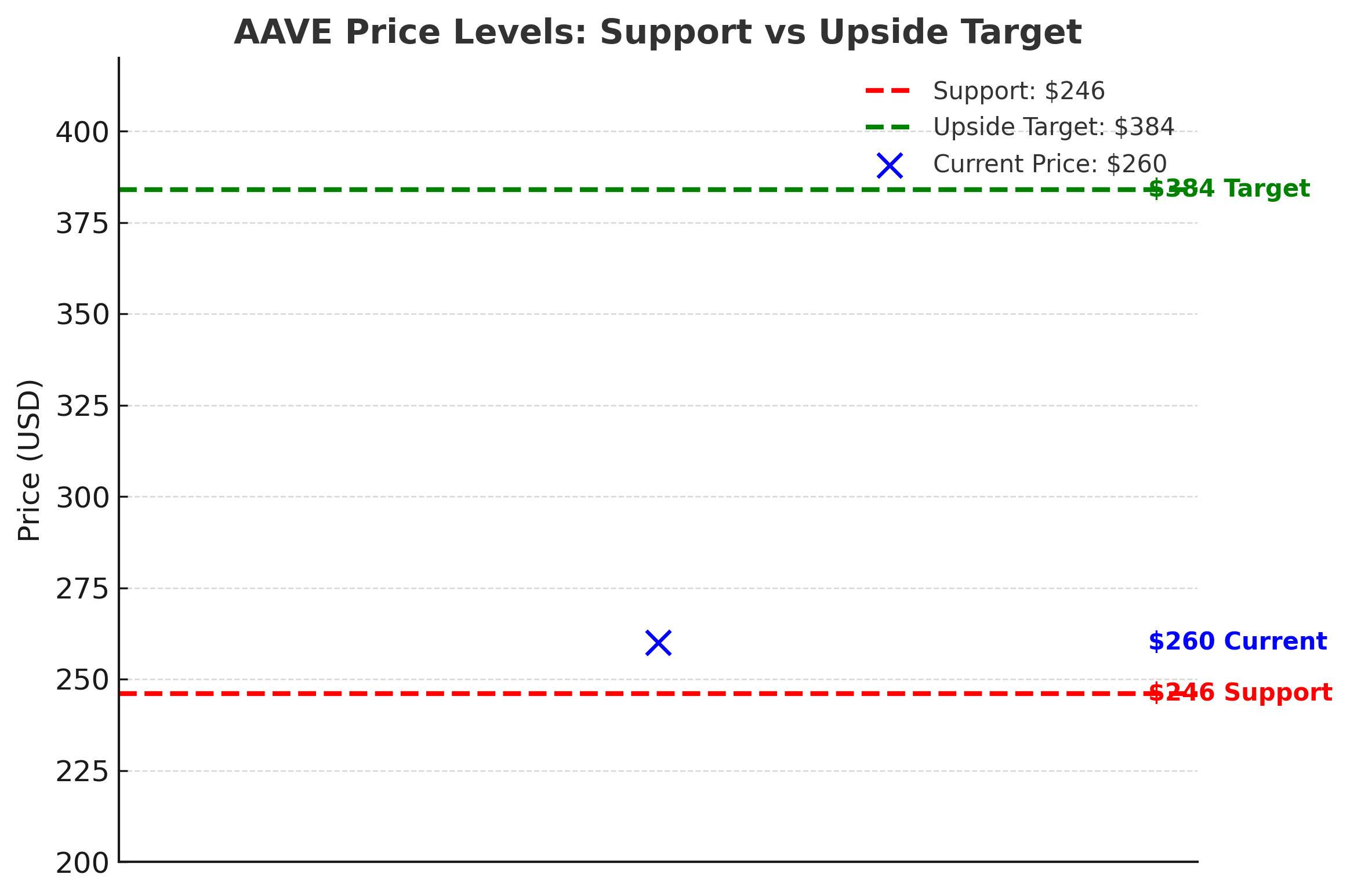

Momentum indicators such as the MACD lean bearish, adding caution to the enthusiasm Hayes’ buy generated. Analysts point to $246 as the line in the sand. Hold that support, and AAVE could push toward $384. Lose it, and liquidation heatmaps suggest a cascade of stops could drag the price significantly lower.

A trader on X put it bluntly: “$246 is do or die. Hayes might be early, but if this level breaks, copycats will regret chasing him”.

On-Chain Fundamentals: More Than Just Price

While the spotlight shines on short-term price moves, AAVE’s fundamentals remain solid. The protocol has carved out a place as one of DeFi’s most important lending markets, and its Horizon division, focused on real-world assets, has now surpassed $150 million in deposits.

That milestone signals that interest in AAVE isn’t just speculative. Traditional financial assets are being tokenized and deployed on its platform, giving AAVE tokens intrinsic utility beyond mere price swings.

Hayes’ purchase, then, may be as much about long-term conviction as it is about short-term momentum.

Whale Behavior and Market Psychology

Whale moves always stir emotions in crypto. Hayes is no exception. His decision to buy AAVE tokens sent social media buzzing, with some hailing it as a bullish signal and others calling it reckless.

The psychology here matters. When well-known traders take positions, retail investors often assume insider knowledge. Yet history has shown that whales can be wrong, or too early. For now, sentiment is split. Enthusiasm has risen, but caution lingers, especially with resistance levels stacking above.

Broader Market Context

This purchase comes amid wider volatility in the crypto market. Liquidity across DeFi platforms has been tightening, and leveraged bets remain a ticking time bomb. In such an environment, moves like Hayes’ can trigger outsized reactions.

At the same time, analysts note that his AAVE position is modest compared to the scale of recent whale buys in Bitcoin or Ethereum. That contrast tempers speculation, reminding the market that while notable, this isn’t a bet that alone decides AAVE’s fate.

Conclusion

Arthur Hayes’ decision to scoop up 1,630 AAVE tokens has given the market plenty to talk about. The fundamentals suggest strength, but the technicals remain fragile. For traders, this is less about blindly following a whale and more about recognizing the crossroads AAVE faces.

If support holds, Hayes may look prescient. If not, the buy could become another lesson in how timing makes or breaks even the boldest trades. Either way, the move highlights how individual actors, strong fundamentals, and fragile technicals intertwine in today’s crypto landscape.

FAQs

Q1: How many AAVE tokens did Arthur Hayes buy?

He purchased 1,630 AAVE tokens worth about $442,000.

Q2: Why is the $246 level important for AAVE?

It is a key support level; holding it could lead to a rally, while losing it risks further declines.

Q3: What are AAVE’s current fundamentals?

The DeFi protocol has surpassed $150 million in real-world asset deposits, showing growing adoption.

Q4: Does Hayes’ buy guarantee a rally?

No. While influential, the market’s direction depends on technical and broader conditions, not one trader.

Glossary

200-Day Moving Average: A widely used indicator to assess long-term market trends.

MACD: Moving Average Convergence Divergence, a momentum indicator.

DeFi: Decentralized Finance, blockchain-based financial services without intermediaries.

Whale: A trader or entity holding large quantities of a cryptocurrency, capable of influencing markets.

Real-World Assets (RWA): Traditional financial instruments tokenized and used on blockchain platforms.