Based on the latest reports, a Satoshi-era whale stirred up a sell-off across the Bitcoin market on Tuesday after moving 80,000 BTC, worth over $8.8 billion from storage (to 8 different wallets) for the first time in 14 years. The activity sent trembling through the crypto space with Bitcoin price dropping 5.6% right after, falling under $117,000 from its earlier high, triggering widespread liquidation alerts.

- A Dormant Wallet Wakes Up and the Market Reacts

- Immediate Price Impact: Bitcoin Dips to $116,700

- OTC Deal or Exit? Analysts are Divided

- Ripple Effects: Other Whales Follow the Lead

- Conclusion: Is the Satoshi-era Whale Done Selling?

- FAQs

- Who is the Satoshi-era whale?

- Did the whale sell all 80,000 BTC?

- Why did Bitcoin drop below $117K?

- Are more BTC sales expected?

- What role did Galaxy Digital play?

- Glossary

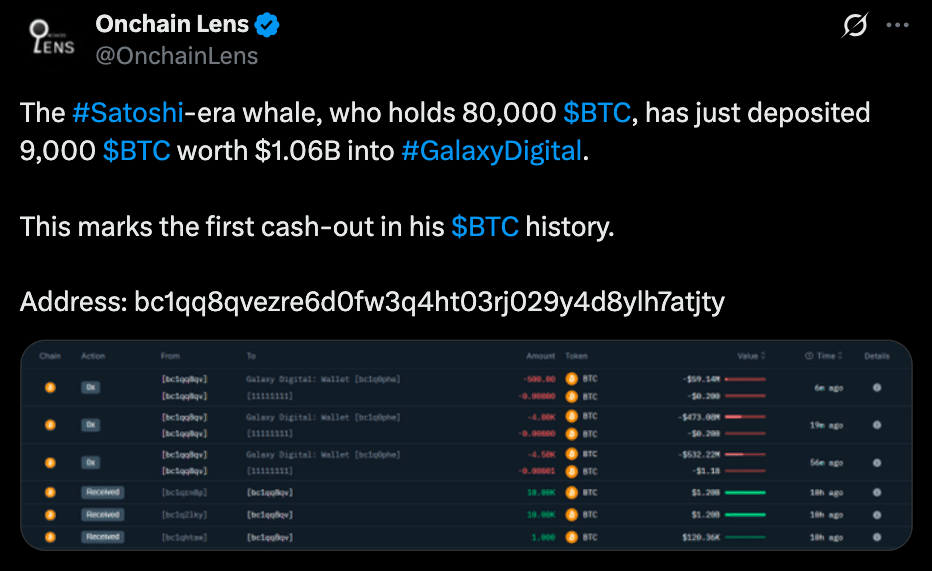

On-chain data shows 16,843 BTC have already been deposited with institutional firm Galaxy Digital, and some have been routed to Bybit and Binance, but analysts warn the full impact may not be over.

A Dormant Wallet Wakes Up and the Market Reacts

The reactivation of the Satoshi-era wallet with a full 80,000 BTC stunned even veteran blockchain analysts. According to Arkham Intelligence and Lookonchain, the wallet in question: bc1qq8…had not moved funds since its creation over 14 years ago. Reports showed that the whale started moving 4,500 BTC in batches to Galaxy Digital on Tuesday morning, valued at around $536 million in the first wave.

In the hours that followed, multiple new transactions were tracked: 4,000 BTC and 500 BTC in the second wave. Three more transactions of 2,043 BTC, 3,000 BTC and 2,800 BTC.

Total known transfers are 16,843 BTC or over $2 billion making this one of the largest movements of dormant Bitcoin in history.

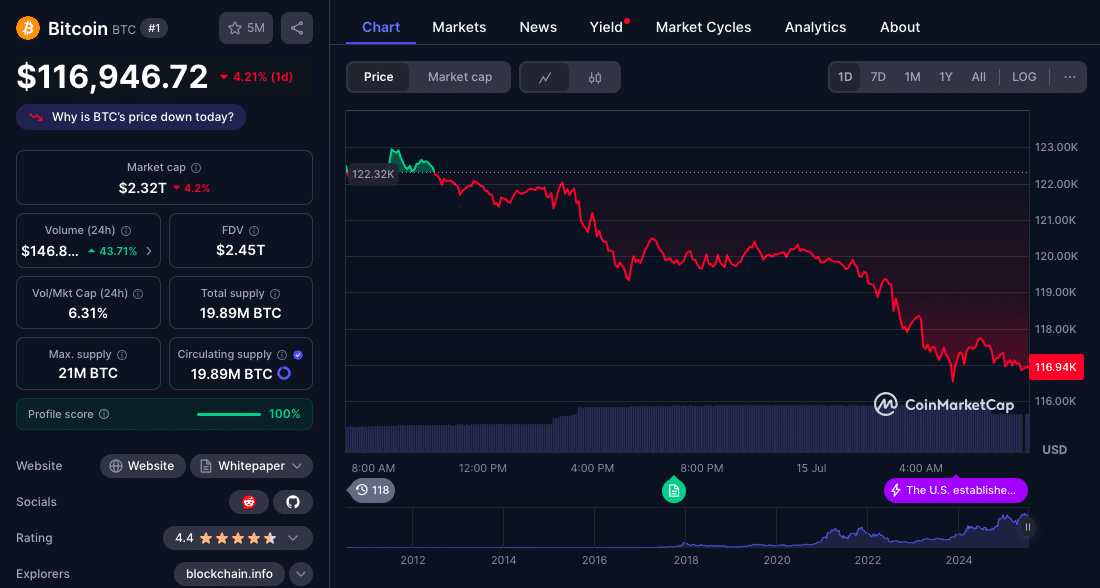

Immediate Price Impact: Bitcoin Dips to $116,700

Just after the Satoshi-era whale moved, Bitcoin dropped more than $6,000 from just above $123,000 to $116,718. CoinGlass data showed a big drop in BTC futures open interest, down 2% to $86.04 billion in 4 hours. Open interest on CME and Binance dropped even further, by 2.27% and 2.68% respectively, indicating bearish sentiment among institutional and retail derivatives traders.

As at the time of this writing, BTC trades at $116,946.

OTC Deal or Exit? Analysts are Divided

Although the BTC has gone through Galaxy Digital, an OTC trading desk that facilitates large private sales without slippage, not all analysts are convinced a full dump is underway.

Blockchain analyst Charles Edwards from Capriole Investments told sources:

“The fact that these coins went through Galaxy likely means OTC settlement, which means minimal exchange pressure… But the optics are bearish.”

Lookonchain confirmed that Galaxy Digital has deposited BTC on Binance and Bybit so at least some of the coins are entering liquid markets.

Ripple Effects: Other Whales Follow the Lead

The Satoshi-era whale’s sudden activity has spooked other long-term holders. Whale wallet 0x960B flipped from long to short on Bitcoin immediately after the first transfers and locked in $228,000 in gains. This is an isolated incident but may be the start of a psychological domino effect.

It can’t be known for sure why the whale sold but the timing is interesting. July 15 is also the day of U.S. inflation data, an important metric that will influence the Fed in the coming weeks. With macro liquidity still uncertain, the whale may have front-run the volatility.

Also, the Bitcoin spot ETF market has seen huge inflows in the last weeks. Analysts note that U.S.-based ETFs have added $3.4 billion in Bitcoin exposure in the last 30 days and pushed BTC above $120K. A big sell from a dormant holder during a rally could be to lock in generational gains before volatility resumes.

Conclusion: Is the Satoshi-era Whale Done Selling?

Despite moving 16,000 BTC the original wallet still holds 3,157 BTC worth $371 million so more could be coming.

Analysts are watching three things to see near-term direction: More deposits from Galaxy Digital; On-chain alerts for whale movement clusters; Shifts in open interest and funding rates in derivatives markets.

If nothing happens for a while, it will help to restore confidence, but for now traders are cautious.

Summary

A Satoshi-era whale moved 80,000 BTC worth over $8.8 billion on July 15, causing market panic. After sending 16,843 BTC to Galaxy Digital, Bitcoin dropped 5.6% to $116,718, with derivatives open interest down 2%. Some funds went to Binance and Bybit, but most remain untouched. Analysts think this is OTC-based repositioning, not a dump. On-chain data shows 3,157 BTC still held, and no further exchange inflows yet.

FAQs

Who is the Satoshi-era whale?

The wallet is over 14 years old and associated with early Bitcoin mining. Identity unknown.

Did the whale sell all 80,000 BTC?

No. 16,843 BTC were moved to Galaxy Digital, but over 63,000+ BTC are in new wallets.

Why did Bitcoin drop below $117K?

Market panic from the whale activity and BTC futures open interest drop.

Are more BTC sales expected?

The wallet still has over 3,000 BTC. More movement possible but not confirmed.

What role did Galaxy Digital play?

Galaxy was the OTC desk for the whale’s transfers and routed some to Binance and Bybit.

Glossary

Satoshi-era whale – Someone who mined or acquired large amounts of Bitcoin in the early years (2009–2011) and has held them dormant.

OTC (Over-The-Counter) – Private trading between parties, often facilitated by brokers like Galaxy Digital, to avoid slippage on exchanges.

Open Interest (OI) – Total value of outstanding contracts in derivatives markets. OI dropping means less speculation.

Galaxy Digital – A crypto-focused financial services firm offering institutional OTC, custody and investment products.