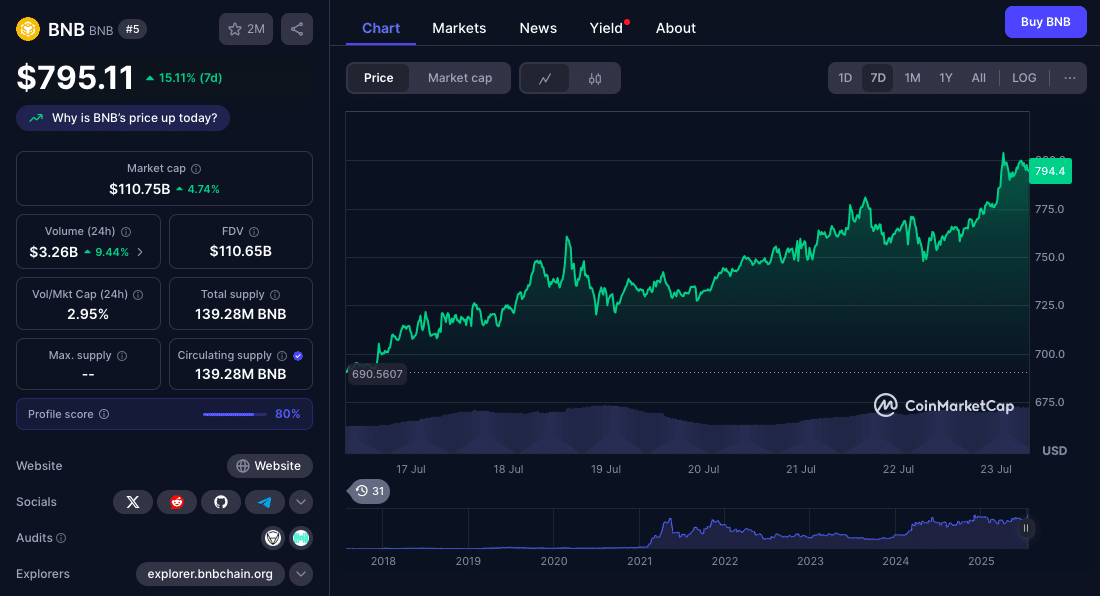

BNB, the native token of BNB Chain, just broke its all-time high, reaching $801 during early Asian trading on July 23. This was accompanied by a 4% daily and 14% weekly gain, driven by increased buying volume and institutional demand. But what exactly lies ahead?

- Bull Case: $1,100 by November If Institutional Backing Holds

- Bear Case: Overheating Could Cause a Pullback to $705

- Expert BNB Price Prediction for Q3–Q4 2025

- Conclusion

- FAQs

- Why is institutional accumulation important for BNB?

- Can BNB reach $1,100 before November?

- Is a pullback likely?

- What’s the importance of 20 day SMA?

- Glossary

Experts are speculative as to what comes next for BNB price prediction. Can the price momentum continue till the end of Q4? As at the time of this writing, BNB has had a little retracement to $795.

Bull Case: $1,100 by November If Institutional Backing Holds

Institutional investment has been the most important drivers of BNB’s recent rally, pulling the major weight. Chinese Web3 firm Nano Labs Ltd announced they acquired 120,000 BNB ($90 million) via OTC, showing strong corporate confidence. This is similar to what has been seen with Bitcoin-inspired portfolios, suggesting that BNB could be adopted as a reserve asset.

Certain experts like Coincodex are very bullish, they predict BNB could reach $1,100 by November 2025 if the momentum and institutional support continues. Technical strength supports this view as BNB remains above its 20-day Simple Moving Average (SMA) of $705, with increasing volume, confirming the price strength.

A continued move past the current price level could take prices to the $850 level, then $900, and then a new all-time high.

Bear Case: Overheating Could Cause a Pullback to $705

Despite the optimism, there are warning signs. BNB’s daily RSI is 87.5, which is way above the overbought threshold of 70. This might be short-term exhaustion. Also, BNB briefly traded above the upper Bollinger Band, a classic sign of a pullback.

Without new catalysts, BNB’s strength at these levels is uncertain. A short-term correction could test the support zones, including the 20-day SMA ($705) or a more conservative $740 level.

Derivatives data shows high speculation. Futures open interest ($1.23 billion) and daily derivatives volume ($2.18 billion) surged with the price. This is often a sign of volatility to come.

Expert BNB Price Prediction for Q3–Q4 2025

| Source | Q3 Target | Q4 Target | Commentary |

| CoinCodex | $884 (±5%) | $1,106 | Forecast algorithm based on technicals, momentum, and sentiment |

| WalletInvestor | $797 in 2 weeks | — | Short-term bullish projection |

| BlockchainReporter | $700 breakout | $700+ | Noted institutional accumulation; sees Q3–Q4 as key period |

| CoinJournal | Bulls eye $1,000+ | — | Highlights environment supportive of new ATH |

| Standard Chartered | — | bull case $2,775 | Longer-term projection; underscores BNB’s ecosystem strength |

Analyzing the table above; for Q3 outlook, all short-to-mid term forecasts are bullish, projecting a price between $700–$900, momentum to continue. For Q4 outlook: Higher end forecasts go to $1,100 but that’s dependent on institutional inflows and broader crypto market stability.

CoinCodex vs WalletInvestor shows different models, a medium term momentum vs short term technical.

BlockchainReporter is looking at structural support while Standard Chartered is looking at long term ecosystem strength, framing BNB as a strong asset beyond short term cycles.

Conclusion

Based on the latest research, BNB price prediction case depends on deepening institutional adoption and technical strength. $1,100 by winter is possible if momentum and macro factors align. However, overbought signals warn against irrational exuberance because a pullback to $705–$740 is still a realistic scenario.

The next few weeks will tell if BNB consolidates the breakout or retrace to refresh the uptrend. Also read the long term BNB Price prediction here.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

BNB recently hit a new high of $801, riding institutional inflows and high trading volume. Nano Labs $90m takeover and CoinCodex’s bullish forecast points to $1,100 by November 2025. But overbought indicators (RSI 87.5) and price testing upper Bollinger Bands means near term exhaustion. If performance stalls, BNB may correct to 20 day SMA ($705) or $740.

FAQs

Why is institutional accumulation important for BNB?

Institutional interest brings long term capital and stability, big price moves and asset legitimacy.

Can BNB reach $1,100 before November?

If momentum and institutional accumulation holds, as per CoinCodex’s forecast.

Is a pullback likely?

Overbought indicators like RSI and Bollinger Bands means short term retracement to $705–$740 is possible.

What’s the importance of 20 day SMA?

It’s a dynamic support level, above it keeps the bullish structure intact.

Glossary

RSI (Relative Strength Index): Momentum indicator 0–100; above 70 is overbought.

SMA (Simple Moving Average): Average price over a period; used to identify trends and support/resistance.

Open Interest (OI): Total value of open futures contracts; market sentiment and risk exposure.

Bollinger Bands: Volatility bands above and below SMA; above means overheating, below means oversold.

Psychological Level: Round number price points that affect trader behavior ($850).