This article was first published on Deythere.

USDC adoption gained strong momentum today as Bybit announced a strategic partnership with Circle. According to the official release, the deal aims to expand USDC across Bybit’s trading, payments, and fiat on- and off-ramp services.

This move comes while USDC’s market cap sits near $76.0 billion and daily trading volume remains robust, reflecting growing demand for a stable, regulated digital dollar alternative.

What the Bybit Circle Partnership Covers

Better Trading Conditions Via Stablecoin Liquidity

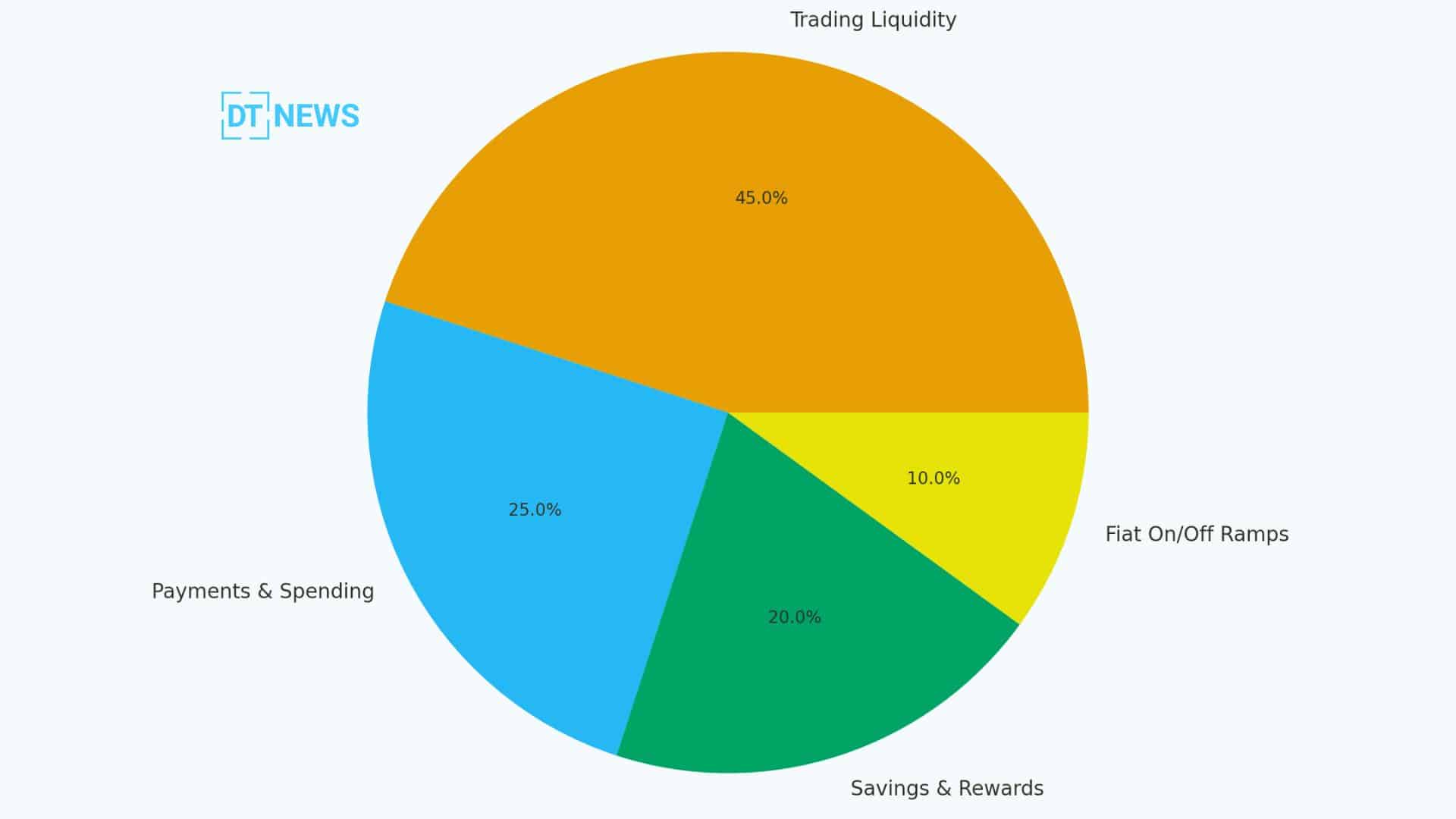

With this agreement, Bybit commits to improving USDC liquidity across both spot and derivatives markets. That should allow traders, retail, and institutional to access deeper order books and tighter price spreads on USDC pairs.

USDC adoption under this partnership will go beyond trading. Bybit said USDC will be available for payments, savings, and rewards. The stablecoin will integrate with Bybit Earn, Bybit Pay, and Bybit Card, giving users real-world ways to use USDC beyond speculation.

Easier Fiat On- and Off-Ramps for Global Users

The collaboration merges Circle’s fiat infrastructure with Bybit’s global user base. In various areas, that could mean transfers of local currency deposits and withdrawals happening both faster and more transparently.

Those features could make it easier for users in restricted crypto markets or with weaker banking systems to adopt stablecoins.

Regulatory Compliance and Infrastructure Growth

This partnership gains added strength as Bybit recently secured a full Virtual Asset Platform Operator license from the UAE regulators. This licensing enhances user trust and positions Bybit as a compliant platform for stablecoin services.

Further, Bybit joined Circle’s public testnet for its new blockchain network. Named Arc, explicitly designed for stablecoin-native finance. Arc launch took place in October 2025 and supports global collaboration on blockchain infrastructure.

What This Means for Crypto Users

- USDC-based trading pairs on Bybit may offer tighter spreads and more stable liquidity for traders.

- Users in regions with challenging fiat-crypto rails may find it easier to enter or exit crypto markets.

- USDC’s value could transform overnight beyond simply a speculative token to become an everyday money tool for payments, savings, and spending.

- This action may lead other exchanges and stablecoin projects to elevate their compliance game, ultimately leading to more trust in the overall crypto world.

Conclusion

USDC adoption appears ready for a fresh push. The Bybit Circle partnership realizes the united offering of stablecoin liquidity, fiat connectivity, and real-world use cases.

This whole approach has the potential to finally make USDC a digital dollar that doesn’t swerve on stability for global consumers in addition to fueling more upfront, useful and trustworthy crypto financial services.

Glossary of Key Terms

USDC: A stablecoin pegged 1:1 with the U.S. dollar through a treasury of U.S. dollars or equivalent assets. It seeks to retain stable value while providing transparency via periodic reserve attestations.

Stablecoin: A digital asset pegged to and meant to remain stable relative to a fiat currency.

Fiat On-Ramp / Off-Ramp: Services that allow users to easily buy and sell local (fiat) currency in exchange for crypto.

Liquidity: The ability to easily buy and sell an asset without causing price to change significantly.

FAQs About USDC Adoption

1: What does USDC adoption mean now for regular users?

It means easier access to a stable, dollar-backed crypto asset. Users may trade, save, and even spend USDC via exchange services and payment tools.

2: Is USDC any more trustworthy than other stablecoins?

USDC is backed by liquid assets, such as cash and cash equivalents that are held by the regulated financial institutions. It is subject to regular reserves audits, helping system users build trust.

3: Will this partnership affect other stablecoins?

It could. If USDC adoption grows significantly as a result of this deal, other stablecoin issuers may need to improve their compliance, liquidity, and transparency to remain competitive.

4: Does the Bybit Circle partnership restrict users to USDC only?

No. The partnership expands USDC offerings but does not signal exclusivity. Users will likely still have access to other assets and stablecoins.