This article was first published on Deythere.

- Recent Price Action and Technical Setup

- What the Experts Predict for December 2025 and Early 2026 Price Forecast

- Bull, Base and Bear Cases for BNB

- What Might Trigger BNB’s Next Move: Catalysts to Watch

- Conclusion

- Glossary

- Frequently Asked Questions About BNB Price Forecast

- Is $BNB really expected to hit $1,200 in a month?

- What is the most probable price range for $BNB by the end of December 2025?

- What could derail $BNB’s rally?

- Is the price affected by on-chain metrics or ecosystem expansion?

- Should traders expect volatility?

- References

Binance coin (BNB) seems to be experiencing a solid price rise. Having dipped below $1,000 earlier, the cryptocurrency has displayed signs of strength again. A fresh analysis shows a double-bottom pattern and falling wedge breakout that could bring $BNB back to the $1,000 level this December.

A number of analysts have been forecasting increasingly bullish targets in the low $1,000s over the next few weeks, ranging from modest rebounds up to around $920-$940 to more ambitious ranges encompassing prices as high as $1,100 and possibly even approaching $1,200 if critical resistance levels are overcome.

Recent Price Action and Technical Setup

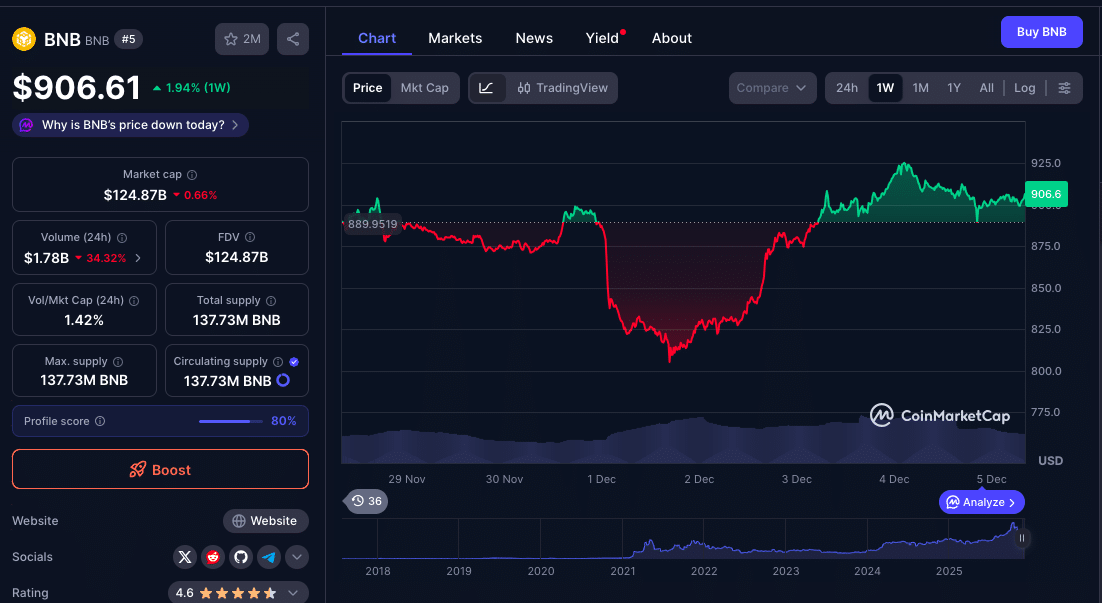

$BNB is trading at the $900 range, up from a bottom of $800 in the last month.

Technical signals lend credibility to the bullish case for a December rebound. As reported by experts, a double-bottom structure near $800-$820 has printed alongside a falling-wedge breakout giving $BNB strength to break the $910.

A good number of analysts support this, with one recent analyst noting that $BNB will likely reach between $920-940 by 2025 based on the current trajectory and as long as a crucial level of support at $875 is not broken.

However, $BNB is still within striking distance of resistance levels, most notably as high as $950 and other psychological level at the $1,000 price point, so any potential rally would need strong buying volume to push through both of those obstacles.

What the Experts Predict for December 2025 and Early 2026 Price Forecast

Here’s a look at some, recent technical analyst and market-forecast predictions for $BNB’s long-to-short-term price range.

| Source / Analyst | Target Price | Time Horizon | Conditions |

| Trading-view analysis | $1,020-$1,115 | December 2025 | Based on double-bottom + wedge breakout from $800-820. |

| Blockchain News | $1,150 | 4-6 weeks | Requires breakout above $950 and strong volume. |

| Blockchain News | $1,100-$1,150 | Medium-term (weeks) | Assumes bearish momentum weakens; strong support around $860. |

| MEXC | $950-$1,020 | 3-4 weeks | If BNB reclaims $950, bulls may push toward $1,020. |

| More conservative end-of-year baseline | $920-$940 | By the end of December 2025 | Base-case if markets stay neutral and support holds. |

These are the estimates and they depend heavily on technical breakouts, wallet volumes, broader market trends etc.

Bull, Base and Bear Cases for BNB

In the Bull Case, if $BNB can maintain support at the $875-$900 level, pierce through resistance at $950, and given a broader crypto market move in terms of pushing higher prices, a move toward somewhere around $1,100-$1,150 is plausible before year-end.

Confirming technical signals (RSI growing, MACD bullish crossover) and the increasing demand could ignite a short squeeze that would push $BNB above $1,200.

In the Base Case, for the rest of 2025, $BNB consolidates around $920-$940. The coin doesn’t reach $1,000 but it settles on support and remains neutral to slightly bullish. This supports initial prospects of limited upside without some market catalyst.

In the Bear Case, If $BNB is unable to hold onto key support areas, in particular at the $875 level, and market sentiment moves bearish for a while, it’s possible $BNB price will meander back toward somewhere between $790-$860.

In that case, resistance could be stiff around $950 and $1,000, while sentiment will continue to manage the downside into early 2026.

What Might Trigger BNB’s Next Move: Catalysts to Watch

Whichever way $BNB goes, be it towards or away from) $1,000 may come down to wider crypto market momentum as movement from Bitcoin and Ethereum tends to spill over into BNB.

Volume and Liquidity are also factors as breakout attempts need high volume to break resistance.

Growth of BNB Chain usage, burns, or ecosystem developments may rekindle interest.

Macroeconomic sentiment, regulatio,n and risk appetite also apply to speculative assets at large.

Conclusion

December 2025 presents another opportunity for $BNB. Technical signals point to a possible rebound toward $1,000, a psychological and technical barrier.

Forecasts of experts are concentrated in the range between $920 and $1,150, suggesting reserved enthusiasm as well as a more forceful bullish forecast.

Also, success depends on volume and holding of support, as well as if the crypto market sees tokens rallying.

There is a slight possibility that $BNB will be able to return into the positive zone ahead of 2026. But with a lack of follow-through in either support or volume, the possibility turns to a bearish consolidation.

Glossary

Double-bottom: A type of chart pattern that indicates a significant bottom followed by a strong resistance level after two equal lows, which usually precedes upward movements in prices.

Falling wedge: Bullish reversal pattern where price squeezes lower within a wedge and eventually breaks out higher.

Resistance: A level at which it is more common for an increase in momentum to halt because of selling.

Support: A level from which the price gently tends to rise or at least retraces with less strain.

Frequently Asked Questions About BNB Price Forecast

Is $BNB really expected to hit $1,200 in a month?

Under bullish conditions, $BNB could hit $1,100-$1,150 provided there’s high volume, market sentiment is positive, and there’s a technical breakout.

What is the most probable price range for $BNB by the end of December 2025?

Forecasts range from $920 to $940; the bull scenario is more optimistic, with a target of $1,050-$1,150.

What could derail $BNB’s rally?

A break below the support levels ($875-$900), general weakness in crypto markets, and lackluster trading momentum could bring a rally failure end with a move lower to $790-$860.

Is the price affected by on-chain metrics or ecosystem expansion?

Yes. Increased activity on BNB Chain, token burns, and new developments tend to be supportive of demand; this could help $BNB maintain upward momentum.

Should traders expect volatility?

Absolutely. With major resistance zones and mixed sentiment, $BNB is susceptible to swings. Careful risk management is advised.