According to latest reports, a new $1 billion BNB treasury initiative engineered by former Bitmain executives under the banner of B Strategy is about to launch in the US, backed by Binance co-founders via their investment arm, YZi Labs. Meanwhile, experts believe $BNB’s price is moving in line with this growing trust, heading towards four figures.

A Calculated Launch with Institutional Roots

B Strategy is setting up the first US-listed company to hold and re-invest BNB, modelled after traditional investment giants like Berkshire Hathaway. Co-founder Leon Lu sums the mission up simply as “maximise BNB per share”.

Sources claim Institutional investors, especially family offices tied to BNB’s founder Changpeng Zhao (CZ) have already anchored the raise. YZi Labs is behind not only this B Strategy fund but also 10X Capital’s earlier funding for a similar US listed BNB treasury vehicle.

Also read: BNB Breaks Out: $1.25B Fund Launch Fuels New All-Time High

A Corporate Movement: $BNB as a Reserve Asset

$BNB’s corporate adoption seems to be accelerating. Few months back, CEA Industries formed BNB Network Company and bought 200,000 BNB; roughly $160 million, to build a reserve targeting $1.25 billion in BNB holdings.

Meanwhile, Nano Labs publicly disclosed a plan to buy up to $1 billion in BNB to claim 5-10% of circulating supply, and Windtree Therapeutics allocated nearly all its new capital to BNB reserves, according to reports.

Even before all this, hedge fund veterans were preparing to launch Build & Build Corporation on Nasdaq, turning a shell company into BNB’s “MicroStrategy counterpart” with a $100 million treasury allocation.

Momentum and Market Pulse: What This Means for Price

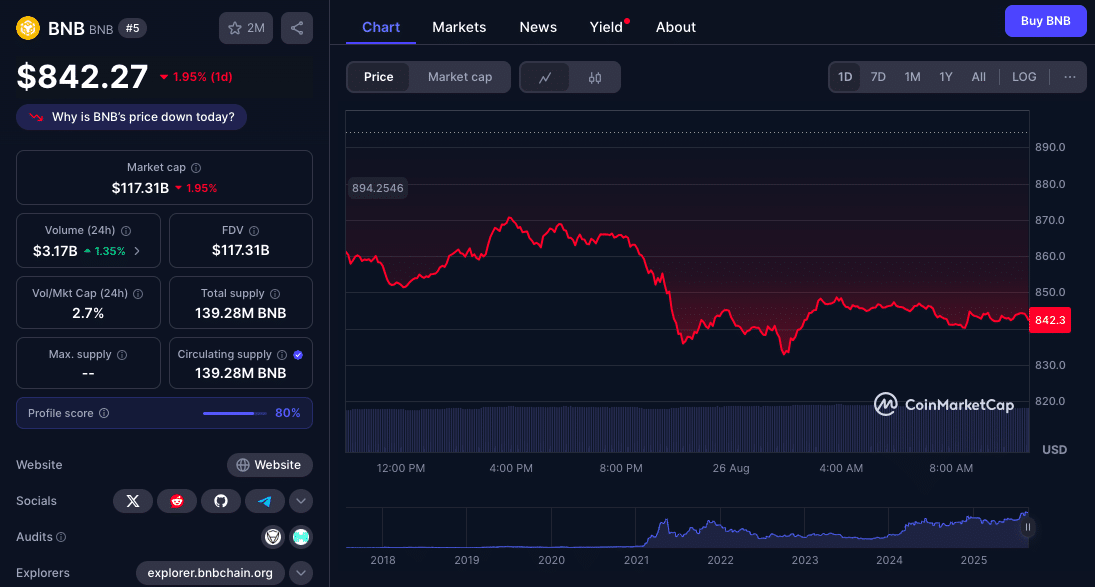

$BNB is standing strong. After hitting all time highs;, its market cap has gone over $110 billion. Market data shows rising open interest of over $1.23 billion in futures, with positive funding rates.

Technical analysis shows $BNB in an ascending triangle, with a possible breakout above $865. Analysts see targets at $900-$951 if it clears resistance, and volume metrics show whale accumulation not sell offs.

Other forecasts expect more upside. Momentum to $900-$950 is expected in weeks, and $1,000+ if breakout and institutional buying continues.

Why BNB’s Infrastructure Strength Matters

LN2 Robson analysis shows opBNB; the Layer-2 solution on BNB Chain; hit 3.08 million transactions in a single day in mid August. That points to real activity behind the token, which is still central to stablecoins, DeFi, NFTs and real world asset tokenization.

All these backings from usage to institutional structuring are reinforcing the price narrative.

Also read: Binance Coin Price Prediction 2025-2026: Can BNB Hit $1,292

Conclusion

Based on the latest research, BNB treasury strategy might just be moving beyond speculation. Publicly traded BNB holding companies are becoming a reality. As this institutional push happens, $BNB price follows, and the momentum feeds back into itself.

With resistance at $900, technicals look good, but the bigger picture is governance, utility and access through regulated markets.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

A $1 billion BNB treasury is coming via B Strategy, backed by Binance co-founders through YZi Labs. It will list in the US and hold $BNB and re-invest in the ecosystem like Berkshire Hathaway holds equities. Other companies like Nano Labs, Windtree and CEA Industries are also building BNB treasuries.

Glossary

Ascending triangle – A bullish chart pattern that forms during uptrends; breakout above resistance often leads to gains.

Open interest – Total value of outstanding derivative contracts; rising OI on BNB means growing investor confidence.

opBNB – A Layer-2 scaling solution on BNB Chain, handling millions of transactions and showing real ecosystem usage.

BNB treasury strategy – A corporate approach to holding and managing BNB as a reserve asset, often in a public or regulated structure.

FAQs

What is the B Strategy BNB treasury?

A US listed company designed to hold $BNB as an asset and re-invest in the ecosystem, backed by YZi Labs and anchored by CZ affiliated family offices.

Are there other BNB treasuries?

Yes. Nano Labs, Windtree Therapeutics and CEA’s BNB Network Company are among the firms building large holdings.

What’s driving $BNB price?

Institutional participation, technicals (ascending triangle), open interest and on-chain usage.

Can BNB hit $1,000?

Analysts say yes with sustained breakout and momentum; many moderate models have $BNB between $800-$1,100 by end of 2025.