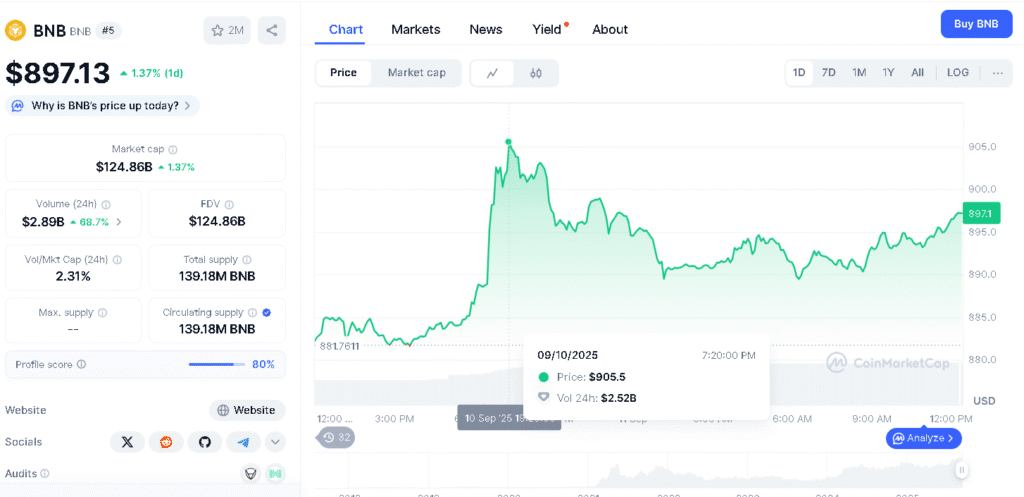

According to sources, BNB all-time high touched $907.38 on September 10 after Binance announced its partnership with Franklin Templeton to work on tokenization products for global markets. This new record makes $BNB one of the best-performing assets of 2025, showing strong support from institutions and rising adoption in the crypto space.

What triggered BNB’s new surge?

BNB all-time high came as the broader market added $100 billion in value within 24 hours, taking total crypto capitalization beyond $4 trillion. Traders connected the rally to fresh U.S. Producer Price Index data showing inflation easing to 2.6%, below forecasts.

Analysts said the lower inflation figure made a September rate cut by the Federal Reserve more likely. This led investors to put more money into risk assets such as $BTC, $ETH, and $BNB.

Also read: BNB Breaks Out: $1.25B Fund Launch Fuels New All-Time High

How does the Franklin Templeton deal strengthen Binance?

The BNB all-time high coincided with Binance’s new alliance with Franklin Templeton, a $1.6 trillion asset manager. The collaboration aims to develop blockchain-based tokenized products by combining Franklin’s regulatory experience with Binance’s global trading infrastructure.

Franklin Templeton EVP Roger Bayston explained that the goal is to deliver breakthrough investment products. These products are designed to meet institutional and retail demands at scale.

| Metrics | Value |

| BNB All-Time High | $907.38 on September 10, 2025 |

| Year-to-Date Gain | +29% (2025) |

| Institutional Asset Manager | Franklin Templeton ($1.6 trillion AUM) |

| Market Cap of BNB | Over $120 billion |

| Macro Trigger | US PPI inflation eases to 2.6% |

| Key Technical Price Level | $1,000 next |

Why does tokenization matter for institutional adoption?

Tokenization is moving from concept to mainstream, with Franklin Templeton already running its Benji platform for digital securities. By partnering with Binance, Franklin expands its reach and gives investors more ways to access tokenized assets.

Experts believe this shift could speed up the institutionalization of crypto markets. Sandy Kaul, Franklin Templeton’s Head of Innovation, said that tokenization is becoming an institutional-grade strategy rather than an experimental idea.

How does BNB compare to other major cryptocurrencies?

BNB all-time high shows a sharp contrast to the negative performances of many other crypto sectors in 2025. The token gained 29% this year and 191% since 2024, while 22 tracked sectors, including $BTC and $ETH, posted an average fall of almost 29%.

Analysts say this makes BNB the only asset from the 2017 cycle that continues to post new records in 2025. Traders on Reddit pointed out that BNB remains in its own league and outshines the heavyweights.

Also read: Binance-Backed B Strategy Unveils $1B BNB Reserve Amid Explosive Demand

What does this mean for investors going forward?

Market participants are closely watching whether BNB all-time high levels can stay above $900. Some traders believe that Binance’s strong focus on tokenization could give solid support to $BNB’s value.

Catherine Chen, Head of VIP & Institutional at Binance, said that the partnership cements Binance’s role as a bridge between digital assets and traditional capital markets. This shows how the exchange is working to link the two financial worlds.

Conclusion

Based on the latest research, BNB all-time high reflects not only favorable macroeconomic conditions but also the growing link between crypto and traditional finance. With Binance and Franklin Templeton working together, tokenization is moving into a new stage of adoption.

For investors, $BNB’s record is more than just a price milestone. It marks a wider shift in how digital assets will be built and offered in the years to come.

Summary

BNB all-time high reached $907 after Binance announced a major partnership with Franklin Templeton, a $1.6 trillion asset manager. The deal focuses on building tokenized products by combining Franklin’s regulatory expertise with Binance’s trading power.

Analysts link the price surge to lower U.S. inflation data, which boosted investor confidence in crypto. BNB all-time high also stands out as the token gained strongly in 2025, making it one of the top performers compared to $BTC and $ETH.

Get the latest news on crypto partnerships and coins hitting all-time highs only on our platform

Glossary

BNB all-time high – The record price BNB has reached.

Tokenization – Turning real assets into digital tokens.

Franklin Templeton – A big global investment company.

Market cap – Total value of all crypto coins.

Rate cut – When interest rates are lowered.

FAQs for BNB all-time high

1. Why did BNB jump to $907?

Because of lower inflation data and the Franklin Templeton deal.

2. How does Franklin Templeton help Binance?

By adding trust and support for new token projects.

3. What is tokenization in simple words?

It means making real-world assets tradable as digital tokens.

4. Is BNB doing better than other coins?

Yes, BNB is rising while many others are down.

5. Can BNB pass $1000 soon?

It’s possible if demand keeps growing.

6. What does this mean for investors?

It shows BNB is becoming stronger in both crypto and finance.