This article was first published on Deythere.

- Buffett Doubles Down on Japanese Trading Houses

- Sumitomo’s Banking Arm Ties Buffett to Ripple

- Why Analysts Think Buffett XRP Is Happening

- Japan’s Crypto Adoption Soars, A Big Tailwind for XRP

- Could Buffett Actually Be Backing XRP Indirectly?

- Risks and Considerations

- Conclusion

- Glossary

- FAQs About Buffett XRP

- Q: Is Buffett buying XRP directly?

- Q: How does Sumitomo connect to Ripple?

- Q: Why is Japan important for XRP?

- Q: What are the risks of this strategy?

- References

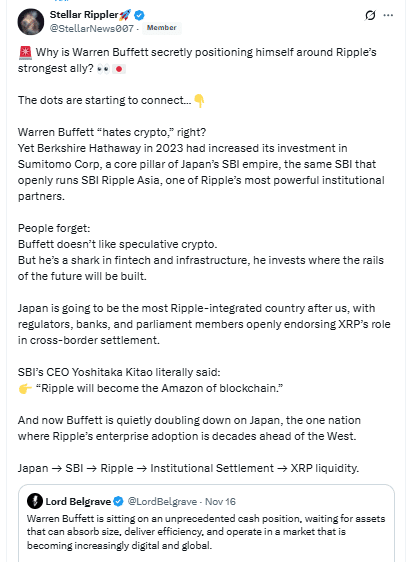

Warren Buffett’s growing investments in Japan may offer an indirect route into Buffett XRP, according to crypto analysts watching closely.

According to published reports, Buffett’s firm has raised its stakes in Japanese trading houses, putting it closer to SBI Holdings’ blockchain and Ripple-linked infrastructure.

Buffett Doubles Down on Japanese Trading Houses

Berkshire Hathaway has made substantial purchases of stock in five leading Japanese trading companies, Mitsui & Co., Mitsubishi, Sumitomo, Itochu, and Marubeni.

According to the regulatory filings these investments are currently between 8.5% and 9.8%, and Buffett has communicated that the corporation’s strategy is to keep its shares for an extended period.

Bloomberg reports that the average holding is about 9.3%, based on recent regulatory filings.

Buffett has also noted that Berkshire and these trading houses amended a prior 10% ownership cap, allowing for more flexibility in future growth.

Sumitomo’s Banking Arm Ties Buffett to Ripple

One of the most interesting pieces of the puzzle is Sumitomo Corporation, one of the five trading houses Buffett is backing. Its financial arm, Sumitomo Mitsui Banking Corporation (SMBC), is part of SBI Ripple Asia, a consortium of more than 60 Japanese banks that use Ripple’s technology for payments and settlement.

Analysts argue this structure could give Buffett a backdoor into Ripple’s network, highlighting the indirect Buffett XRP connection.

Why Analysts Think Buffett XRP Is Happening

- Utility over speculation: Analysts argue that Buffett is not placing a bet on volatile crypto like Bitcoin. Instead, he is investing in Ripple’s payment rails through traditional finance.

- Strategic alignment: Berkshire’s stake in Sumitomo allows it indirect exposure to Ripple’s settlement network without touching XRP tokens directly.

- Long-term play: Buffett’s style favors durable, cash‑flowing systems over hype. A Ripple-based payments network aligns with that philosophy.

Japan’s Crypto Adoption Soars, A Big Tailwind for XRP

Japan’s on-chain crypto activity has surged. According to a report, the country saw a 120% year‑on‑year increase in crypto value received during the 12 months up to June 2025.

Policy changes have played a significant role. Japan reformed key rules to provide crypto with greater legal clarity and relaxed stablecoin regulations, enabling greater institutional and retail adoption.

These shifts make Japan an even more attractive market for Ripple and XRP, and analysts suggest that Buffett XRP could indirectly benefit if Berkshire’s investments align with this growing crypto infrastructure, especially for cross-border payments or stablecoin-based flows.

Could Buffett Actually Be Backing XRP Indirectly?

- Buffett’s indirect route: Rather than buying XRP, Buffett puts money into companies (like Sumitomo) tied to Ripple’s network.

- Institutional confidence: If Buffett backs infrastructure, it could validate Ripple’s business model with a broader audience.

- Long-term upside: The longer the Japanese banks stick to Ripple tech, the more the need for credible settlement (and probably XRP) might increase.

Risks and Considerations

- Buffett may never buy XRP tokens; this could remain purely an infrastructure play.

- Regulatory changes in Japan or globally could alter the economics of Ripple-based payments.

- Even if Buffett is indirectly supporting Ripple, that does not guarantee an immediate price impact for XRP.

Conclusion

Buffett’s Japan investments may hide a Buffett XRP angle. By backing Sumitomo and other trading houses, he gains exposure to SBI’s Ripple infrastructure without directly holding crypto. In addition, the shift in payment methods in Japan’s crypto market towards a more friendly usage will eventually make this decision a great one.

Glossary

- Sogo Shosha: Large Japanese trading companies active across many sectors.

- SBI Ripple Asia: Consortium of Japanese banks using Ripple’s blockchain for payments.

- SMBC: Sumitomo Mitsui Banking Corporation, a major bank in Japan.

- On‑chain value: The total value of transactions recorded on a blockchain network.

- Bridge currency: Digital asset used to facilitate cross-border value transfers.

FAQs About Buffett XRP

Q: Is Buffett buying XRP directly?

No. Evidence suggests his exposure comes through Sumitomo Corporation and its banking ties to Ripple, not through direct purchases of XRP.

Q: How does Sumitomo connect to Ripple?

Sumitomo’s banking arm, SMBC, is part of SBI Ripple Asia, which builds real-time cross-border payment infrastructure on Ripple’s tech.

Q: Why is Japan important for XRP?

Japan’s crypto adoption has surged (120% YoY), and regulatory reforms support payment systems that could use Ripple’s technology, boosting XRP’s potential utility.

Q: What are the risks of this strategy?

Buffett’s move may never involve XRP tokens. Regulatory shifts or changes in Ripple’s business could also affect its long-term value.