To redefine state-level financial strategies, Ohio is stepping into the crypto arena with a proposal to establish its own Bitcoin reserve. Introduced by State Senator Sandra O’Brien recently, Senate Bill 57 authorizes the state treasurer to invest public funds exclusively in Bitcoin, creating the “Ohio Bitcoin Reserve Fund.” If enacted, this legislation would position Ohio at the forefront of cryptocurrency adoption among U.S. states.

- Ohio’s Vision: A Five-Year Bitcoin Commitment

- Beyond Investment: Embracing Bitcoin in State Transactions

- A Growing Trend: States Exploring Bitcoin Reserves

- National Momentum: Federal Support for Cryptocurrency

- Conclusion: Ohio at the Forefront of a Financial Revolution

- Glossary of Key Terms

Ohio’s Vision: A Five-Year Bitcoin Commitment

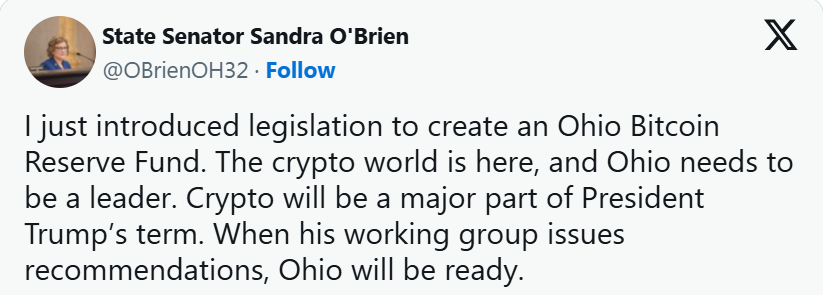

Senate Bill 57 mandates that any Bitcoin acquired must be securely stored for at least five years, reflecting a long-term commitment to the digital asset. Senator O’Brien emphasized the importance of proactive engagement with emerging financial technologies, stating,

“The crypto world is here, and Ohio needs to be a leader.”

She further highlighted Ohio’s need to align with potential federal-level crypto policies, especially given President Donald Trump’s growing interest in digital assets.

Beyond Investment: Embracing Bitcoin in State Transactions

The proposed legislation extends beyond mere investment. It proposes that Ohio state agencies and government entities accept Bitcoin for various payments, including taxes, fees, and fines. Once received, these funds would be converted into Bitcoin and stored in the reserve. Additionally, the bill encourages Ohio residents, state agencies, and universities to donate Bitcoin to the fund, suggesting creating a recognition program to honor major contributors.

A Growing Trend: States Exploring Bitcoin Reserves

Ohio is not alone in this endeavor. In December 2024, Ohio House Republican leader Derek Merrin introduced House Bill 703, known as the Ohio Bitcoin Reserve Act, which similarly seeks to authorize the state treasurer to invest in Bitcoin. Merrin argued that the devaluation of the U.S. dollar necessitates exploring alternative assets like Bitcoin to protect public funds.

Beyond Ohio, other states are also considering similar measures. Utah, for instance, is leading the charge to approve a strategic Bitcoin reserve, potentially setting a national precedent. As of now, more than a dozen U.S. states are contemplating legislation to establish Bitcoin reserves, signaling a broader shift toward cryptocurrency adoption at the state level.

National Momentum: Federal Support for Cryptocurrency

The movement at the state level aligns with growing federal interest in cryptocurrency. U.S. Representative French Hill recently announced the formation of a bipartisan working group within Congress to develop policies favoring the growth of digital assets. This initiative aims to provide clarity on a regulatory framework for cryptocurrencies, reflecting a more supportive environment for the crypto industry compared to previous administrations.

Conclusion: Ohio at the Forefront of a Financial Revolution

Ohio’s proposed Bitcoin Reserve Bill represents a significant step toward integrating cryptocurrency into state financial operations. By embracing Bitcoin, Ohio aims to hedge against inflation, diversify its asset portfolio, and position itself as a leader in technological innovation. As more states consider similar legislation, the landscape of public finance in the U.S. could transform, with digital assets playing an increasingly central role.

FAQs on Ohio’s Bitcoin Reserve Bill

1. What is Ohio’s Bitcoin Reserve Bill (Senate Bill 57)?

Ohio’s Bitcoin Reserve Bill proposes allowing the state treasurer to invest public funds in Bitcoin. The Bitcoin would be securely held for at least five years, creating the “Ohio Bitcoin Reserve Fund.”

2. Can Ohio residents pay taxes with Bitcoin under this bill?

Yes! The bill suggests that Ohio state agencies and government entities accept Bitcoin for payments like taxes, fees, and fines. These funds would then be converted and stored in the reserve.

3. How does this bill compare to other states’ crypto plans?

Ohio is one of several U.S. states considering Bitcoin reserves. Utah, Arizona, and at least 12 other states are exploring similar legislation to invest in and accept cryptocurrency.

4. Why is Ohio pushing for a Bitcoin reserve?

Lawmakers argue that Bitcoin can serve as a hedge against inflation and U.S. dollar devaluation. Senator Sandra O’Brien believes Ohio must lead in crypto adoption and align with potential federal policies under a pro-crypto administration.

Glossary of Key Terms

Bitcoin Reserve Fund – A state-managed fund where Bitcoin is stored as a financial asset.

Senate Bill 57 (SB 57) – The Ohio legislation proposes establishing a Bitcoin reserve and allowing Bitcoin payments for taxes.

Cryptocurrency Adoption – The process by which governments and institutions integrate digital currencies into financial systems.

Fiat Currency – Traditional government-issued money (like the U.S. dollar) that is not backed by a physical commodity like gold.

Digital Asset Investment – The act of allocating funds to cryptocurrencies or blockchain-based assets for financial growth.

Inflation Hedge – An investment strategy used to protect against the loss of purchasing power due to inflation, often associated with Bitcoin.