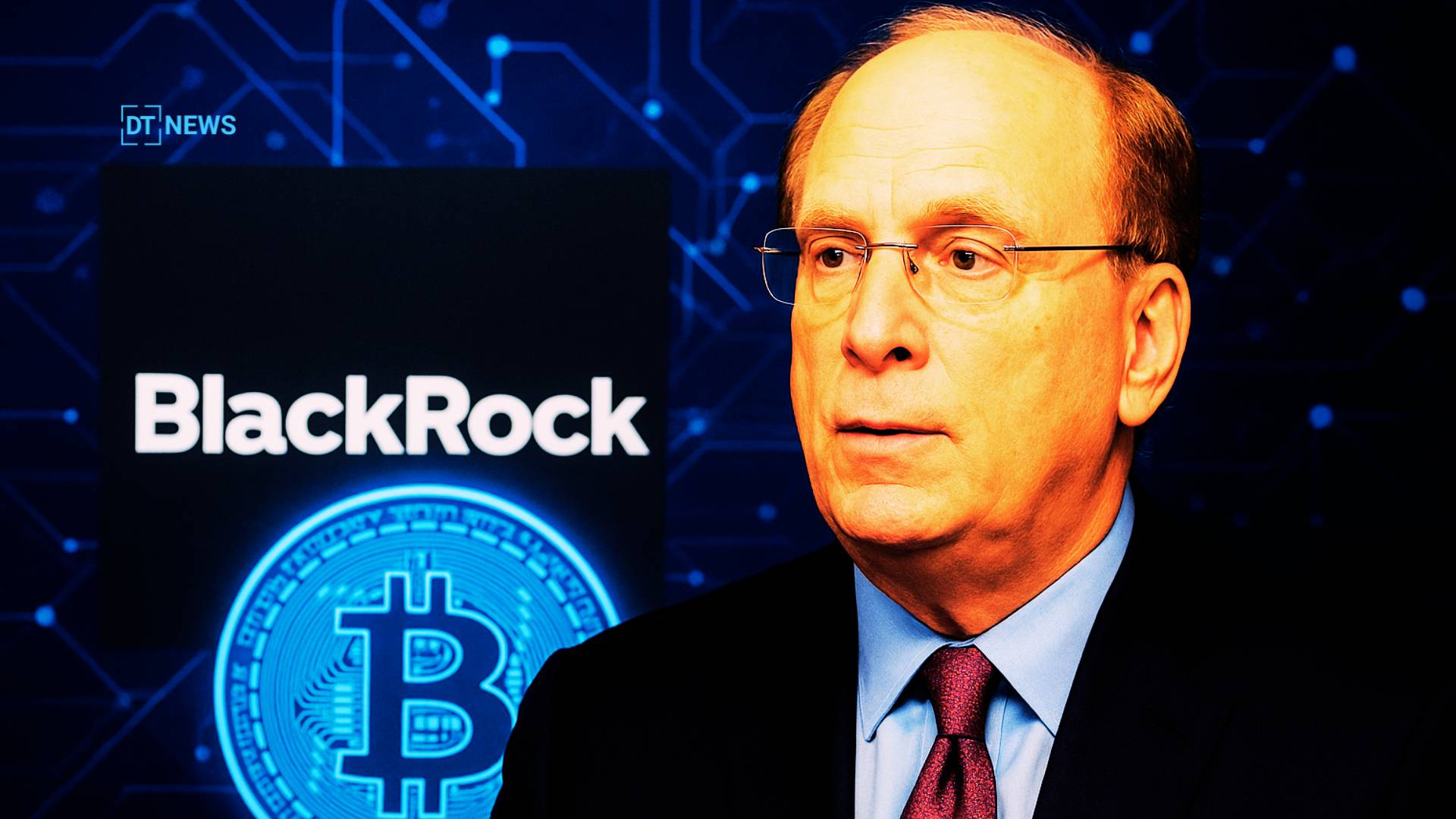

According to sources, the talk about BlackRock tokenization has moved beyond just ideas and is now being put into action. In a recent interview on Squawk on the Street, BlackRock CEO Larry Fink said the company is changing its strategy by moving traditional assets into digital formats.

- How is BlackRock tokenization shaping the future of asset management?

- Why does Larry Fink believe tokenization is in its early phase?

- What role does the BUIDL fund play in BlackRock tokenization?

- How has BlackRock’s stance toward crypto evolved?

- What challenges could BlackRock face in executing large scale tokenization?

- Conclusion

- Glossary

- Frequently Asked Questions About BlackRock tokenization

With $13.5 trillion in assets and $104 billion in crypto, BlackRock’s focus on tokenized assets marks a key step in global finance. It shows how the company is helping shift traditional finance toward digital systems.

How is BlackRock tokenization shaping the future of asset management?

Larry Fink said that BlackRock tokenization is a new wave of opportunity for both the company and investors. The company plans to turn ETFs and other financial tools into digital form to make investing simpler and more efficient. By doing this, BlackRock hopes to bring people from the crypto world into long term financial products.

This shows the company’s goal to link traditional finance with digital innovation. He explained that turning real world assets into digital tokens can change how people access and take part in investing. Fink said that tokenized ETFs can help new investors gain exposure to stable income assets while staying within the digital system.

Institutions are adopting blockchain to improve how people use financial services and to make processes clearer. This points to a shift where old financial systems and digital tools work together.

Also read: BlackRock Buys $60M in Bitcoin During Sell Off, Signaling Institutional Conviction

Why does Larry Fink believe tokenization is in its early phase?

Fink said asset tokenization is still very new. He noted it could grow into real estate, equities, and fixed income assets. Many on Wall Street are hopeful about blockchain’s growth in finance. It could change how traditional assets are managed and traded. Market intelligence firm Mordor Intelligence estimates the tokenized asset market at over $2 trillion in 2025.

They forecast it could surpass $13 trillion by 2030. For BlackRock tokenization, these projections match the company’s plan to integrate blockchain across multiple divisions by the end of the decade. Fink said that tokenization’s long term value comes from efficiency, liquidity, and global accessibility.

What role does the BUIDL fund play in BlackRock tokenization?

The BlackRock USD Institutional Digital Liquidity Fund, also called BUIDL, is a major milestone in BlackRock tokenization efforts. It was launched in March 2024 and managed $2.8 billion. The fund shows how tokenized money market functionality works in real life.

This highlights BlackRock’s progress in applying digital solutions to traditional finance.

Fink said the initiative embodies the firm’s real-world use of blockchain by offering round-the-clock liquidity and immediate settlements.

Supported by blockchain partners like Securitize, the BUIDL project creates a connection between traditional finance and decentralized asset management. The project shows how BlackRock tokenization can change market access. It also keeps institutional standards intact.

How has BlackRock’s stance toward crypto evolved?

Once skeptical, Fink’s view of digital assets has changed a lot over the past seven years. In an interview with CBS’s 60 Minutes, he said crypto now has a role similar to gold in diversified portfolios. This shows his growing acceptance of digital assets.

It reflects how digital assets are becoming part of mainstream investing. He clarified that crypto should not dominate investments but can be used to hedge risk. Today, BlackRock manages $104 billion in crypto assets, about 1% of its total holdings.

This shift from doubt to participation shows the firm’s growing confidence in BlackRock tokenization. It also highlights the role of blockchain technologies alongside traditional financial models.

Also read: Ripple Brings RLUSD to BlackRock’s $2B BUIDL Fund in Tokenization Breakthrough

What challenges could BlackRock face in executing large scale tokenization?

Although BlackRock tokenization promises a new financial structure, challenges remain. Regulatory clarity is a major concern. Global authorities are still working on consistent rules for digital assets. Fink has stressed the need for frameworks that protect investors and support innovation.

Fink has stressed the need for frameworks that protect investors and support innovation. Cybersecurity is a challenge. Digital identity verification is a challenge. Cross chain interoperability is a challenge.

Still, BlackRock keeps hiring digital specialists. It works with blockchain developers. The company is ready to handle technical issues. It is ready to handle legal and operational issues.

Conclusion

Based on the latest research, BlackRock tokenization signals the start of a deep financial transformation. Through fractional ownership, faster settlement, and transparent governance, tokenization could rewrite how capital moves worldwide.

Industry strategists see BlackRock’s $10 trillion tokenization plan by 2030 as a major milestone, similar to the rise of ETFs twenty years ago. With a focus on accessibility and innovation, BlackRock tokenization is creating a new financial system where traditional assets and digital ecosystems begin to merge.

Summary

BlackRock tokenization is turning traditional assets into digital tokens. Larry Fink aims to simplify investing and attract crypto users. The BUIDL fund shows liquidity and instant settlements.

Despite challenges like regulations and security, BlackRock hires experts and works with blockchain partners. This prepares the company for a more efficient and transparent financial system.

Stay updated on BlackRock tokenization and the $13T market shift only on our platform

Glossary

Tokenization: Changing regular investments into digital tokens.

TradFi: Normal banks, stocks, and traditional money systems.

Liquidity Fund: A fund you can easily buy or sell.

Asset Management: Taking care of money and investments.

Digital Ownership: Holding assets safely in digital form.

Frequently Asked Questions About BlackRock tokenization

Why is Larry Fink focusing on tokenization?

He wants to make investing easier and attract more people to digital finance.

How much does BlackRock manage?

BlackRock manages $13.5 trillion in total, including $104 billion in crypto.

What assets will be tokenized?

ETFs, bonds, equities, and possibly real estate and private credit will be tokenized.

How does tokenization connect traditional finance and crypto?

It turns old style assets into digital tokens, linking normal investing with blockchain.

Why is BlackRock’s tokenization important?

It shows big companies are using blockchain to make finance faster and clearer.