Despite the industry’s optimism following Ripple’s court win over the U.S. Securities and Exchange Commission (SEC), BlackRock Dismisses XRP and Solana ETFs telling sources that it has no plans to launch the spot ETFs, thereby crushing hopes that the Ripple-SEC case closure would lead to new altcoin products.

- Ripple Case Closure Spurs ETF Hopes But BlackRock Says No

- Little Demand Beyond Bitcoin and Ethereum

- Analyst Views on BlackRock’s Narrow ETF Scope

- Conclusion

- FAQs

- Why is BlackRock ruling out XRP and Solana ETFs?

- Did the Ripple-SEC case impact BlackRock’s decision?

- Could BlackRock change its mind later?

- What do other analysts say about Solana ETFs?

- Glossary

A spokesperson said neither asset is on the firm’s near-term roadmap. This comes just months after BlackRock launched spot Bitcoin and Ethereum ETFs, which drew billions.

Ripple Case Closure Spurs ETF Hopes But BlackRock Says No

The resolution of Ripple’s long-running legal battle with the SEC was viewed widely as a breakthrough for XRP. With the appeals process wrapping up, many thought institutional hesitation would ease. Nate Geraci, President of the ETF Store, said earlier that it would be “hard to justify ignoring crypto assets apart from Bitcoin and Ethereum” now that regulatory clarity around XRP had improved.

However, BlackRock seems to be pouring cold water on that theory. The firm’s spokesperson said a spot XRP ETF is not in development, nor is a Solana equivalent. This goes against the hopes of the XRP community, which has reportedly been courting big asset managers for years.

Little Demand Beyond Bitcoin and Ethereum

BlackRock execs have been clear on why the expansion isn’t happening. It was earlier reported that Robert Mitchnick, Head of Digital Assets at BlackRock, disclosed that there was “very little” client demand for crypto ETFs beyond Bitcoin and Ethereum.

He framed the two largest cryptocurrencies as complementary rather than competing portfolio assets, saying they meet an “investability bar” others haven’t yet cleared.

Samara Cohen, the firm’s Chief Investment Officer of ETF and Index Investments, said the same in an interview with Bloomberg:

“We really look at the investor’s ability to see what meets the criteria, what meets the bar to be delivered in an ETF. For us right now, both between [investing] ability considerations and also what we hear from our clients… Bitcoin and Ether definitely meet that bar. I think it will be a while before we see anything else.”

Analyst Views on BlackRock’s Narrow ETF Scope

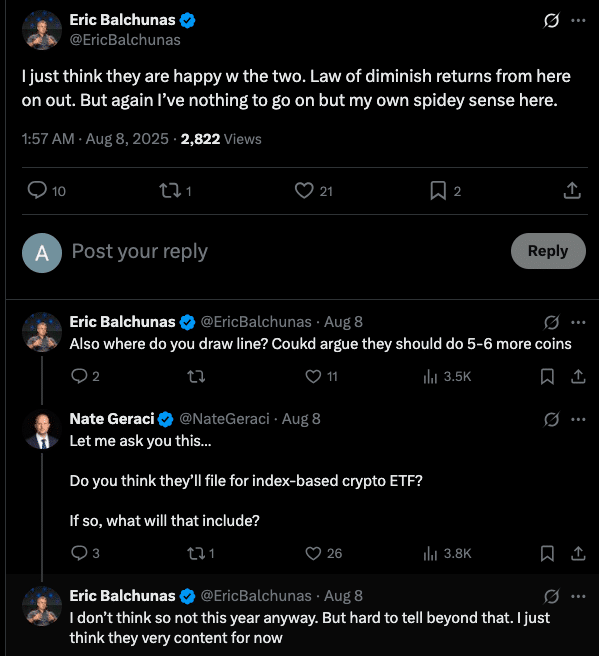

Bloomberg ETF analyst Eric Balchunas thinks this is just basic market economics. He’s said the firm sees decreasing returns from expanding its crypto ETF lineup beyond the top two.

James Seyffart, another Bloomberg ETF specialist, said it would be “messy” for BlackRock to join the first wave of Solana ETFs after smaller issuers have already spent time and resources getting through the SEC approval process.

BlackRock’s move could have effects on the altcoin ETF market. Smaller and mid-tier asset managers may now feel more comfortable being first to market with XRP or Solana products without immediate competition from the biggest player.

Conclusion

Based on the latest research, as BlackRock dismisses XRP and Solana ETFs; it opens their decision to stay focused on a narrow crypto product set aligned with client demand and clear investability criteria.

While Ripple’s win has cleared some fog around XRP, it hasn’t changed BlackRock’s priorities. For now, Bitcoin and Ethereum are the only cryptocurrencies that meet BlackRock’s bar for spot ETFs, thus leaving room for smaller competitors to experiment in the altcoin ETF space.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

BlackRock dismisses XRP or Solana ETFs launch plans even after Ripple’s SEC case is closed. Executives cite minimal client demand for altcoin ETFs and an internal standard that only Bitcoin and Ethereum meet. Analysts believe market share considerations and industry fairness also play into the decision.

FAQs

Why is BlackRock ruling out XRP and Solana ETFs?

BlackRock’s clients want Bitcoin and Ethereum, and internal review says only BTC and ETH meet current ETF standards.

Did the Ripple-SEC case impact BlackRock’s decision?

Despite expected to boost XRP, BlackRock’s stance is still cautious despite the legal win.

Could BlackRock change its mind later?

The firm is looking at broader crypto products, including tokenisation, but no reported plans to add XRP or Solana ETFs anytime soon.

What do other analysts say about Solana ETFs?

Analysts warn BlackRock against entering the race late, arguing smaller firms have already filed for ETFs

Glossary

ETF (Exchange-Traded Fund) — A security that tracks an index, commodity or asset and trades on a stock exchange like a stock.

Spot ETF — An ETF that holds the underlying asset directly, not derivatives or futures contracts.

Investability Criteria — Internal benchmarks an asset must meet before being offered in an ETF, including liquidity, regulation and client interest.