According to the latest reports, BlackRock, the biggest asset manager in the world, has filed to register a Delaware trust company for a Bitcoin premium income ETF, moving away from pure price tracking to yield generation.

This new product will monetize Bitcoin volatility using premium strategies like covered calls.

It will sit alongside BlackRock’s existing iShares spot Bitcoin ETF (IBIT), which already controls most of the US Bitcoin ETF market.

What the Filing Says

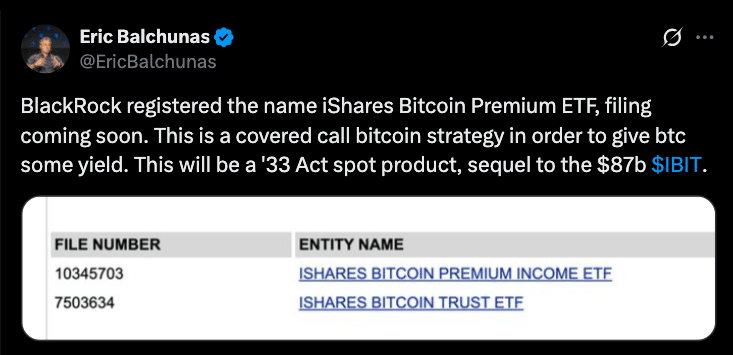

The major point is that BlackRock has filed for a Bitcoin premium income ETF in Delaware by registering a trust company, which is usually a precursor to submitting formal documents (S-1 or 19b-4) to the US Securities and Exchange Commission.

Analysts think this is a fund that will generate income by selling covered calls or derivatives on Bitcoin futures, extracting premium from volatility rather than just tracking price.

Reportedly, BlackRock’s spot Bitcoin ETF, IBIT, has already got around $85-90 billion in assets and has 60% of US Bitcoin ETF market share. In just two years of launch, BlackRock’s Bitcoin and Ethereum ETFs are expected to generate $260 million in annual revenue.

As a result of this, experts say the Bitcoin premium income ETF is a natural next step, offering a product for investors who want yield over pure capital appreciation.

Also read: BlackRock’s Bitcoin ETF Set to Become #1: Outearning 1,197 Other Funds

How the Premium Income Works

The ETF will use covered call strategies on Bitcoin futures or derivatives. In a covered call model, the fund sells call options against Bitcoin holdings and collects option premiums as income.

When these calls expire, if Bitcoin’s price is below the strike, the fund keeps the premium; if the price is above, some upside is given up. In effect, this structure trades some growth for regular income.

The fund will be positioned as a “yield-seeking” alternative to IBIT. Bloomberg ETF analyst Eric Balchunas calls it a “covered call Bitcoin strategy … a ’33 Act spot product, sequel to IBIT.”

Because of the derivative exposure and options mechanics, some experts say this ETF could have additional risks such as counterparty risk, volatility, option roll risk and less upside in bull runs.

Why They Did It

Analysts believe BlackRock is clearly counting on investor demand for a yield-oriented Bitcoin product. Many traditional investors don’t want to hold Bitcoin because it has no native yield. This premium income ETF could fill that gap.

By offering yield, BlackRock can attract a wider investor base; those who want some Bitcoin exposure but regular distributions.

Another reason given is risk management. By collecting option premiums, the ETF could reduce drawdowns in flat or declining markets, although it gives up some of the upside in strong trends.

It also adds to BlackRock’s crypto product suite; with IBIT dominating spot exposure, now there’s choice for different investor profiles.

In coming weeks, the market watches for the SEC filings (S-1, 19b-4) following the Delaware trust registration. See how the SEC responds; approval timelines, feedback and conditions.

Conclusion

Based on the latest research; BlackRock’s filing for a Bitcoin premium income ETF moves Bitcoin exposure to yield generation via options strategies. This could open up Bitcoin to a larger investor base who want crypto exposure with income.

If done well, this new ETF could be a core tool in Bitcoin portfolios seeking yield and diversification.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

BlackRock has filed in Delaware for a Bitcoin premium income ETF that generates yield via covered call option strategies. This complements its successful IBIT spot ETF which has tens of billions in assets and dominates US Bitcoin ETF flows.

Glossary

Premium Income ETF – A fund that generates income by selling options or derivatives; rather than just tracking asset price.

Covered Call – Strategy where call options are sold against an asset owned, earning option premiums.

Spot ETF – An ETF that seeks to mirror the price of the asset (e.g. Bitcoin) without derivatives.

S-1 / 19b-4 filing – SEC filings required for new ETFs or securities offerings.

Volatility Risk — Risk from price fluctuations that affect premium income performance.

Frequently Asked Questions About Bitcoin Premium Income ETF

How is this different from BlackRock’s IBIT?

IBIT is a spot Bitcoin ETF that tracks price; this would generate yield via options and sacrifice some upside for income.

Are returns guaranteed?

Yield depends on strategy performance and market volatility.

Who benefits from this?

Investors who want Bitcoin exposure but also regular income, especially in low-yield environments.

What are the risks?

Upside capping, derivative counterparty exposure, strategy underperformance, regulatory changes.