This article was first published on Deythere.

- BlackRock Bitcoin ETF Flows in 2025

- Relative Performance and Flows Among Major Asset Classes

- Ethereum ETF News and Staking Filings

- BlackRock’s Smart Play in Crypto ETFs

- Markets and ETF Inflows: The 2025 Perspective

- Conclusion

- Glossary

- Frequently Asked Questions About BlackRock Bitcoin ETF in 2025

- What are BlackRock Bitcoin ETF in 2025?

- Why does IBIT matter for the crypto industry?

- How does IBIT stack up against other ETFs?

- What other crypto ETFs has BlackRock applied for?

- References

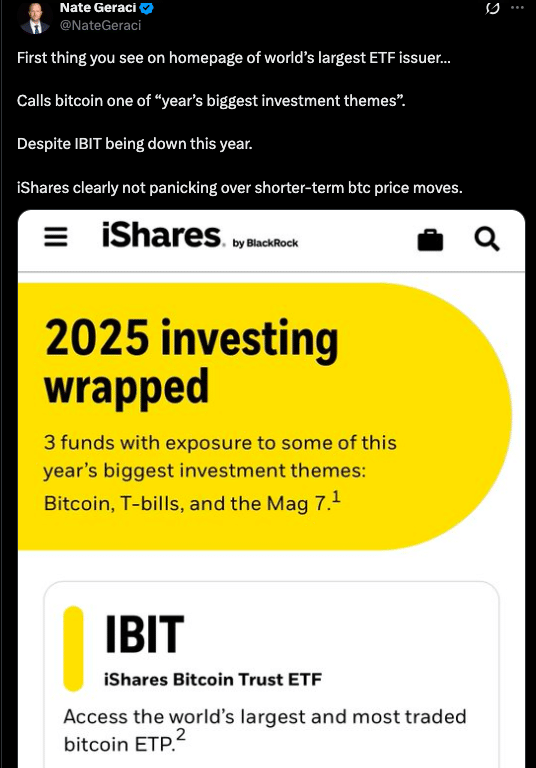

BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT) has emerged as one of this year’s most important investment themes, in a similar category with U.S. Treasury bills and top tech stock ETFs in global asset management trends.

Data extended through mid-December shows IBIT has drawn more than $25 billion in net inflows since the start of the year, putting it among ETFs’ top products by capital flow even as Bitcoin’s own price has experienced spells of weakness.

In addition to Bitcoin, BlackRock Ethereum ETFs have attracted serious attention, and a raft of new crypto product applications including one for a Bitcoin Premium Income ETF, and for a staked Ethereum vehicle

BlackRock Bitcoin ETF Flows in 2025

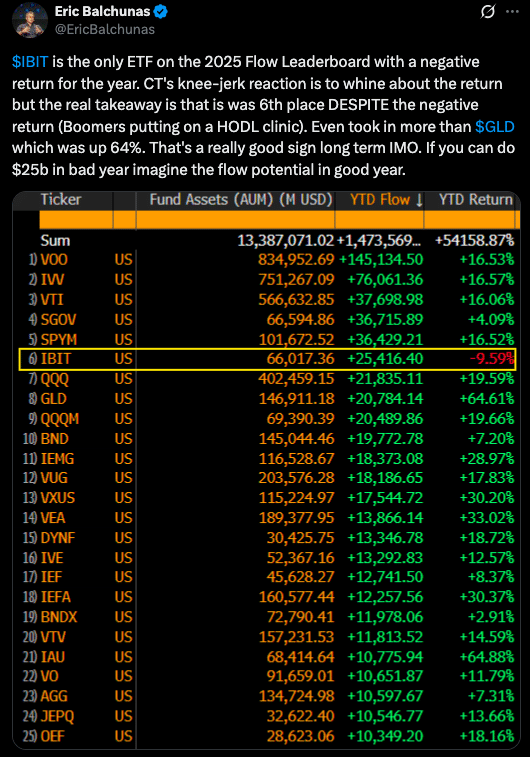

BlackRock’s BlackRock Bitcoin ETF flows in 2025 have been impressive on multiple accounts. IBIT saw net inflows of around $25 billion in 2025, making it the sixth highest ranking ETF globally by net flows, according to data from Farside.

The asset manager named its iShares Bitcoin Trust ETF (IBIT) alongside its ETF tracking Treasury bills and another tied to the “Magnificent 7” tech stocks of Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla.

This impressive ranking comes despite IBIT’s year-to-date being negative, the “only fund in the top cohort with YTD posting a negative return for the year, even as traditional equity and bond ETFs with positive performance also attracted substantial capital.

Bloomberg ETF analyst Eric Balchunas commented in the flows saying that;

“if the ETF can do $25 billion in a bad year, imagine the flow potential in a good year,”

These BlackRock Bitcoin ETF flows have helped the institutional adoption story for Bitcoin in 2025, confirming that while market sentiment and price action can be mixed, regulated crypto products attract significant capital.

Relative Performance and Flows Among Major Asset Classes

Not only has BlackRock’s Bitcoin ETF attracted a lot of interest at the cryptocurrency specific level, it also seems to be performing well against the other market ETF offerings.

In the global ETF inflows league for 2025, IBIT’s roughly $25 billion capital made it comparable to large equity and fixed-income funds, even edging out some traditional investment vehicles despite Bitcoin’s drawdowns.

This is impressive since some gold and broad equity ETFs saw positive returns in the same period as well, but did so with less net flow than IBIT.

Comparisons can be drawn to precious metals ETFs, for instance SPDR Gold Shares (GLD) rose more than 60% in 2025, showing how the demand to deploy capital in a Bitcoin exchange-traded product that offers an ETF wrapper is strong.

The fact that IBIT is able to pull in huge inflows whilst sporting a negative return also implies that many of its investors are using it for tactical long-term exposure as opposed to short term performance chasing.

Ethereum ETF News and Staking Filings

In addition to Bitcoin, BlackRock’s spot Ethereum ETF, iShares Ethereum Trust (ETHA), has seen strong investor demand in 2025.

So far in December, ETHA has rallied more than $9.1 billion in net inflows for the year, and taken its total assets to almost $12.7 billion since inception.

In the November 2025 filing, it stated that iShares had also filed for a Staked Ethereum ETF which aims to offer regulated exposure to Ethereum with staking rewards built in.

This filing demonstrates the increasing regulatory openness to higher-order digital asset products and mirrors the larger trend of yield-based and institutional grade crypto investment offerings in the US market.

Although spot ETH ETFs of which ETHA is one have recently experienced some net outflows, with several consecutive days of negative flows in mid-December, the overall trend points to ongoing institutional testing across different crypto ETF formats.

BlackRock’s Smart Play in Crypto ETFs

Nate Geraci, president of the advisory firm NovaDius Wealth Management, noted that BlackRock’s focus on IBIT signals the firm isn’t fazed by Bitcoin’s 30 percent fall from its high set in October, pointing to a longer-term orientation that drives decisions about allocating money for institutions.

Besides flow statistics, BlackRock’s ETF strategy involves filing for new variations like the Bitcoin Premium Income ETF, which aims to sell covered call options on Bitcoin futures to generate yield

Markets and ETF Inflows: The 2025 Perspective

The BlackRock Bitcoin ETF flows cannot be disconnected from the prevailing market and macro backdrop that has shaped the trajectory of capital allocations across 2025.

U.S. Bitcoin and Ether ETFs have experienced flows in and out as prices moved, indicating active positioning by investors. For instance, in mid-December, when the prices fell, $582 million was taken out, showing some short-term volatility impact.

On the contrary, Bitcoin ETFs saw net inflows of $457 million in a one-day session early December, among the biggest since October, implying there is still some bit of portfolio rotation between crypto products and the traditional market.

Conclusion

BlackRock’s Bitcoin ETF seems to dominate the year 2025 capital market, with flows for BlackRock Bitcoin ETF reaching $25 billion and placing it among the biggest global ETFs by net inflows.

In spite of the difficult price environment for Bitcoin and negative annual performance by IBIT, investors have stayed a direct source through this regulated vehicle, comparing it against traditional safety and tech stock exposure.

Simultaneous developments on Ethereum ETFs, along with filings for new products including staked ETH and Bitcoin income ETFs, continue to show the increasing maturity of crypto investment products as regulated offerings.

Glossary

BlackRock Bitcoin ETF flows: Net inflows and outflows within a certain period of BlackRock’s iShares Bitcoin Trust (IBIT).

Spot Bitcoin ETF: A fund which holds physical rather than synthetic exposure to bitcoin, offering regulated access to BTC price action.

Net inflows: The aggregate amount of capital that has entered an investment fund, less the funds withdrawn.

ETHE: A fundamentally-driven investment product that holds ETH for direct exposure.

Staked ETH ETF: An ETF structure that incorporates Ethereum staking rewards.

Frequently Asked Questions About BlackRock Bitcoin ETF in 2025

What are BlackRock Bitcoin ETF in 2025?

BlackRock’s iShares Bitcoin Trust (IBIT) took in some $25 billion of net new money during 2025, making it the world’s sixth-largest ETF by net capital flow.

Why does IBIT matter for the crypto industry?

There is clearly strong demand for Bitcoin through IBIT despite poor performance, further indicating the persistent appetite from institutional investors for regulated exposure to Bitcoin and increasing acceptance of crypto products with fund-of-fund type investors as part of their investment strategies.

How does IBIT stack up against other ETFs?

IBIT raised more capital than several well known positive returning ETFs, including some gold and bond funds, showing changing investor preferences toward regulated products that offer exposure to digital assets.

What other crypto ETFs has BlackRock applied for?

BlackRock has applied for a Bitcoin Premium Income ETF and an iShares Staked Ethereum ETF, broadening its institutional cryptocurrency products.

References

TodayOnChain

Cointelegraph

Trading News

CryptoRank

Yahoo Finance